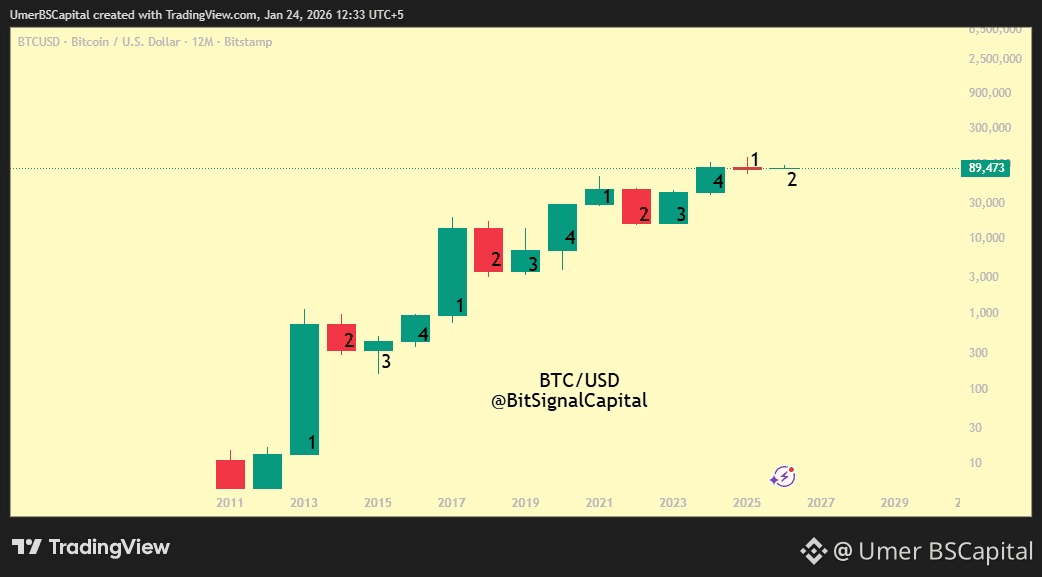

Bitcoin has now entered the second year of its current four-year cycle, a phase that historically aligns with market peaks and early distribution.

Looking at past cycles, 2025 statistically fits the role of a bull-market top, while 2026 has historically acted as the Bitcoin bear-market year. This does not always mean a sharp crash — more often, it reflects a prolonged period of lower highs, fading momentum, and capital rotation.

What makes this cycle different is institutional participation. Spot ETFs and regulated exposure may reduce extreme downside volatility, but they can also extend the duration of bearish conditions.

Based on historical structure: • 2026 → Distribution & controlled bearish phase

• 2027 → Bottoming & accumulation

• 2028+ → New bullish cycle development

Understanding where we are in the cycle is more important than predicting short-term price movements. Successful traders adapt — emotional traders react.

Risk management > predictions.