The first time I took DuskDS seriously, I stopped thinking about “features.” I started thinking about endings. In finance, the ending is the point. A trade is not real because it looks good on a screen. It becomes real when it settles. Ownership changes hands. The record becomes final. Disputes become rare, because the system has a clear answer.

DuskDS is built to be that kind of answer. Dusk describes DuskDS as its settlement, consensus, and data availability layer. Those three words sound technical, but they map to one plain job: decide what is true, make it final, and store enough data for others to verify it. If you want regulated assets on-chain, that job matters more than anything running on top.

Most chains sell excitement. DuskDS sells predictability.

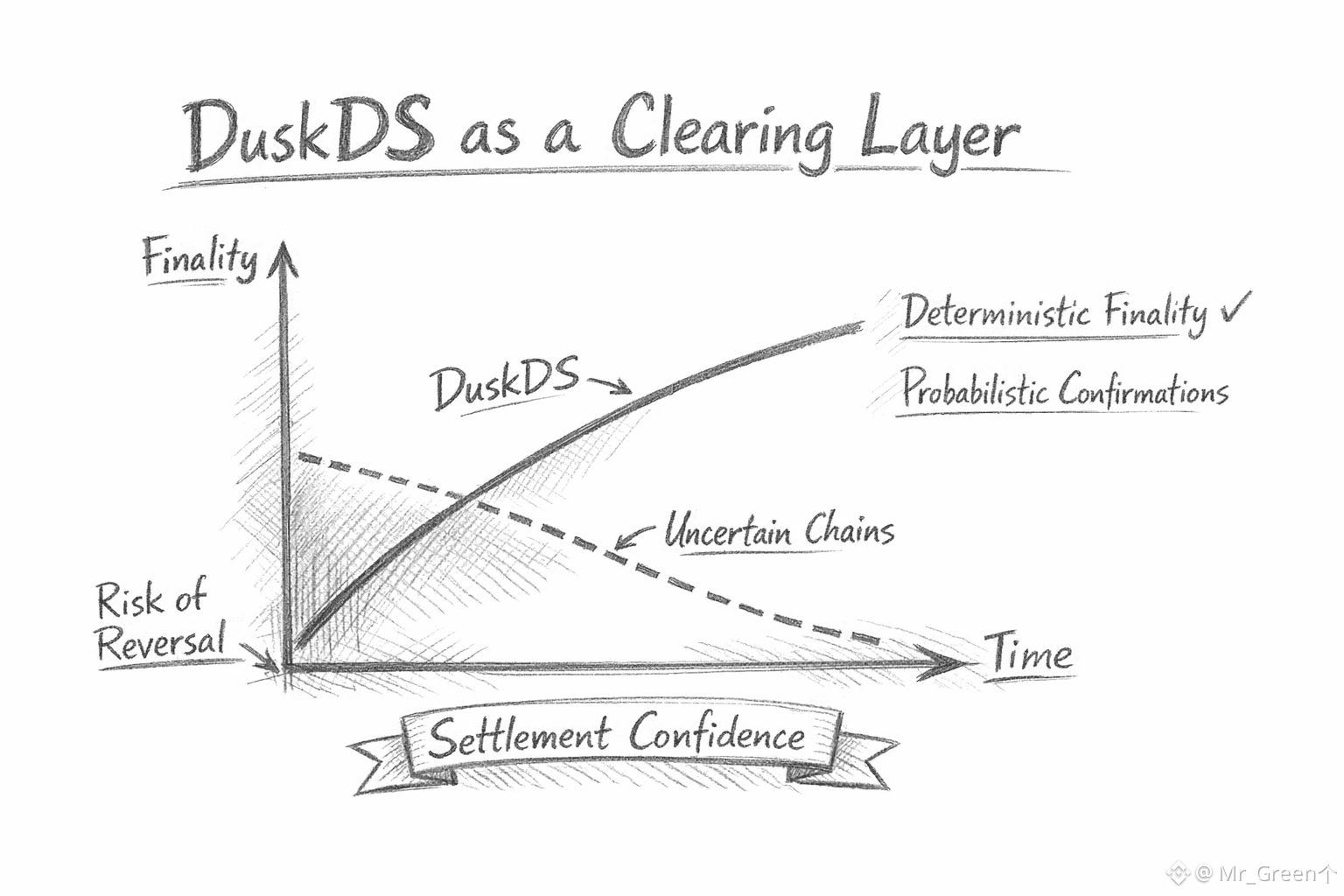

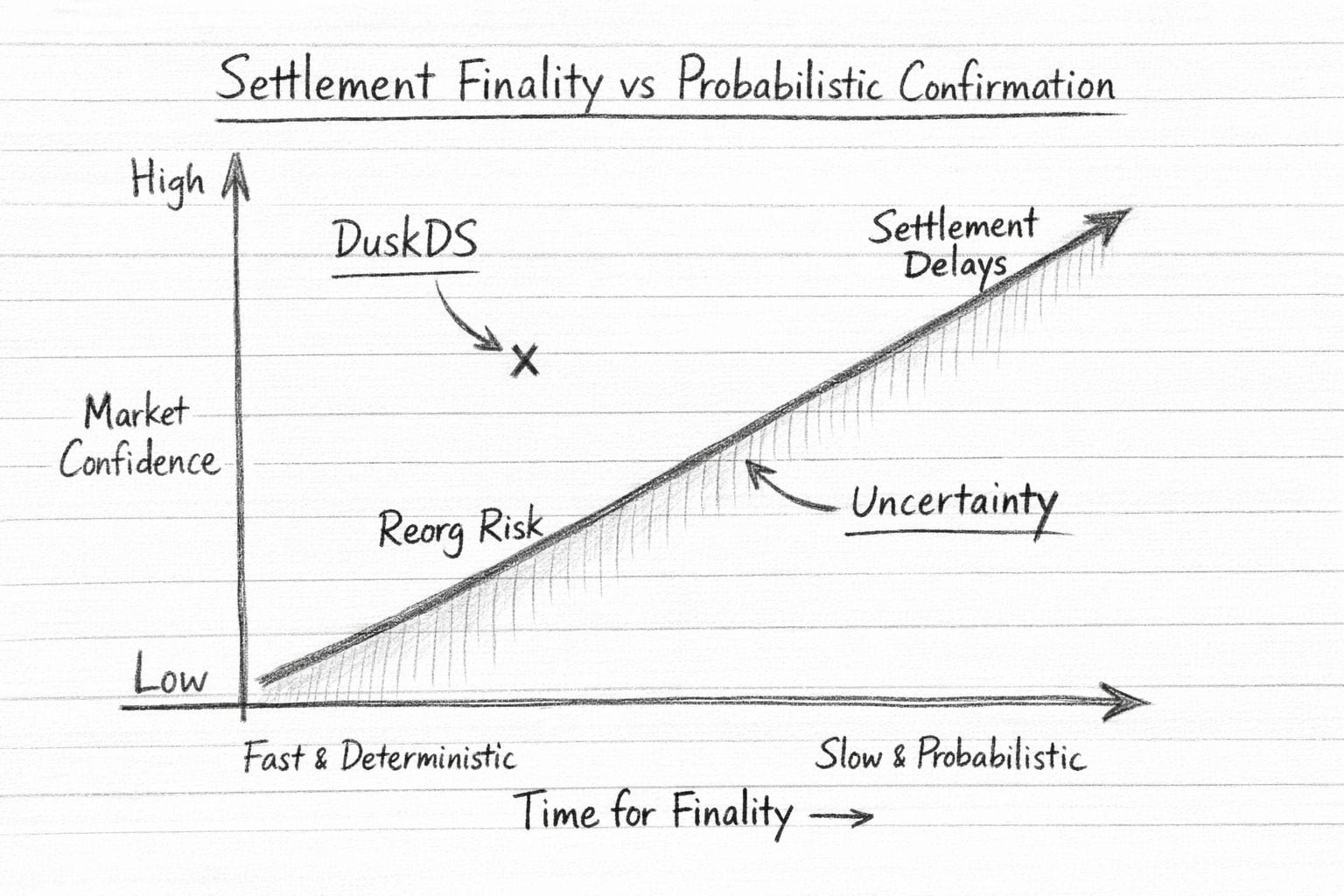

Predictability is the quiet requirement behind serious markets. It is the reason clearing systems exist. It is the reason brokers and custodians have procedures that look slow from the outside. They are not slow because they like friction. They are slow because finality and accountability are expensive to get wrong.

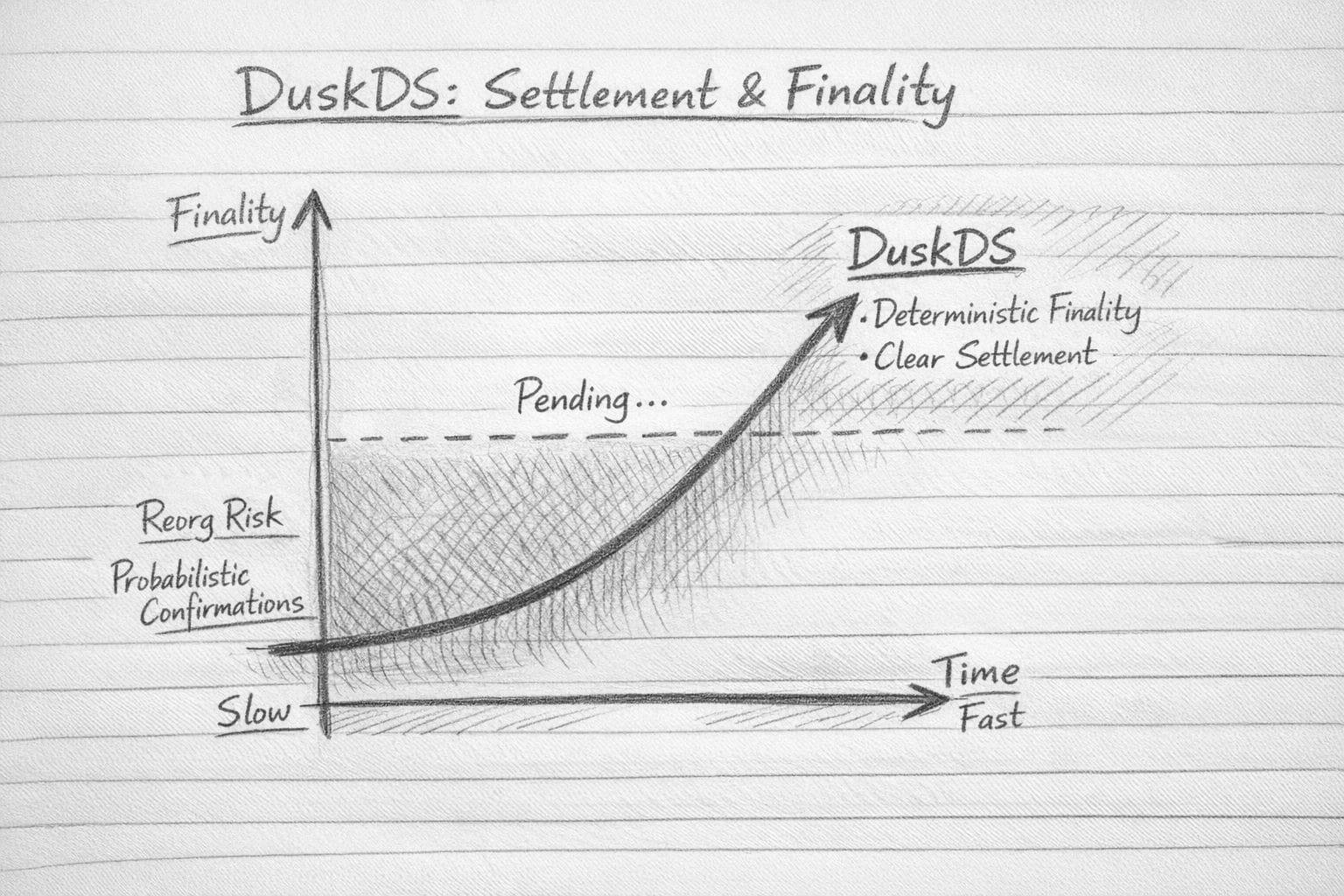

DuskDS tries to bring that posture into a blockchain environment. It uses proof-of-stake, and Dusk emphasizes deterministic finality in its design language. The important idea here is not the label “PoS.” It is what Dusk is trying to achieve with it: a final settlement moment that feels like a switch, not a rumor. If a block is final, you treat it as final. You plan around it. You build operational rules around it.

That is a different mindset from chains where users learn to think in probabilities. “Wait five confirmations.” “Wait thirty blocks.” “Hope there is no reorg.” Probabilistic confirmation can be fine for casual transfers. In regulated workflows, it becomes an operational headache. A compliance team does not like “probably.” A custodian does not like “probably.” A bridge operator does not like “probably.”

This is why DuskDS is not just the “base layer.” It is the product.

Dusk’s modular approach makes that even clearer. Dusk separates settlement from execution. DuskDS handles settlement and consensus. DuskEVM sits above it as an EVM-compatible execution layer. That division matters because it reduces the chance that application complexity disturbs the layer that needs to stay stable.

You can think of it like a courthouse and a marketplace. The marketplace can be noisy. People can shout, bid, and trade. The courthouse should not change its rules every time the crowd gets excited. DuskDS is meant to be the courthouse record. DuskEVM is meant to be a marketplace where familiar smart contract logic can run, then settle back to the base record.

This also explains why Dusk talks about being “built for regulated finance” without sounding like a chain that wants to do everything for everyone. In regulated markets, you do not need a thousand experimental apps. You need a settlement layer you can trust, and execution paths that fit the workflows you actually want.

DuskDS is also where the “data availability” part becomes practical. Data availability is a simple idea with a heavy impact. If the network finalizes something but does not make the supporting data available, other parties cannot verify it. In finance, verification is not a hobby. It is part of trust. If a broker says a position exists, there is a record. If a trade settles, there is evidence. If someone audits, there is data.

So when DuskDS includes data availability in its base role, it signals a mindset: settlement is not only a timestamp. It is a verifiable event with supporting information.

Now, the token economics thread.

DUSK is used for staking and fees on the base layer. That matters because settlement security is not free. Proof-of-stake systems rely on incentives and penalties to keep validators honest. Fees and staking rewards form a kind of security budget. If you want DuskDS to be treated like infrastructure, the system must pay for the behavior that makes infrastructure reliable.

This is one of the clearest differences between “chains built for attention” and “chains built for settlement.” Attention moves. Security costs stay.

The modular design also brings a practical market detail that traders notice quickly: moving between layers introduces timing.

Dusk’s bridge flow between DuskEVM and DuskDS includes a finalization period for withdrawals. The plain implication is that you should not treat cross-layer movement as instant. If you are moving size during volatility, time becomes part of risk. This is not unique to Dusk. It is a general truth of modular systems. But Dusk’s own guidance around finalization makes it concrete. You plan for it. You don’t discover it mid-trade.

That might sound like a drawback, but it is also an honest signal. Finance is full of time windows: settlement cycles, cutoffs, finalization delays, and reconciliation steps. The difference is whether those windows are known and bounded. Bounded time is manageable. Surprising time is where losses happen.

The other part I find interesting about DuskDS is how it sets the stage for privacy without forcing everything into one mode.

DuskDS supports both transparent and shielded transaction styles in its design language. This matters for finance because finance is never “all public” or “all private.” Some flows need openness. Some flows need confidentiality. A public report is not the same thing as a private position. A regulator’s view is not the same thing as the public’s view.

Dusk’s broader idea of selective disclosure fits here. A system can keep details private by default, while still allowing rule checks and audit access when required. The goal is not secrecy for its own sake. The goal is to reduce unnecessary exposure while keeping verifiability intact.

That’s the point where DuskDS becomes more than a technical layer. It becomes a stance on how markets should behave on-chain.

A lot of crypto infrastructure assumes radical transparency is always good. DuskDS sits closer to the opposite belief: transparency should be scoped. It should be purposeful. It should serve verification, not voyeurism.

When you connect this to the real-world asset direction, the role of DuskDS becomes even clearer.

Dusk Trade is presented as a regulated trading and investment platform built with NPEX, with compliance-focused onboarding. Regardless of how quickly any product grows, the existence of that direction tells you what DuskDS is trying to be used for. Regulated assets need more than fast transfers. They need clean settlement, clear records of ownership, and a compliance posture that does not crumble under scrutiny.

So DuskDS is being asked to do something difficult: act like a settlement rail that can support both crypto-native programmability and finance-native constraints.

That is the advantage. It is also where limitations show up.

A finance-grade settlement layer must prove itself over time. It must hold through volatility. It must hold through upgrades. It must hold through edge cases and stress. These are not problems you solve with one good week of uptime. They are problems you solve with years of predictable behavior.

A modular system also raises coordination demands. When execution happens in one place and settlement in another, developer tooling, bridge UX, and operational playbooks all matter. The design can be sound, but the user experience can still fail if the edges are rough. That is where most “good architecture” projects get tested: not in diagrams, but in daily use.

There is also the adoption reality. DuskDS is aimed at a market that moves slowly. Regulated finance does not sprint. It pilots. It reviews. It waits. That can make progress look quiet from the outside. It can also make token markets impatient, because charts want quick catalysts while infrastructure wants long trust cycles.

But I think DuskDS is easier to judge than many chains, because its goal is legible.

If DuskDS succeeds, it will feel boring in the best way. Blocks will finalize predictably. Settlement will be clear. Data will be available for verification. Builders will run familiar logic on DuskEVM and settle back to DuskDS without drama. Regulated platforms will use the rails because the rails don’t surprise them.

If it fails, it will likely fail at the points that always break settlement systems. Not enough real usage to justify the security budget. Too much friction at the edges. Too much complexity for users to handle safely. Or a mismatch between what regulated markets demand and what a public blockchain can comfortably provide.

Either way, DuskDS is a useful reminder of what “Layer 1” can mean.

A Layer 1 does not have to be an amusement park. It can be a clearing layer. It can be a base record of ownership. It can be a system that aims to make on-chain finance behave like finance, with rules that hold and settlement that ends the argument.

That’s the real story of DuskDS. It is not trying to win the loud contest. It is trying to win the trust contest.