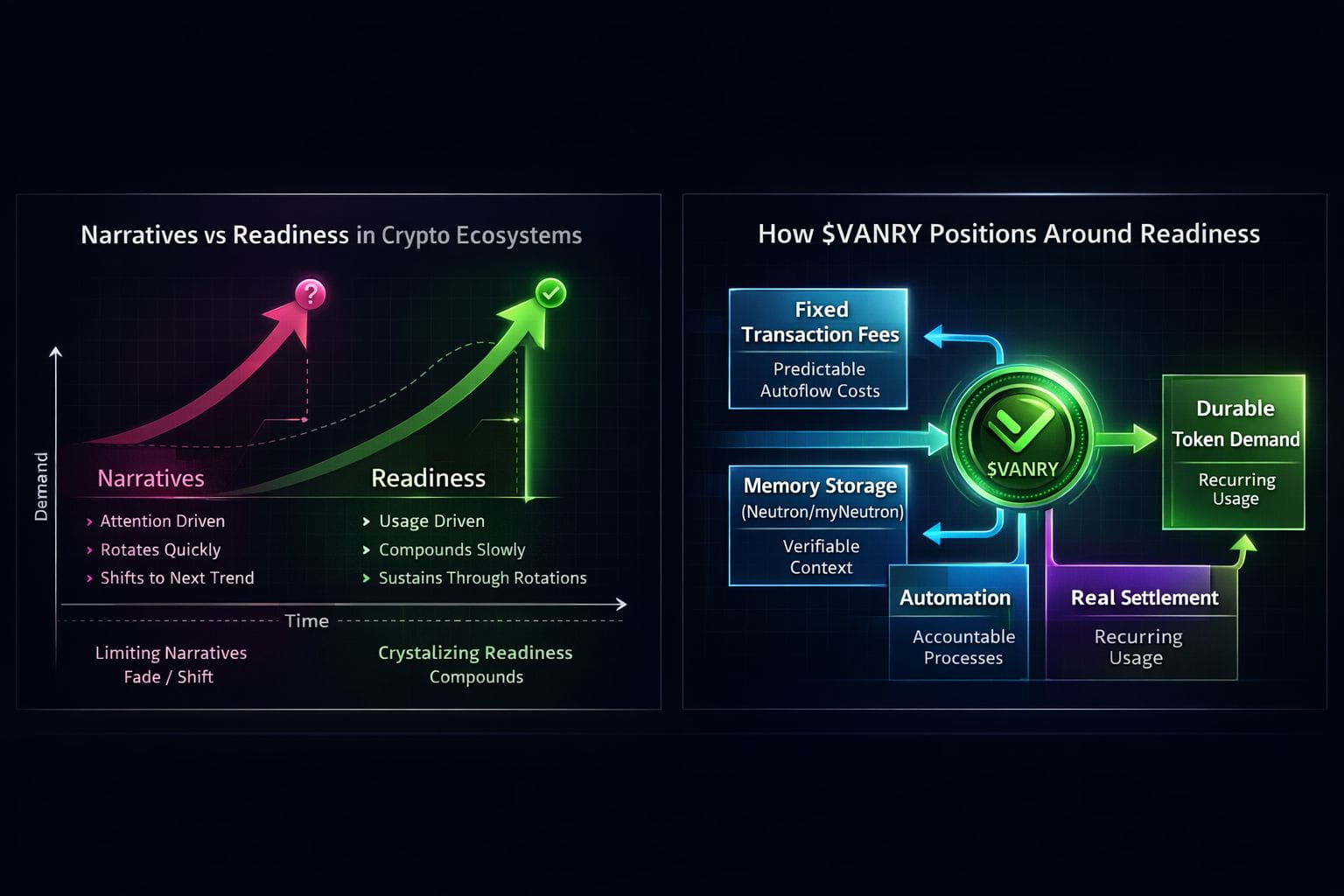

Crypto markets love a clean story. A single word catches fire; AI, RWA, PayFi, and suddenly everything is “the next big thing.” Then the story rotates. Attention moves, timelines reset, and the same projects that sounded inevitable last month are back to fighting for oxygen. This is why narratives are powerful, but also why they’re a bad foundation for long-term conviction: they travel fast, and they expire fast.

“Readiness” is different. Readiness is what remains after the story cools down—whether the infrastructure still works, whether users still show up, whether products still get used when the hype cycle stops doing the marketing. In the AI era, readiness is becoming the sharper lens because intelligent systems don’t care about slogans. Agents route around friction. They choose rails that are predictable, composable, and verifiable. If the infrastructure can’t support repeatable operation, agents won’t “believe” in it—they’ll simply avoid it.

This is the most useful way to interpret Vanar’s positioning, and by extension, how $VANRY tries to matter. Vanar didn’t just rename a token; Binance completed the Virtua (TVK) token swap and rebranding to Vanar (VANRY) at a 1:1 ratio, making VANRY the visible market identity going forward. That event matters because it anchored the ticker—but the more important question is what the ticker does when you stop treating it as a storyline and start treating it as an economic instrument inside a stack.

Start with the least glamorous requirement for agents: cost predictability. Most chains still behave like surge-priced highways—cheap at 3 a.m., expensive at rush hour, and hard to budget if you’re trying to run automated workflows at scale. Vanar’s docs take a direct swing at that problem by describing “fixed fees” where transaction charges are determined in relation to the USD value of the gas token rather than raw gas units, explicitly to keep costs fair through market fluctuations. They publish fee tiers with a baseline $0.0005 fixed-fee tier across a broad gas range, while noting the nominal USD value can vary slightly due to token price changes. This isn’t just a nice UX improvement; it’s the difference between “automation you can deploy” and “automation you can only demo.” Systems need budgets. Agents need guardrails. Predictable execution costs are a readiness feature.

Then comes the second readiness ingredient: accountable operation. Vanar describes a hybrid consensus design—Proof of Authority governed by Proof of Reputation—where the Foundation initially runs validator nodes and onboards external validators through PoR. Whether you love or dislike that model, it signals a specific tradeoff: optimizing for operational clarity and controlled expansion rather than pure permissionless sprawl from day one. In readiness terms, this is Vanar betting that accountable validation can matter more than theoretical decentralization when the target users include enterprises, brands, and eventually autonomous systems that need consistent rails.

But readiness in the AI era can’t stop at execution and consensus, because agents don’t just execute—they remember. If the context that drives an agent’s action lives in a private database or a brittle storage link, then the chain becomes a receipt printer for decisions nobody can independently verify. Vanar’s myNeutron product positioning turns this into an economic loop by tying token usage to persistent knowledge storage. The myNeutron page explicitly states: pay with $V$VANRY d get 50% off blockchain storage costs. That is a concrete example of “readiness over narrative” token design: instead of asking people to hold a token because the theme is hot, it incentivizes spending the token on a resource agents actually consume—durable, queryable memory that can be used across workflows.

This is where the difference between narratives and readiness becomes practical. A narrative can inflate awareness, but it doesn’t create durable demand by itself. Readiness creates demand when usage becomes repetitive. If transaction costs are predictable, high-frequency interactions become realistic rather than theoretical. If storage is priced and discounted in the native token, memory-heavy usage loops can become token sinks rather than marketing claims. And if the chain’s operational model is designed for stable execution and validator accountability, it’s easier to build workflows that enterprises and agents can trust long enough to become habitual.

None of this is a guarantee, and it shouldn’t be read as financial advice. Readiness still has to be proven in public: adoption, real users, real throughput, real integrations, real retention. But the framework matters. Narratives rotate because they’re attention-driven. Readiness compounds because it’s usage-driven. And $VANRY’s strongest case is not that it’s “an AI token.” It’s that the infrastructure it sits inside is being designed to produce repeatable, budgetable, verifiable activity—where the token is consumed as part of doing real work, not just held as a symbol of the current trend.