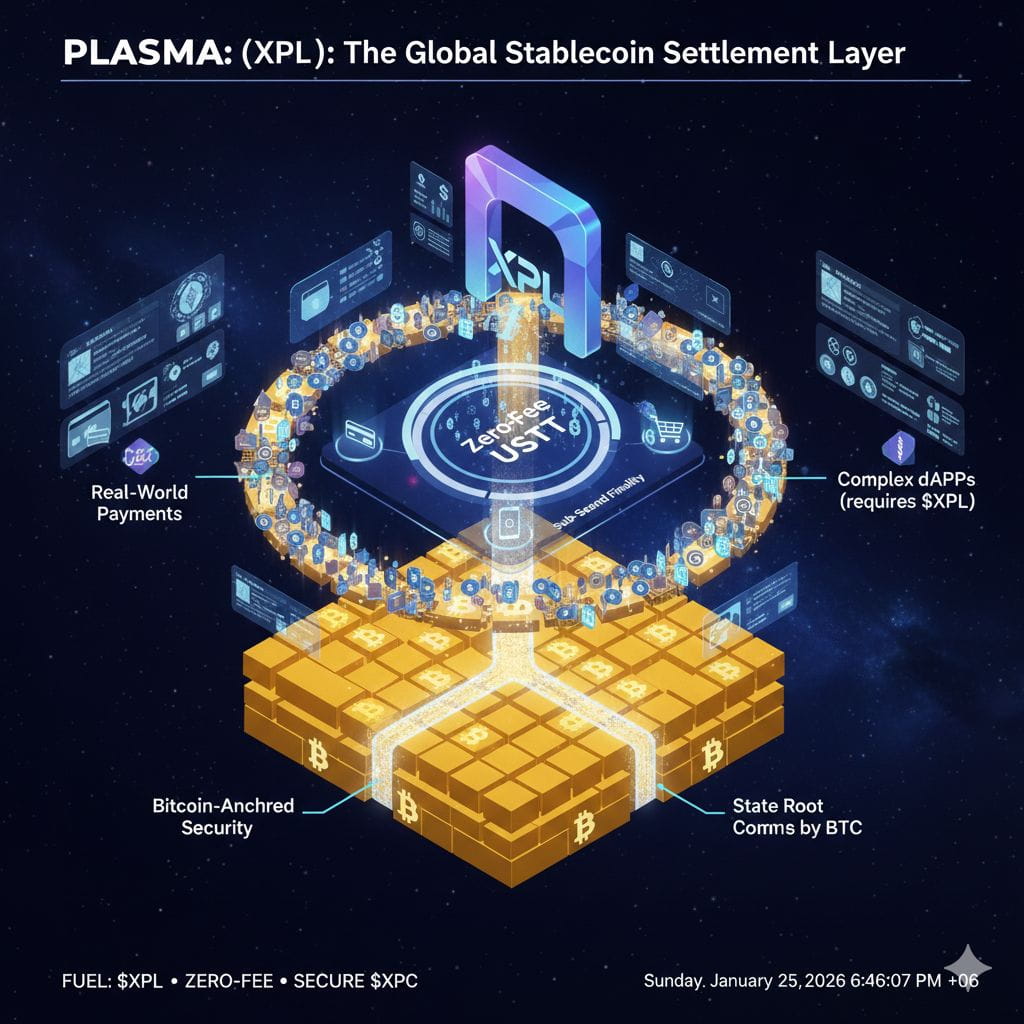

Plasma’s standout feature is its zero-fee USDT transfer model. Unlike general-purpose chains that treat every transaction equally, Plasma is optimized for high-volume payments. This is achieved through a native "Paymaster" system that allows the protocol or dApps to sponsor gas fees for simple transfers. this has evolved from a feature to a standard, enabling merchants to accept payments with the same ease as a credit card, but without the 3% merchant fee or the complexity of gas management.

While Plasma provides the speed of a modern Layer through its PlasmaBFT consensus, it refuses to compromise on security. The network periodically anchors its state roots directly to the Bitcoin blockchain.

By committing cryptographic "snapshots" to Bitcoin, Plasma inherits the world's most robust proof-of-work security.

If the validator set ever became compromised, the Bitcoin-anchored history serves as an objective "court of final appeal," making the ledger virtually immune to long-range attacks.

A Multi-Dimensional Utility

In this ecosystem, XPL acts as the economic cornerstone:

Network Security: Staking XPL is required for validators to participate in the SBA (Stablecoin-Based Agreement) consensus.

Complex Execution: While simple transfers are fee-free, advanced DeFi operations and smart contract deployments are powered by $XRP PL.

As the network activates the pBTC bridge in early. XPL holders play a pivotal role in governing the liquidity flows between the Bitcoin and stablecoin ecosystems.

With partnerships like the Rain card integration, Plasma is no longer just a technical experiment. It is a live payment rail where stablecoins "work in real life." For investors and developers, the value of Plasma lies in its specialization. By doing one thing—stablecoin settlement—better than anyone else, it is creating a moat that general-purpose blockchains simply cannot match.#plasma $XPL @Plasma