Despite facing selling pressure from a delayed crypto bill in the U.S. Senate, XRP found a critical support in robust institutional investment. While regulatory uncertainty triggered a three-day decline, persistent inflows into U.S. XRP-spot ETFs have helped cushion the fall. Analysts maintain a cautiously bullish outlook, with medium-term price targets of $3.00 and $3.66 hinging on the passage of favorable legislation.

Highlighted Major Points:

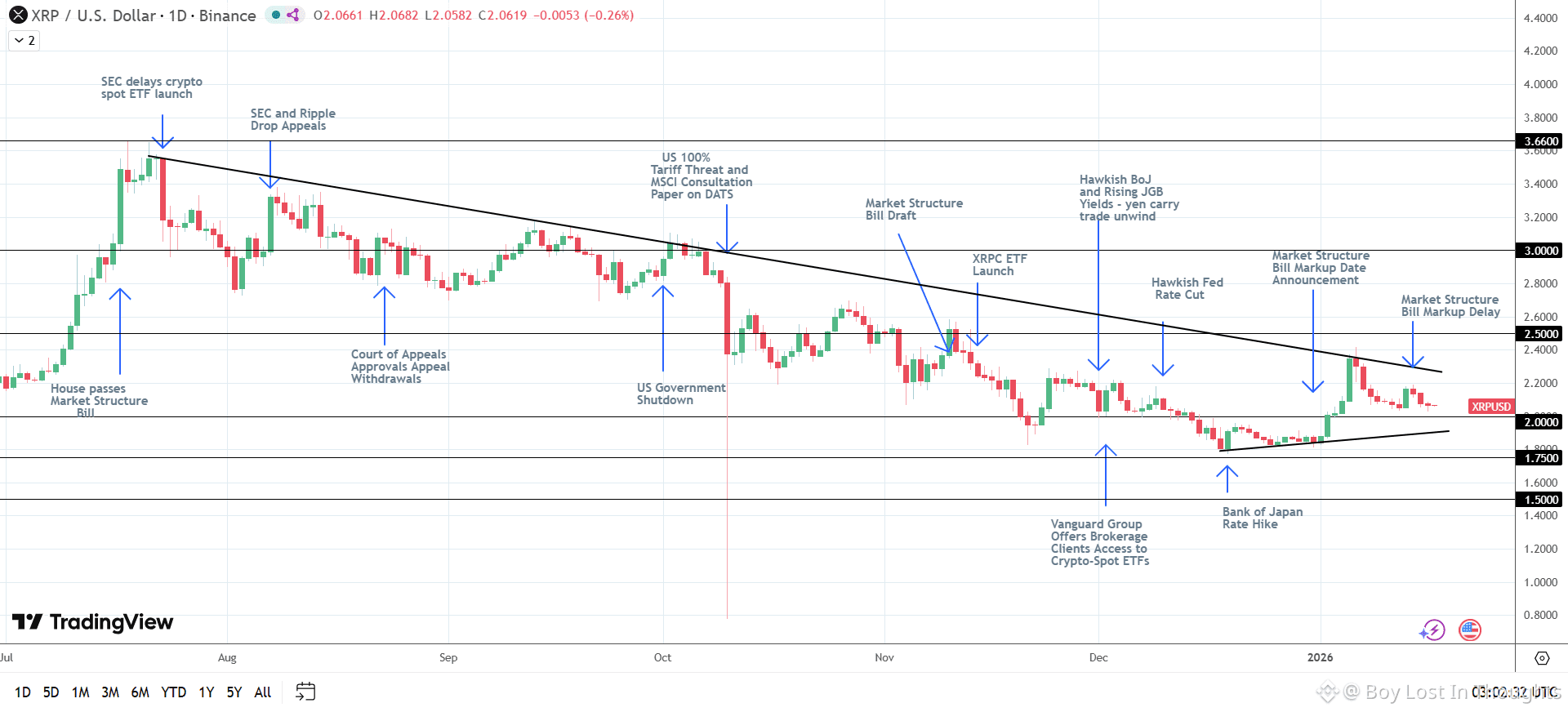

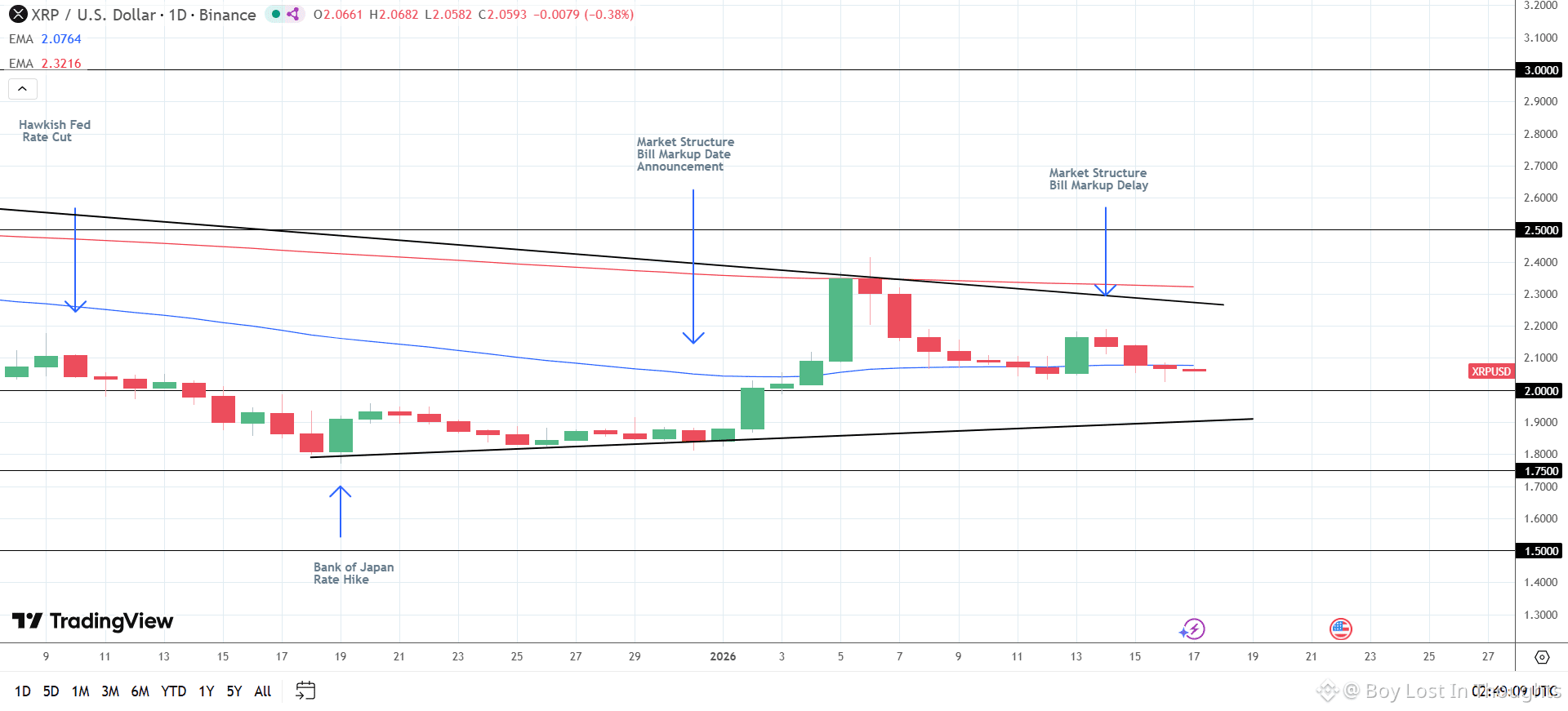

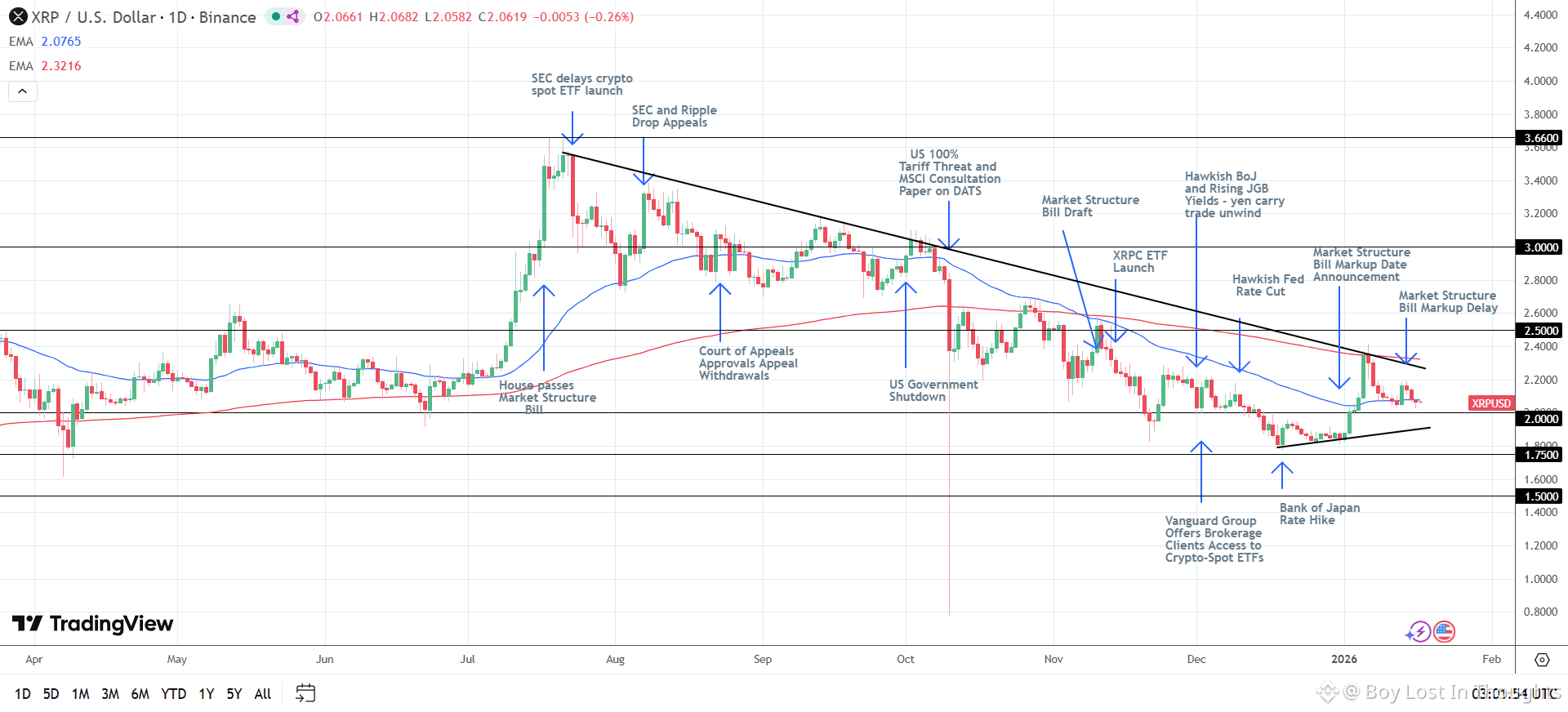

Regulatory Pressure: XRP's price dropped after the U.S. Senate postponed key votes on the "Market Structure Bill," creating uncertainty and cooling investor sentiment.

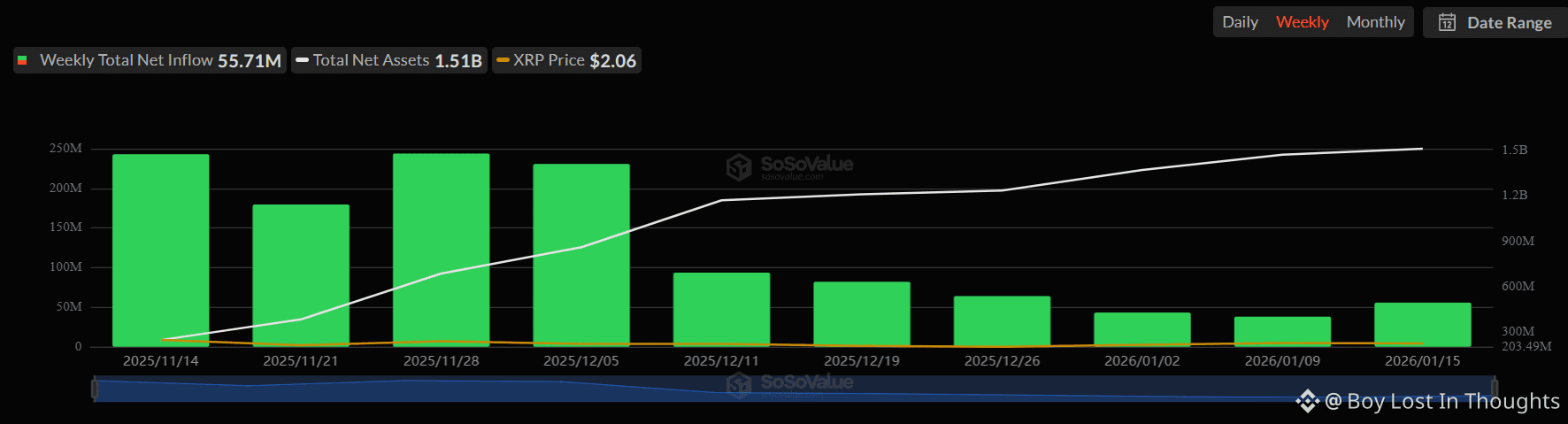

ETF Lifeline: Strong institutional demand persists, with U.S. XRP-spot ETFs recording 10 consecutive weeks of net inflows, providing a crucial buffer against negative news.

High-Stakes Legislation: The bill's progress is contentious. The White House's support may depend on compromises with major players like Coinbase, whose CEO criticizes provisions that could harm innovation and consumer rewards.

Price Sensitivity: XRP has proven highly reactive to legislative news, rallying on positive developments and falling on delays.

Constructive Forecast: The core outlook remains positive. Analysts cite ETF demand, growing real-world utility for XRP, and expected crypto-friendly laws to fuel a move toward $3.00 in 4-8 weeks and $3.66 in 8-12 weeks.

Key Risks: Threats to this bullish scenario include hawkish central bank policies, delays in U.S. rate cuts, political challenges to the crypto bill, and a reversal in ETF fund flows.

Technical Watch: XRP is currently testing important support near $2.00. Holding above this level is seen as vital to maintaining the positive medium-term structure.