Gold is on fire right now... and it's not slowing down!

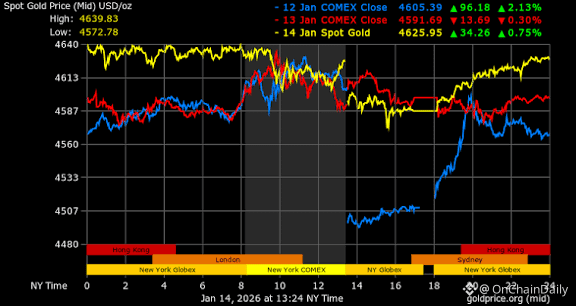

As of January 15, 2026, spot XAU/USD is trading around $4,585–$4,600 after dipping slightly from yesterday's explosive new all-time high of ~$4,643. That's +6–7% year-to-date already, following a monster ~65–69% rally in 2025. We're in full price-discovery mode – and the catalysts are stacking up fast!

🚨Why Gold Keeps Breaking Records in 2026:

Fed Independence Crisis – Powell Probe Ignites Panic

✅US prosecutors launched a criminal investigation into Fed Chair Jerome Powell's past testimony. Markets are freaking out over potential political interference → massive safe-haven rotation into gold. Central bank independence is the bedrock of the system – any cracks = rocket fuel for XAU!

2. Geopolitical Flashpoints Refuse to Cool

✅Ongoing tensions around Iran (potential US delays but risks remain high), broader global uncertainty, and "resource nationalism" (US-China rivalry over critical materials) keep buyers aggressive. Gold thrives in chaos – and 2026 looks chaotic.

3. Macro Backdrop Still Bullish

✅Sticky inflation + cooling growth → bets on more Fed rate cuts (despite recent hawkish signals).

✅Weaker USD supports precious metals.

✅Central banks keep stacking (China extended buying streak; global averages ~70 tons/month expected).

✅ETF inflows exploded in 2025 – momentum carries forward.

🚨Expert Forecasts for 2026 – $5,000+ in Sight?

⚡HSBC: Momentum could drive to $5,000 in H1 2026.

⚡JP Morgan: Average ~$5,055 by Q4, with peaks toward $5,200–$5,300.

⚡Goldman Sachs: Around $4,900 year-end.

⚡Many retail surveys: 70%+ see >$5,000.

Even conservative views eye $4,500–$5,000 range – with upside to $6,000+ if things get really wild.

Technical Setup – Bullish but Volatile

Holding above key supports (~$4,576–$4,510). Breakout above $4,645? Next targets: $4,700 → $5,000.

RSI overbought on shorter timeframes → possible short-term pullback (profit-taking), but trend remains firmly up.

Bear Case (Always DYOR):

Stronger-than-expected US data or eased geopolitics could trigger corrections to $4,300–$4,400. But structural demand looks unbreakable.

My Take:

Gold isn't just hedging – it's leading the new macro regime. With real crises driving flows (not just hype), $5,000 feels inevitable in 2026. Accumulation phase? Or FOMO breakout?

What do you think?

$5,000 gold this year? 🚀

Pullback first? 📉

Holding physical/gold-backed crypto like PAXG? Share your stack below! 👇#TrendingTopic #viralpost #TrendingPredictions #TrendingInvestments

#Gold #XAUUSD #SafeHaven #PowellProbe #CryptoGold #PAXG #BinanceSquare $XAU $PAXG $BTC