January 18, 2026 - The “sluggish” specter of 2025 has finally been exorcised. As the crypto market continues into its third week of the new year, the mood is electric. Coming off a period of sideways action and a brutal sector purge to the tune of $1.2 trillion towards the end of the previous year, the digital asset market is fully redeemed and in force, thanks to the presence of “suits” and the currently favored macro trends.

The Main Event: Bitcoin Eyes Six Figures

The Main Event: Bitcoin Eyes Six Figures

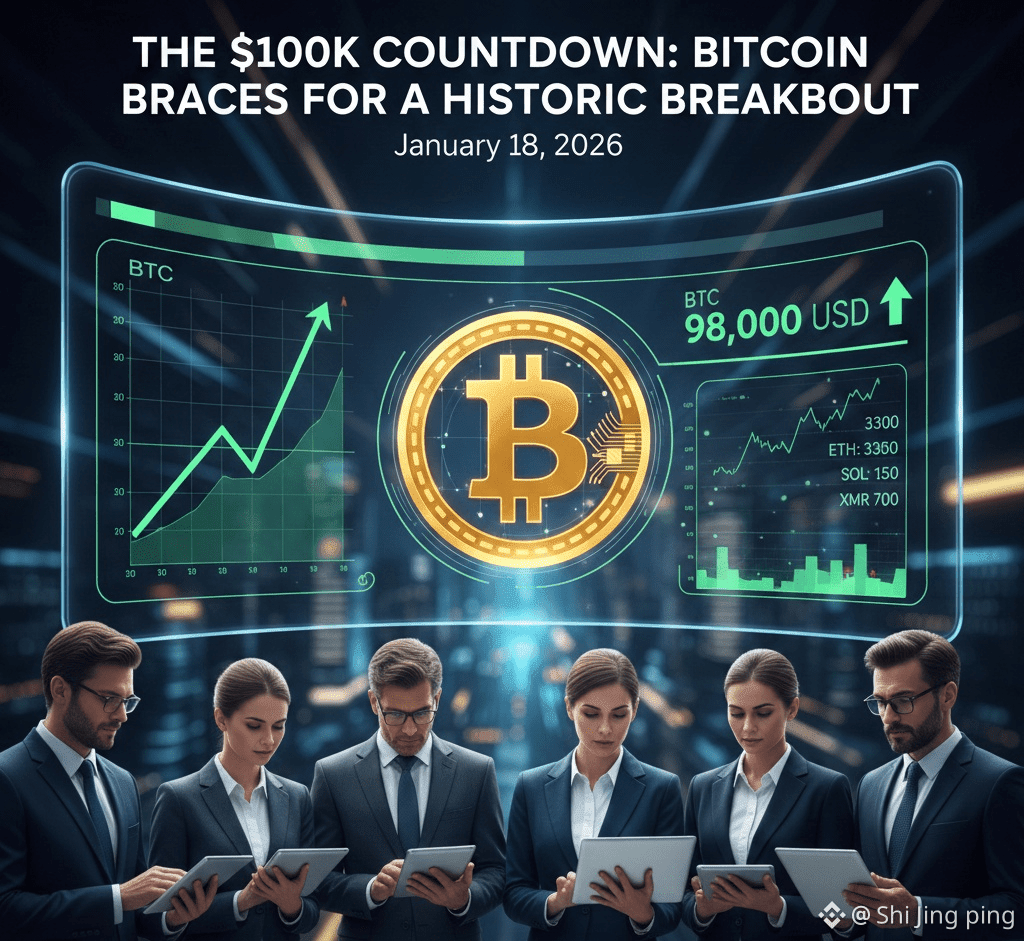

“Bitcoin (BTC) is the current center of attraction, hovering near the $98,000 level. Interestingly, for the first time in the past three months, the 'king of crypto' has formed a stronger 'higher high' pattern, thereby confirming the end of the bearish phase and the commencement of the bullish trend.”

The Catalyst: A "perfect storm" of growing demand for Spot ETFs and decelerating U.S. inflation.

The Resistance: All eyes are on the region of $100,000 to $106,000. Crossing this level could set off the "ETF Palooza" situation which analysts have been talking about since the year began.

The Safety Net: Major Support remains strong at $94,500. While BTC is above this level, the direction of least resistance is up.

???? Altcoin Watch: Beyond the King

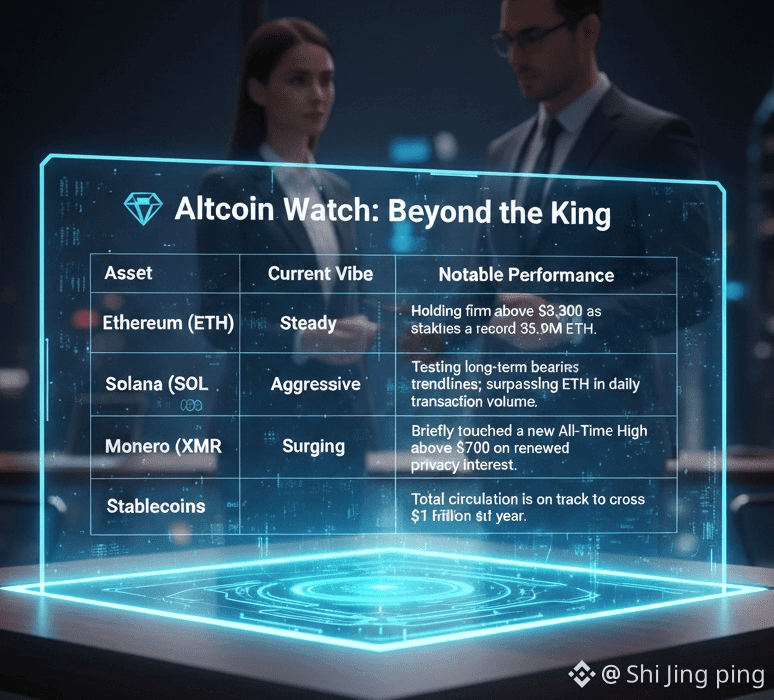

However, while Bitcoin is at the forefront, there are hints of a “sophisticated rotation” seen in the altcoin market. There is more than just a “meme” market; there is a search for utility here

The “Institutional Era” is Upon Us

Forget the retail-driven ‘moon missions’ that marked the last decade. The new year, and indeed the new decade, has been declared the ‘Dawn of the Institutional Era

Corporate Treasuries: In excess of 170 publicly listed companies own Bitcoin as a commonplace hold alongside cash.

“Regulatory Relief”: The U.S. is set to usher in the CLARITY Act, which provides regulatory guardrails that large banks are craving in terms of legal protection.

The IPO Wave: In the wake of Circle’s record-breaking $1.1 billion IPO, behemoths such as Gemini and Kraken are said to be lining up for public listings too.

Bottom Line: "The casino is not a casino." With the SEC tossing out several big-name cases and a crypto-friendly regime in DC, the groundwork is being laid in real-time to support a long-term bull market.

⚠️ A Word of Caution

Despite the optimism, the Fear And Greed Index is currently in “Neutral” with a value of 45. This is quite a good indication in itself, since it implies that instead of the buying euphoria by individuals, it seems to be largely institutional rebalancing that is taking place in markets. However, it would be important to watch the surprise inflationary numbers due on January 20th, which could trigger a rapid test of support levels around $85,000 in their wake.