I once watched a trade “work” in a demo… and still feel wrong in my gut. The price matched. The buttons lit up. But the real question hung there like a loose wire: where does the deal finish? That’s the thing Dusk Foundation (DUSK) keeps poking at with Dusk Trade. It’s not trying to invent a new kind of hype. It’s trying to fix a boring pain that makes big money stay cautious.

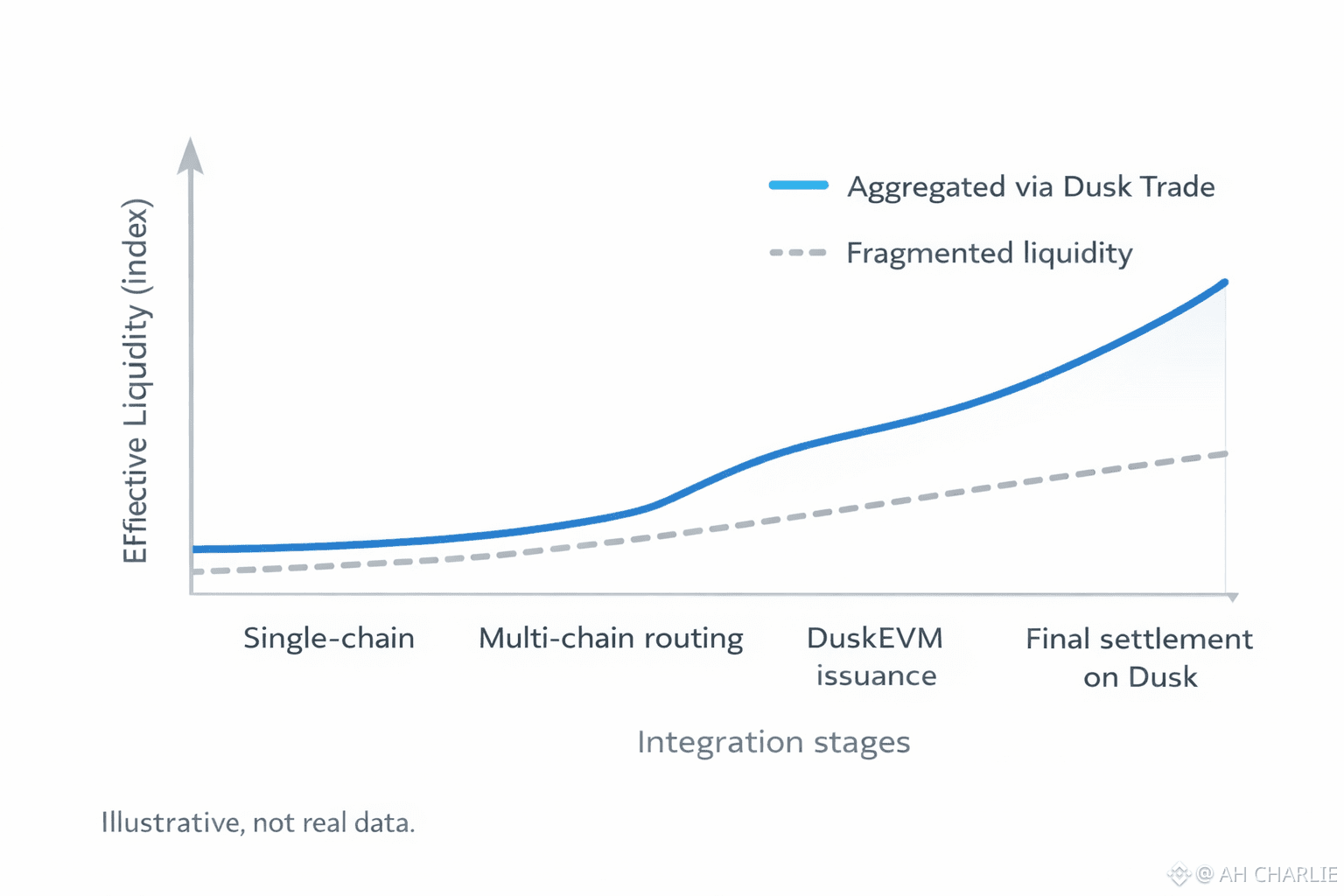

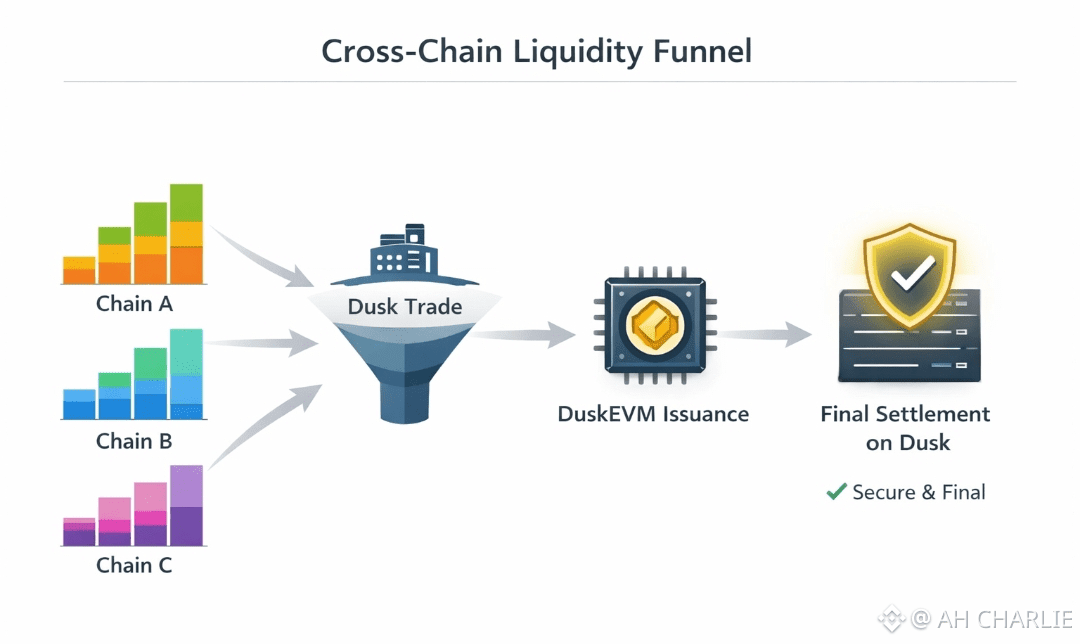

Liquidity is split across chains. Buyers here. Sellers there. A bridge in the middle. And time… time is risk. So Dusk Trade’s idea is blunt and clear: pull liquidity from many chains, issue the asset through DuskEVM, then settle for real on Dusk. One place to end the story.

Liquidity just means “can I buy or sell fast without moving the price a lot.” Like water flow. When it’s spread out, the pipes get thin. You feel it as slippage, weak books, weird gaps. And when you add many chains, the mess grows. Each chain has its own rules, its own timing, its own way of saying “done.” A trade becomes a relay race where nobody wants to be the last runner holding the baton.

That’s why the issuance layer matters. Issuance is just a fancy word for “making the asset on-chain.” Minting it. Setting its rules. Who can hold it, how it can move, what checks must happen first. DuskEVM is the workshop for that. “EVM” means Ethereum Virtual Machine, but you don’t need the full tech history.

It basically means devs can write smart contracts in a style a lot of people already know. So instead of forcing everyone to learn a brand new tool set, DuskEVM says, “build the asset logic here.” Familiar hands. Familiar tools. Less friction.

Now comes the part I care about most. Settlement. Settlement is the final step where the trade stops being a promise and becomes fact. Ownership changes. The cash leg is real. No “pending.” No “maybe.” In old finance, clearing and settlement systems exist for a reason. They reduce the fear that the other side won’t pay or deliver. On-chain, you can push settlement into code, but only if the base layer is built for it. Dusk wants final settlement on Dusk itself. That’s the point where the ledger closes the loop.

So imagine Dusk Trade as a funnel. Wide mouth on top, pulling order flow from many chains. Narrow, strict end at the bottom, where the final book of record lives. The top is messy by nature. Many chains. Many pools. Many sources of liquidity. The bottom has to be clean. One settlement layer. One final “this is true” moment.

The tricky part is cross-chain. Cross-chain just means moving value or data from one chain to another. It sounds easy. It isn’t. Bridges are where bad things love to happen, because you’re stitching two rule worlds together.

Dusk’s approach, as it’s framed, is to keep the asset’s core rules anchored in the issuance layer (DuskEVM), even if liquidity comes from elsewhere. That way the asset doesn’t turn into a different creature each time it travels. Same DNA. Same checks.

And those checks are not only tech checks. With Dusk, the theme is often “privacy with rules.” Not privacy as in hiding everything. More like selective reveal. You can prove you meet a rule without showing your whole life.

If you’ve ever had to show your entire ID just to prove your age, you get the idea. Dusk aims for the opposite: show the minimum, prove the point. That matters when you talk about real-world style assets and markets that can’t just be wild west forever.

I have a simple way to test if an architecture is serious. Does it respect how markets actually break? Dusk Trade’s model tries to. It assumes liquidity will stay multi-chain. It assumes users won’t live on one island. It also assumes final settlement needs a home that doesn’t shift every time you chase a better pool.

DuskEVM as issuance is like printing the ticket with the rules on it. Multi-chain liquidity is like letting many people trade that ticket in different towns. Settlement on Dusk is the gate where the ticket is finally scanned, accepted, and recorded. No scan, no entry. That’s not drama. That’s safety.

Will it be hard to pull off? Yeah. Cross-chain is cruel. Market micro issues pop up in places you didn’t plan for. But the direction makes sense to me. Dusk is not saying, “trust us, it’s magic.” It’s saying, “here is where assets are created, here is where liquidity comes from, and here is where the trade becomes final.” That clarity is rare. And honestly… it’s what real markets need if they ever want to feel normal on-chain.

@Dusk #Dusk $DUSK #RWA #Write2EarnUpgrade