The Fed is under siege... and gold is loving every second of it!

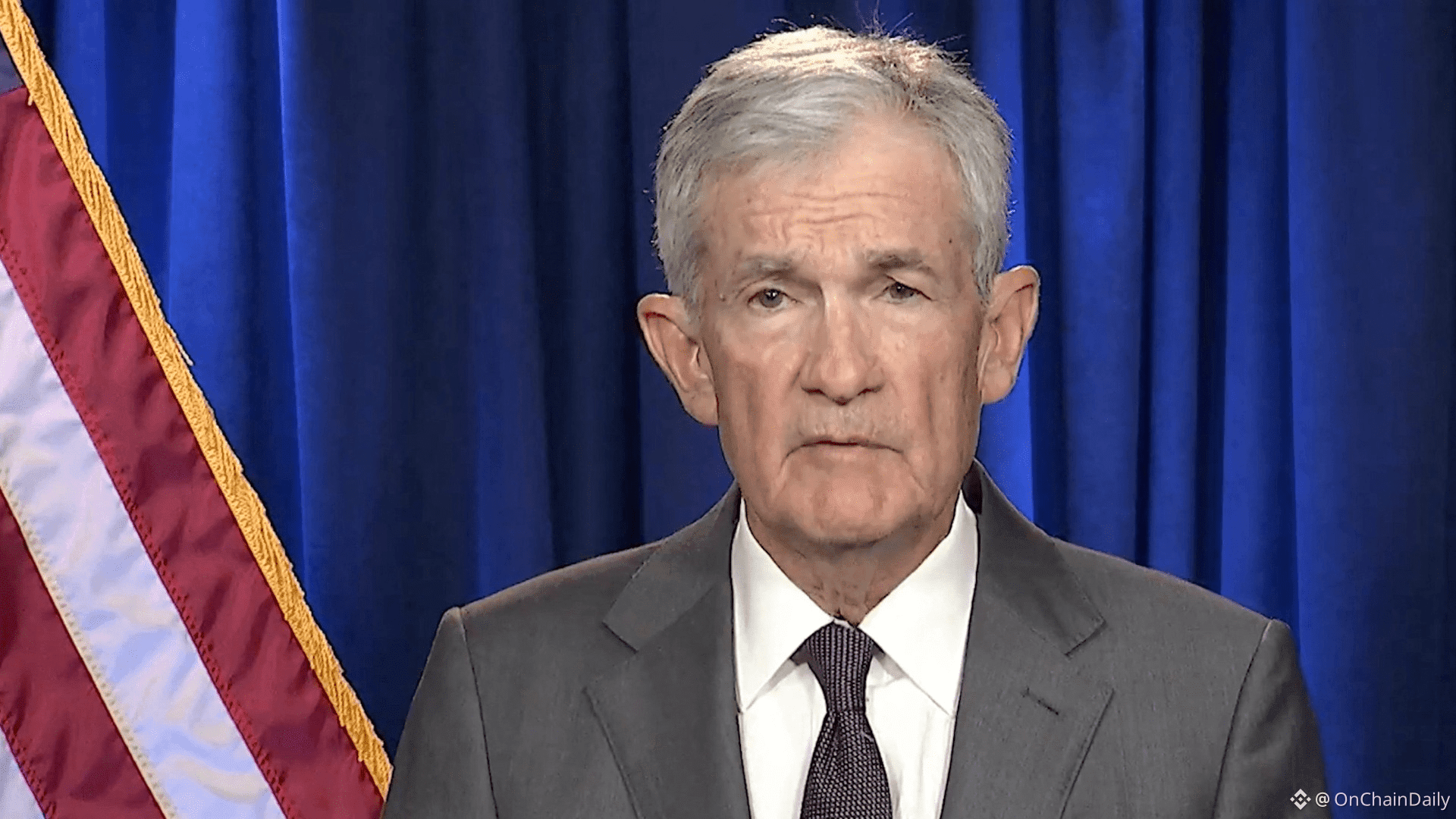

As of January 15, 2026, gold (XAU/USD) is holding strong near $4,585–$4,600 after rocketing to a fresh all-time high above $4,643 on Monday. That's a blistering surge triggered by the bombshell criminal investigation into Fed Chair Jerome Powell — the first time in history a sitting Fed Chair faces federal prosecutors!

What’s the Powell Probe Really About?

On Friday (Jan 9), the DOJ served the Federal Reserve with grand jury subpoenas threatening indictment. The official focus? Powell's June 2025 Senate testimony on the $2.5 billion multi-year renovation of the Fed's historic headquarters in D.C. (Eccles & Constitution Ave buildings). Critics (including Rep. Anna Paulina Luna) accuse him of perjury — allegedly downplaying extravagant features and misrepresenting costs to Congress and officials.

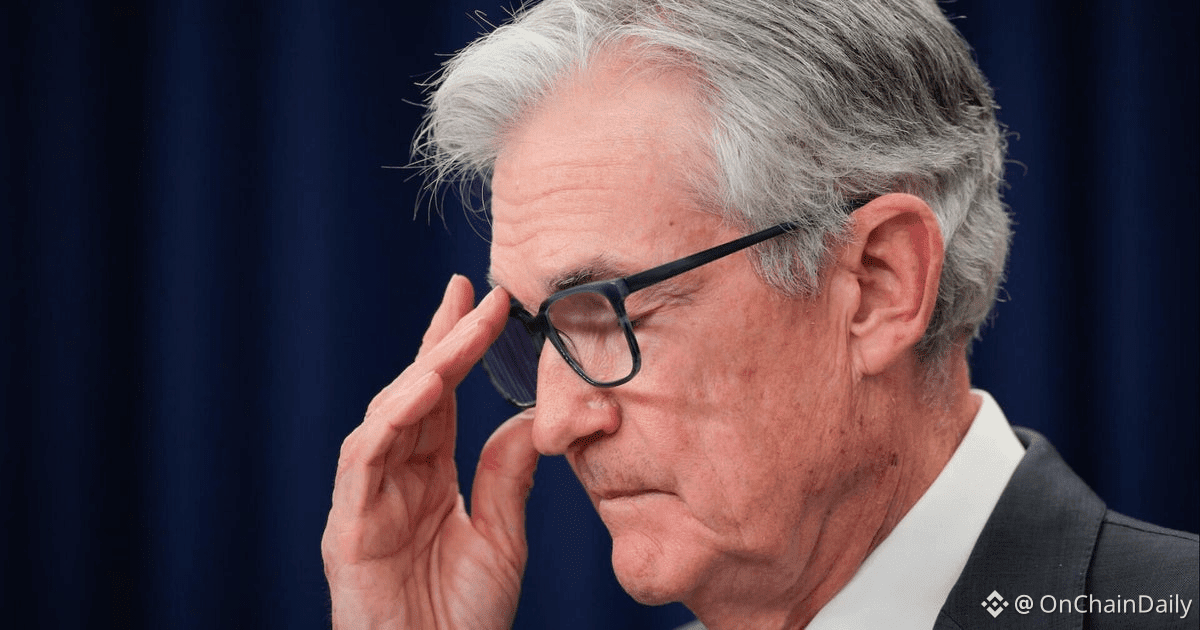

But Powell fired back in a rare Sunday video statement (Jan 11), calling it "unprecedented" and a blatant pretext. He claims it's retaliation for the Fed refusing to slash rates aggressively amid Trump's repeated demands. "The threat of criminal charges is a consequence of setting interest rates based on what serves the public — not the preferences of the President."

Trump denied direct involvement but kept the heat on, saying Powell should feel pressure over "too high" rates. No charges filed yet, but Powell has top-tier counsel (Williams & Connolly), and the probe is heating up fast.

Here are key visuals of the drama:

The Renovation at the Center of the Storm — Take a look at the massive Fed HQ project that's now political dynamite:

Market Fallout = Gold Rocket Fuel

Safe-haven panic → Gold + silver to records (silver topped $86!).

Weaker USD, softer stocks initially, then rebound.

Analysts (Goldman, HSBC, Julius Baer) call this a "bullish wildcard" for precious metals — potential Fed leadership shakeup could mean faster cuts → lower opportunity cost for non-yielding gold.

Forecasts: $5,000+ in H1 2026? Very much on the table if independence fears deepen.

Crypto Angle — While BTC/ETH stayed range-bound (modest gains), many see this as validation for decentralized assets. If institutions look shaky, hard money like Bitcoin shines brighter as a hedge.

My Take:

This isn't just about renovations — it's a historic test of Fed independence. If political pressure wins, expect more volatility... and even higher gold. Accumulation time?

What do you think?

Gold to $5,000 in 2026? 🚀

Fed independence doomed? 😱

Stacking gold, PAXG, or BTC as hedge? Share your plays! 👇#TrendingTopic #viralpost

#PowellProbe #FedDrama #GoldATH #XAUUSD #SafeHaven #CryptoHedge #BinanceSquare