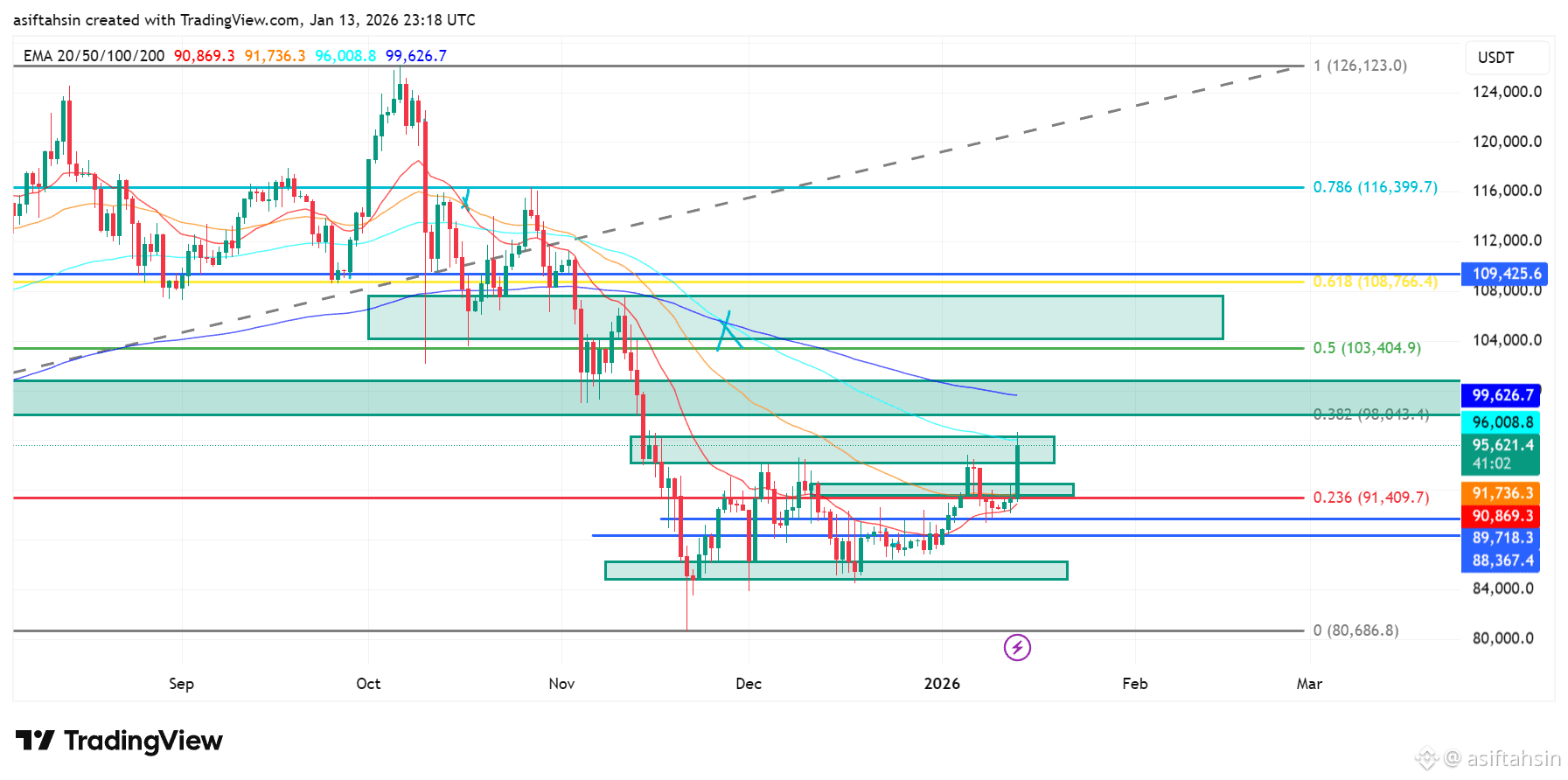

Bitcoin is showing a strong rebound from the macro demand zone, but price is now approaching a critical resistance cluster, where multiple technical factors converge. The broader structure remains corrective, though short-term momentum has clearly improved.

Market Structure & Trend

BTC previously faced a sharp rejection from the $116k–$126k macro supply zone (0.786–1 Fib), confirming a distribution top. The subsequent breakdown below $109k (0.618 Fib) triggered an accelerated selloff toward the $88k–$90k demand region, where buyers successfully defended price.

Recent price action indicates a higher-low formation, suggesting a short-term trend reversal attempt, but the market is still trading below key medium- and long-term resistance levels.

EMA Structure (Still Bearish, Momentum Improving)

20 EMA: $90,869

50 EMA: $91,736

100 EMA: $96,009

200 EMA: $99,627

BTC has reclaimed the 20 & 50 EMA, signaling short-term bullish momentum. However, price remains below the 100 & 200 EMA, keeping the broader trend bearish-to-neutral.

The $96k–$100k zone represents a major dynamic resistance area, where previous breakdown occurred and selling pressure is likely to re-emerge.

Fibonacci Levels & Key Zones

1 Fib: $126,123

0.786 Fib: $116,399

0.618 Fib: $108,766

0.5 Fib: $103,405

0.382 Fib: $98,043

0.236 Fib: $91,410

Fib 0: $80,687

BTC is currently testing the 0.236 Fib at $91.4k, which aligns with a short-term supply zone. A clean breakout above this level would open the path toward $96k–$99k, where Fib 0.382 and the 100/200 EMA cluster converge.

Failure to hold above $90k–$91k could result in a pullback toward the $88k demand zone.

RSI Momentum

RSI (14): 67

RSI is approaching overbought territory, reflecting strong bullish momentum in the short term. While this supports further upside attempts, it also increases the probability of near-term consolidation or a shallow pullback below resistance.

📊 Key Levels to Watch

Resistance

$91,400 (0.236 Fib – immediate)

$96,000–$99,600 (0.382 Fib + EMA cluster)

$103,400 (0.5 Fib)

$108,700 (0.618 Fib)

Support

$90,000–$89,700 (short-term)

$88,300–$88,700 (major demand)

$80,600 (macro downside support)

📌 Summary

Bitcoin is in a short-term recovery phase after defending a strong demand zone. Momentum favors buyers in the near term, but the market remains technically vulnerable below $96k–$100k, which acts as a decisive resistance cluster. A sustained breakout above this zone would signal a trend shift, while rejection may lead to range-bound consolidation or another corrective pullback.