U.S. stocks closed higher on Friday, led by a tech rally with Micron surging 6%. Stronger-than-expected industrial data boosted confidence, though weaker housing numbers capped gains. The SP500 and NASDAQ advanced, while the Dow Jones was held back by resistance.

Major Points:

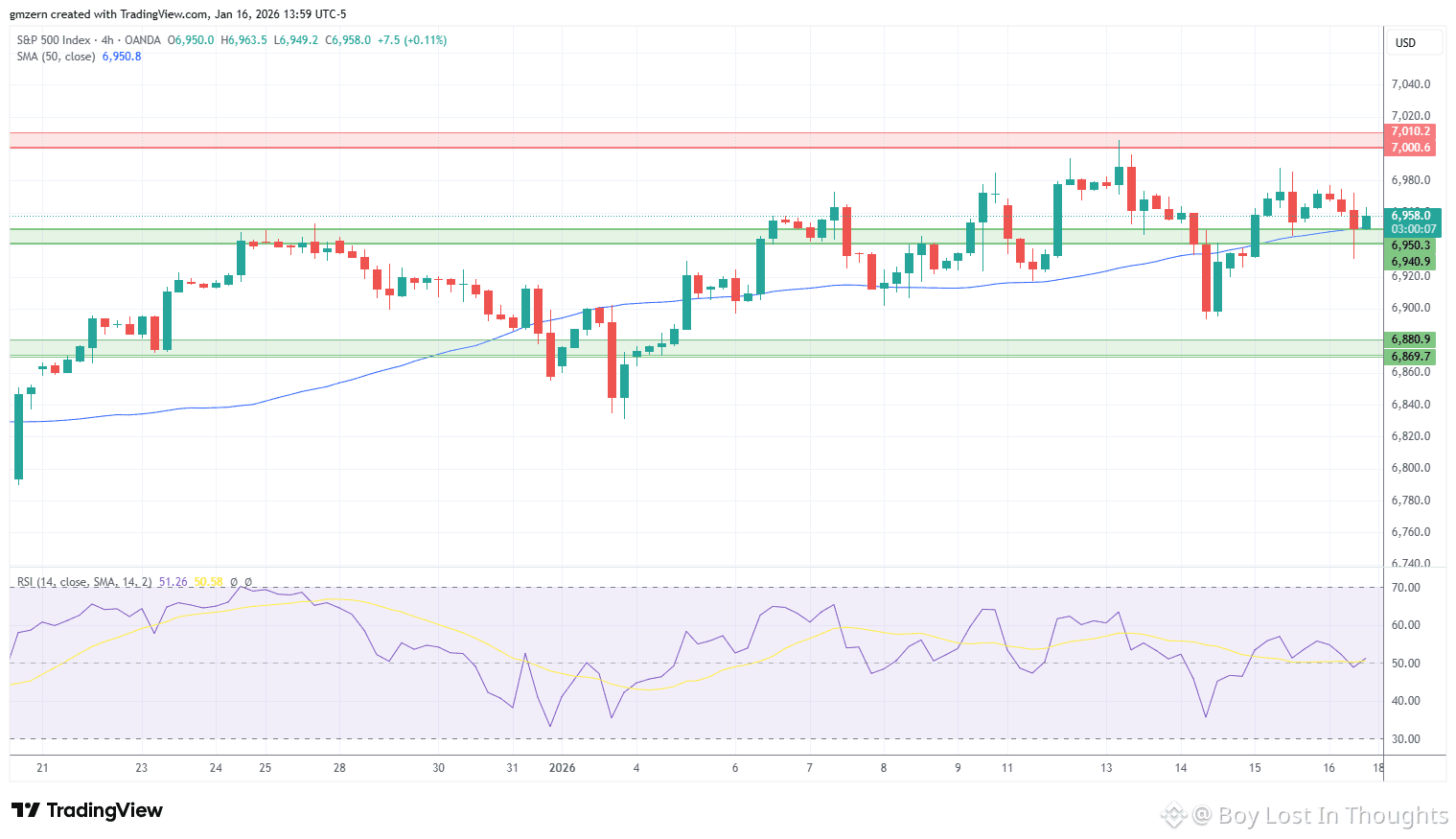

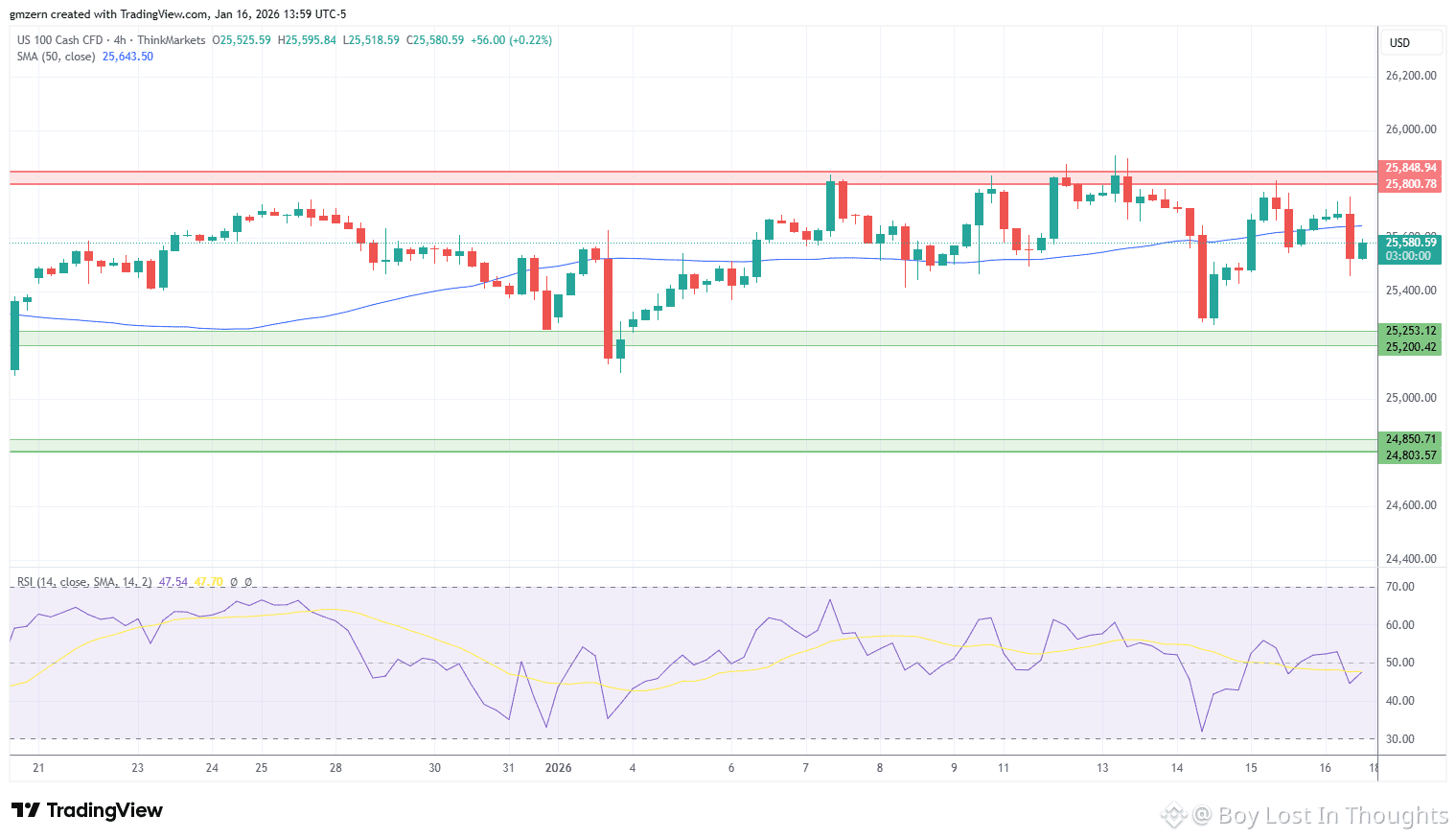

Broad Market Gains: The SP500 and NASDAQ both closed higher, driven by strong economic data and tech stock momentum.

Tech Sector Strength: NASDAQ outperformed, fueled by a 6% surge in Micron stock and broad demand for tech shares.

Economic Catalyst: A better-than-expected Industrial Production report (+0.4% vs. +0.1% forecast) supported the rally, signaling economic resilience.

Mixed Housing Signal: Gains were slightly tempered by a weaker-than-anticipated NAHB Housing Market Index.

Resistance Levels in Focus:

SP500 faces near-term resistance at 7,000 – 7,010.

NASDAQ eyes a move toward 25,800 – 25,850 if it holds above key moving averages.

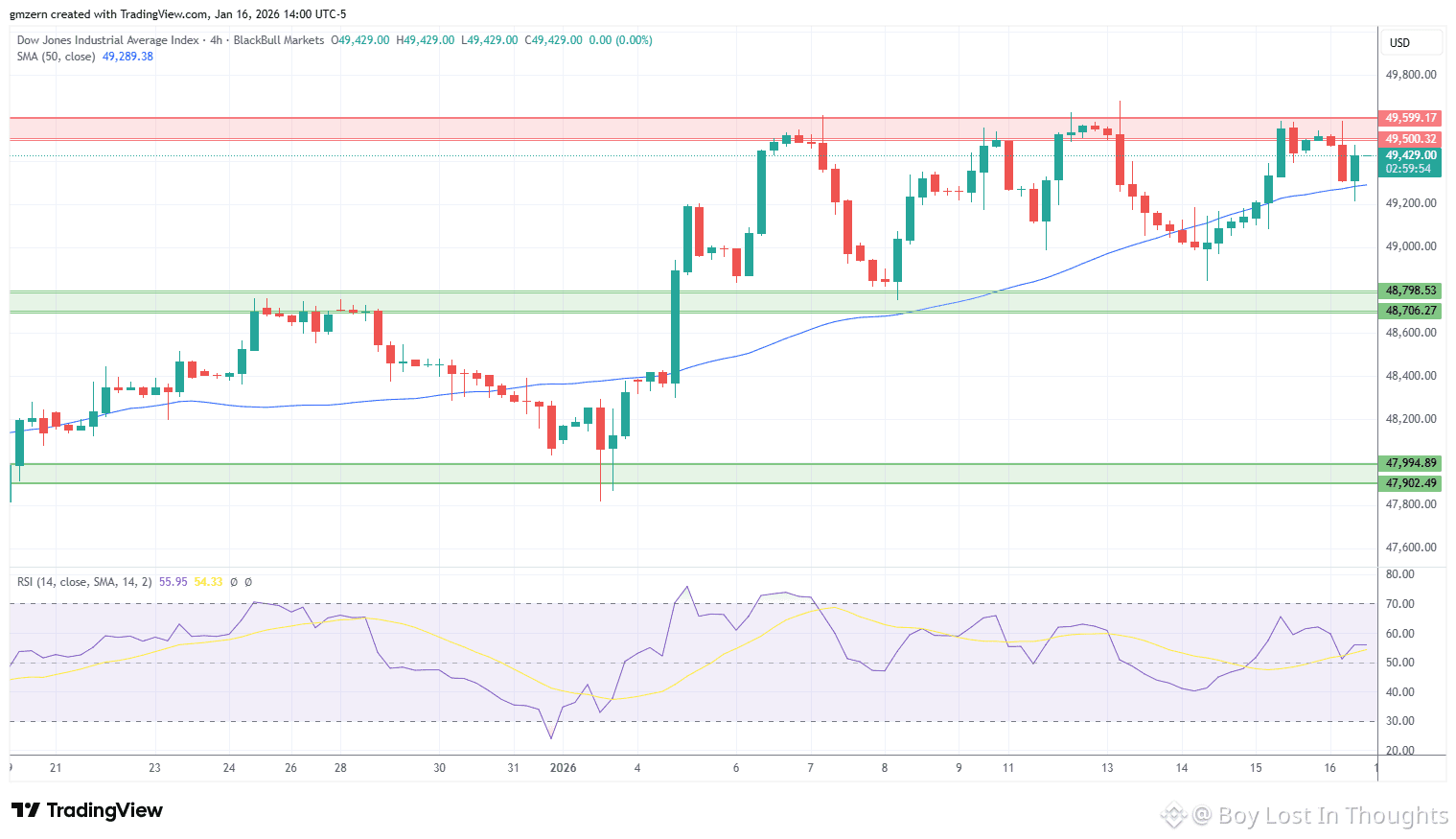

Dow Jones stalled below 49,500 – 49,600, needing catalysts to push toward 50,000.

Sector Split: Real estate and industrials led gainers, while basic materials lagged due to a pullback in precious metals.

Rate Cut Bets Adjust: Rising Treasury yields suggest traders are scaling back expectations for near-term Fed rate cuts amid strong economic signals.