In any decentralized infrastructure, technology alone is not enough. What ultimately sustains a network is its economic design—how incentives are aligned, how security is enforced, and how long-term participation is rewarded. Within the Walrus ecosystem, this role is fulfilled by the WAL token, the native asset that powers operations, security, and governance across the protocol.

Unlike many tokens that exist primarily for speculation, WAL is deeply embedded into the core mechanics of Walrus. Every meaningful action on the network, from storing data to maintaining uptime, is economically tied to WAL, making it a true utility token rather than a passive asset.

At a fundamental level, WAL functions as the payment layer of the Walrus protocol. Users and applications pay in WAL to store data and retrieve it when needed. This creates a direct economic loop between demand for decentralized storage and the value generated within the network. As more data-intensive Web3 and AI applications rely on Walrus, transactional demand for WAL grows alongside real usage rather than hype.

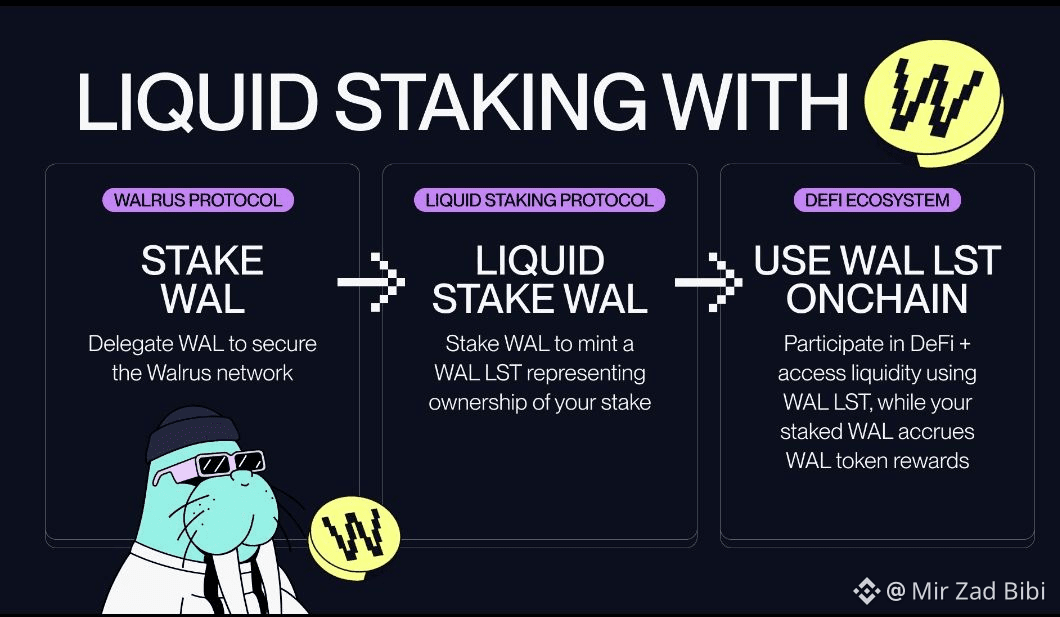

Security is another pillar supported by the WAL token. Storage node operators are required to stake WAL in order to participate in the network. This staking mechanism ensures operators have economic skin in the game. Honest performance and high availability are rewarded, while downtime or malicious behavior is penalized. As a result, WAL directly underwrites the reliability and integrity of the network.

Governance further strengthens WAL’s role. Token holders can participate in decision-making by voting on protocol upgrades, economic parameters, and ecosystem-level changes. This ensures that Walrus evolves in a decentralized, community-driven manner rather than through centralized control, reinforcing long-term trust in the protocol.

From a tokenomics perspective, WAL is designed with sustainability in mind. The token has a maximum supply of 5 billion, with a circulating supply of approximately 1.58 billion. Burning mechanisms are built into the system to introduce deflationary pressure over time, gradually reducing supply as network usage increases and aligning long-term incentives with adoption.

At present, WAL is trading around $0.15 USD, with a market capitalization of roughly $246 million. While prices fluctuate with broader market conditions, this valuation reflects growing recognition of Walrus as critical Web3 infrastructure rather than a short-term narrative. More importantly, WAL’s value is increasingly tied to actual storage demand and network activity.

The importance of WAL becomes even clearer within Walrus’ broader architecture. Built on the Sui, Walrus benefits from high throughput and low latency, while WAL acts as the economic layer that aligns incentives across users, developers, and node operators. Together, they enable scalable use cases across NFTs, gaming, AI datasets, and decentralized web hosting.

Institutional confidence further supports this vision. Walrus is backed by leading investors such as a16z crypto and Standard Crypto, signaling strong belief in both the protocol’s technology and its economic model.

As Web3 matures, tokens backed by real utility and infrastructure demand will increasingly stand apart. WAL represents this shift clearly. It secures the network, powers storage, enables governance, and aligns incentives across the ecosystem. In doing so, it transforms Walrus from a storage solution into a self-sustaining decentralized economy built for the data-driven future of Web3 and AI.