Looking back at 2025, Binance Research paints a compelling picture of crypto moving beyond speculation toward real infrastructure. What stands out most to me is how digital assets increasingly behaved like core financial plumbing rather than just volatile tokens. Stablecoins, DeFi, real-world asset tokenization, and institutional adoption all tell a story of maturation.

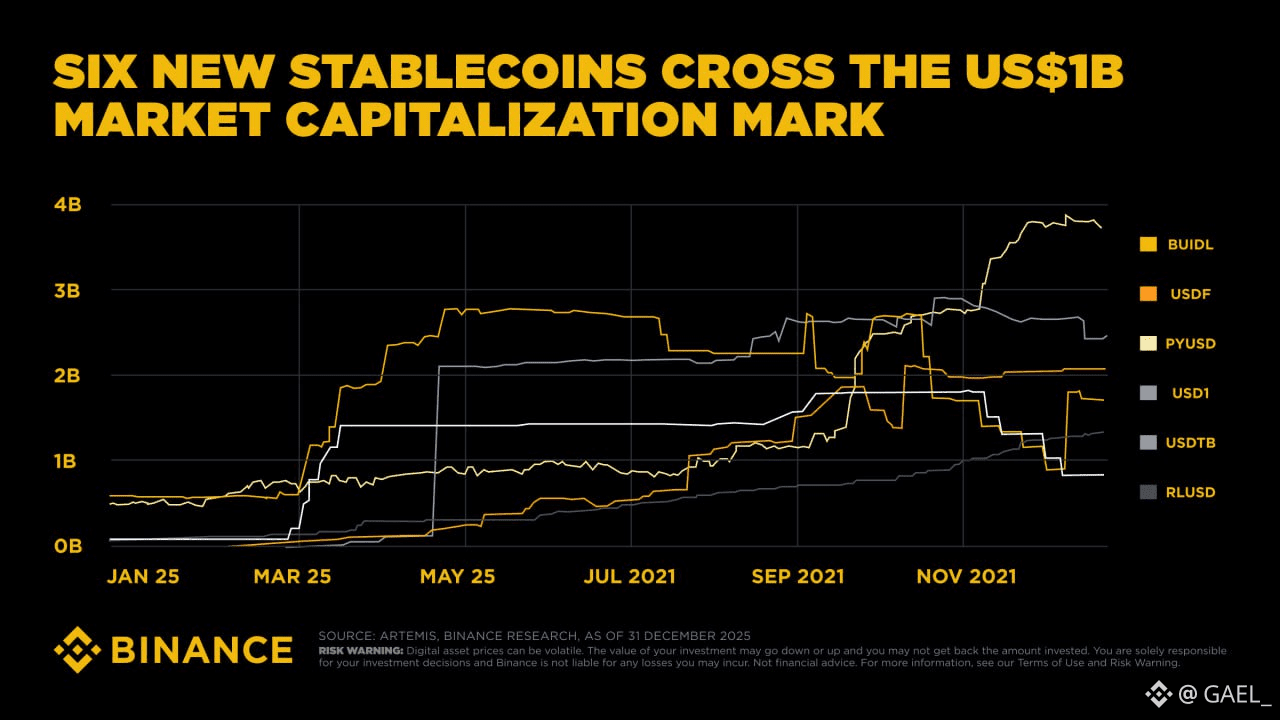

Stablecoins led the way, doubling Visa’s annual transfer volume to $33 trillion and collectively reaching a market cap of $305 billion. The growth wasn’t limited to incumbents; newcomers such as BlackRock’s BUIDL and PayPal’s PYUSD each surpassed $1 billion in market capitalization, signaling that traditional finance is actively exploring programmable money as a complement to legacy systems. This isn’t hype—it’s a structural shift in how value moves across borders and networks.

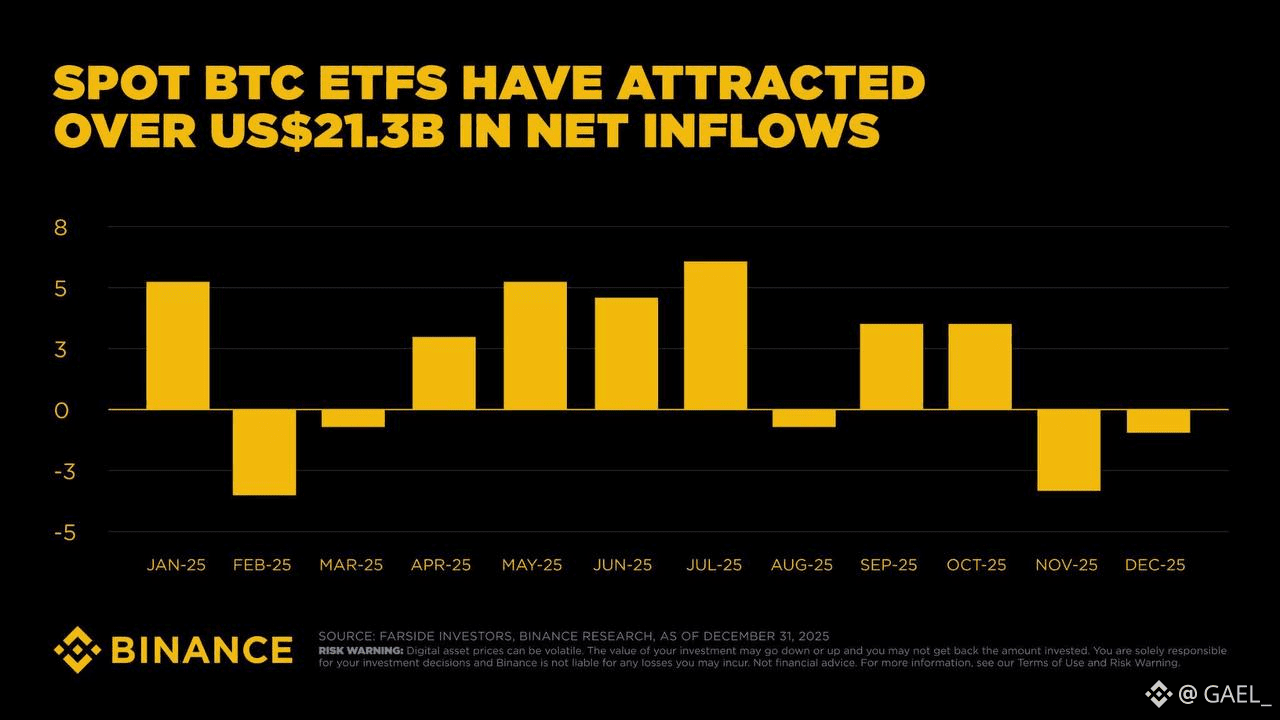

DeFi also proved its staying power. Total revenues reached $16.2 billion, surpassing the likes of Nasdaq and CME in the same period. Real-world assets locked on-chain climbed to $17 billion, demonstrating that crypto is not just a parallel market but increasingly intertwined with tangible economic activity. Bitcoin ETFs alone drew $21.3 billion in inflows, reflecting both retail and institutional appetite for regulated, familiar entry points into the ecosystem. For me, these figures highlight a transition from theory to practice: digital finance is being built to scale and integrate with the existing financial system.

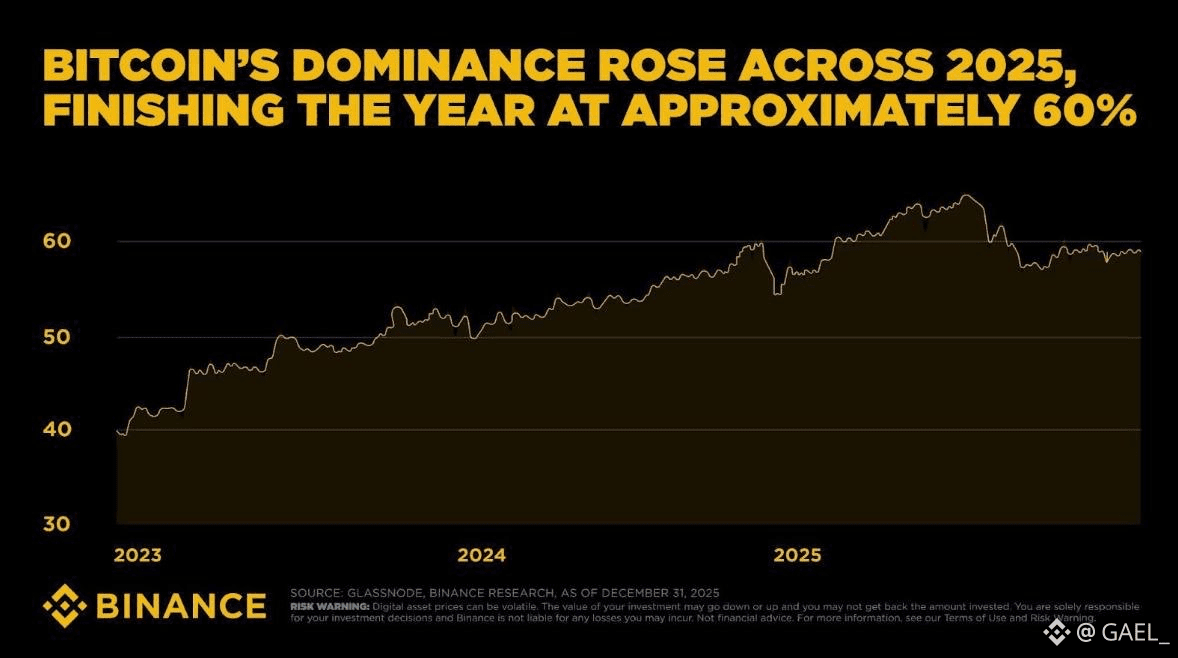

Even as the overall market cap experienced a year-end dip, on-chain activity tells a different story. Transactions remained robust, networks absorbed higher volumes, and adoption signals remained strong. The narrative emerging from this data is one of “industrialization”: crypto infrastructure is growing in complexity, resilience, and real-world relevance. Institutional adoption, while gradual, is steadily shifting the focus from short-term price movements to functional, long-term utility.

Reflecting on 2025, the takeaway is clear. The market isn’t defined solely by bull or bear cycles anymore. It’s increasingly measured by how digital assets serve as usable infrastructure, enabling programmable money, decentralized finance, and tokenized real-world assets. As we move into 2026, the challenge—and opportunity—will be scaling these systems responsibly, integrating them into broader financial frameworks, and maintaining the balance between innovation and regulation.

Crypto’s journey in 2025 wasn’t just growth; it was proof that the ecosystem is capable of operating at scale, bridging digital and traditional finance, and setting the stage for the next phase of adoption.

#BinanceResearch #crypto2025 #CryptoNews #BTC100kNext? #volatility