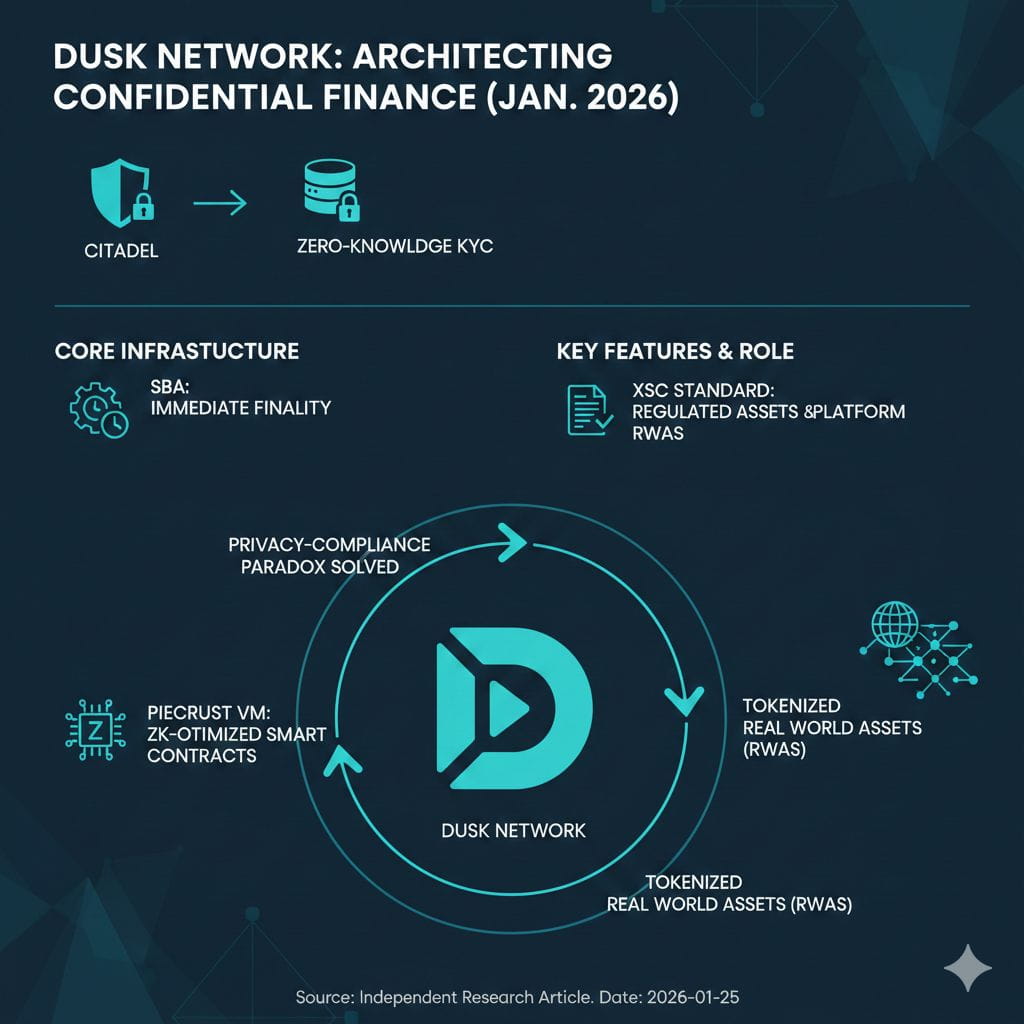

The institutional adoption of blockchain has historically stalled at the intersection of public transparency and regulatory privacy. @Dusk addresses this by reimagining the Layer 1 as a specialized clearing house. In my research, I have found that its value isn't derived from retail hype, but from its ability to handle the "Privacy-Compliance Paradox" through native zero-knowledge integration.

Core Infrastructure: SBA and Piecrust

The network utilizes Segregated Byzantine Agreement (SBA), a consensus model that ensures immediate finality. For institutional-grade finance, probabilistic finality is a non-starter; transactions must be settled instantly and irreversibly. I read about that being paired with Piecrust, a ZK-friendly Virtual Machine. Unlike standard VMs, Piecrust is optimized for the mathematical overhead of zero-knowledge proofs, allowing it becomes a high-speed engine for confidential smart contracts.

The Role of Selective Disclosure

Through the Citadel protocol, there are mechanisms for "Zero-Knowledge KYC." We become aware that a user can prove their eligibility to trade a regulated security without leaking sensitive PII (Personally Identifiable Information) onto the ledger. It becomes a middle ground where the user maintains sovereignty, but the institution maintains compliance.

Strategic Market Position

The project’s focus on the XSC (Confidential Security Token) standard positions it as the primary plumbing for Real-World Assets (RWAs). In my research, I have noted that by embedding compliance at the protocol level, @Dusk removes the need for expensive third-party legal intermediaries