Natural gas prices are hovering just above a major long-term support level, signaling that the recent aggressive selloff may be losing steam.

Key Takeaways:

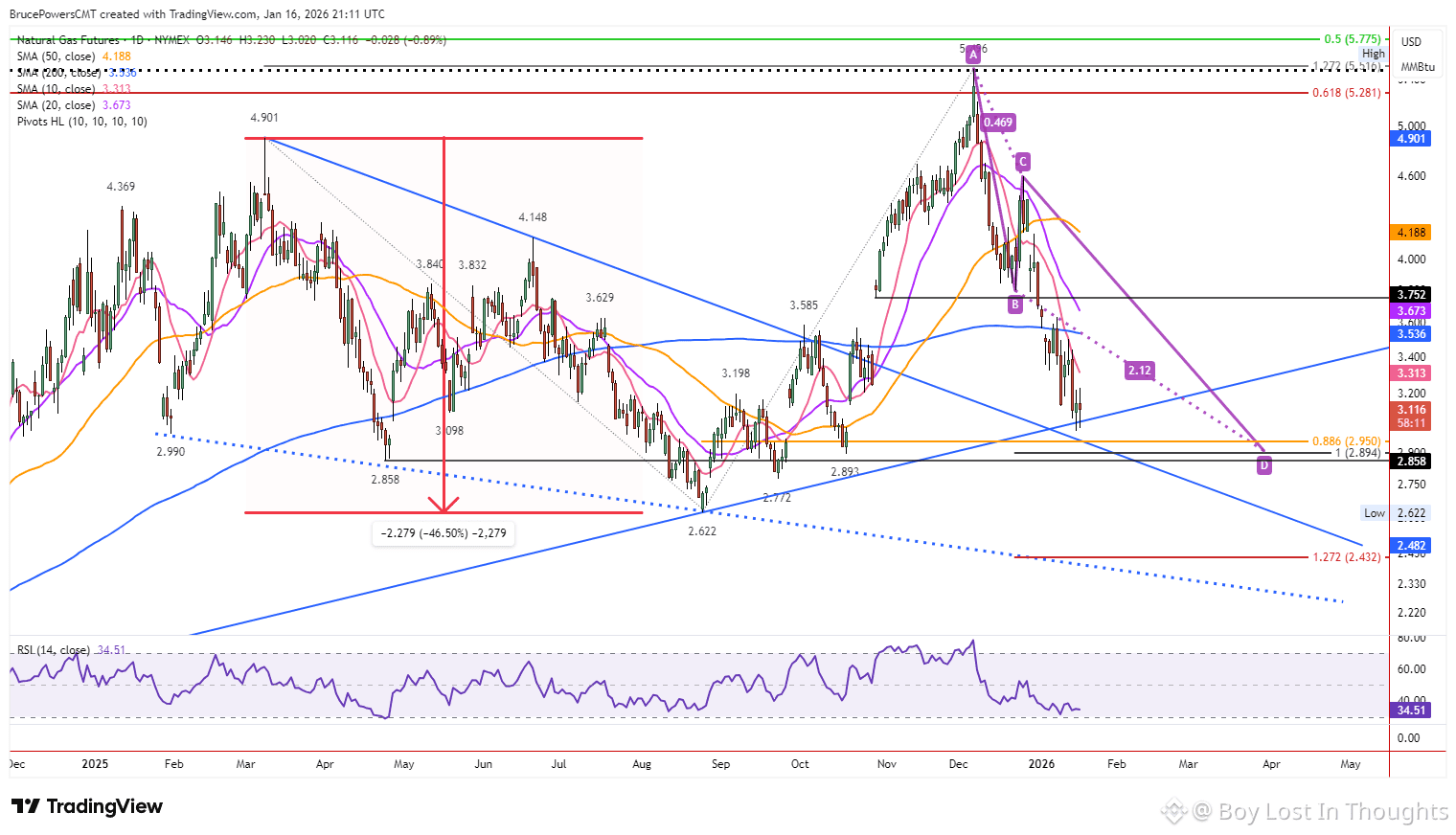

Selling Pressure Stalls: Bearish momentum is slowing as prices consolidate near the trend low of $3.01, forming similar daily closes.

Critical Support Test: The price is finding temporary footing at a key long-term uptrend line, creating a higher daily low.

Immediate Resistance: Any short-term rally faces a cap at the falling 10-day moving average ($3.31), which has recently triggered renewed selling.

Make-or-Break Levels:

Bullish Case: A hold above the trendline could signal exhaustion and a potential reversal.

Bearish Case: A decisive break below $3.01 opens the door for a drop toward the next major targets between $2.89 and $2.95.

Correction Nearing Historic Extreme: The current ~45% drop from November's peak is nearing the maximum decline seen since 2024 (46.5%), suggesting the selloff is maturing and a significant bounce could be imminent.