Dusk Network is a Layer-1 blockchain built for one very specific problem in crypto: how to use public blockchains for real finance without exposing sensitive data. Most blockchains are transparent by default, which is fine for simple transfers, but it does not work well for regulated assets, institutions, or businesses that must protect identities, balances, and deal details. Dusk focuses on confidential smart contracts, allowing transactions and logic to stay private while still settling on a public and verifiable network. This makes it different from typical smart-contract chains that expose everything on-chain.

Dusk Network is a Layer-1 blockchain built for one very specific problem in crypto: how to use public blockchains for real finance without exposing sensitive data. Most blockchains are transparent by default, which is fine for simple transfers, but it does not work well for regulated assets, institutions, or businesses that must protect identities, balances, and deal details. Dusk focuses on confidential smart contracts, allowing transactions and logic to stay private while still settling on a public and verifiable network. This makes it different from typical smart-contract chains that expose everything on-chain.

The reason Dusk matters is simple. Real-world finance cannot move fully on-chain if every transaction is visible to everyone. Banks, asset issuers, and regulated platforms need privacy, but they also need public settlement, strong security, and finality. Dusk tries to sit in the middle of this problem. It aims to offer privacy without sacrificing decentralization and auditability. Instead of choosing between public blockchains or closed private systems, Dusk attempts to combine both ideas into one network.

At the core of Dusk is a proof-of-stake system designed for fast and deterministic finality. This is important because financial markets cannot wait for long confirmation times or probabilistic settlement. Dusk uses a committee-based consensus approach where selected participants propose and validate blocks, helping the network reach finality quickly and reliably. For financial use cases, knowing when a transaction is truly final is just as important as speed.

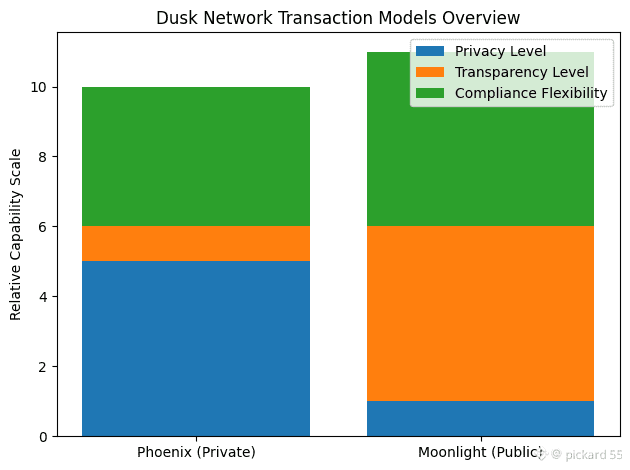

One of the most interesting parts of Dusk is how transactions work. The network supports two different transaction models. One model is fully private and uses zero-knowledge proofs to hide balances and transaction details. The other model is public and account-based, similar to what users are familiar with on many blockchains. Both live on the same chain. This gives developers and institutions flexibility. When privacy is required, it can be used. When transparency is required for compliance or reporting, it can also be used. This dual approach reflects how real finance actually works in practice.

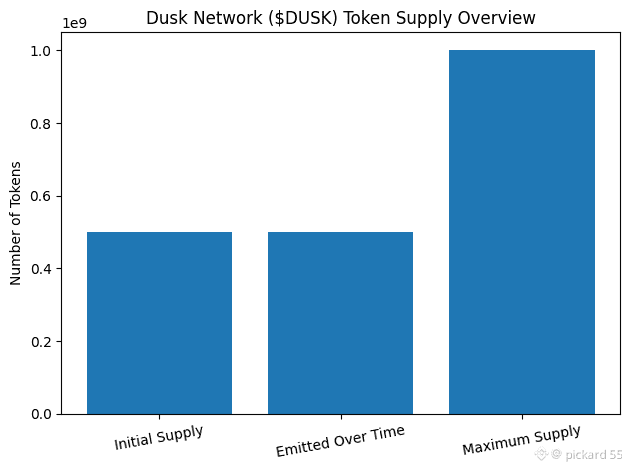

The $DUSK token plays a central role in securing the network. It is used for staking, participation in consensus, and incentives for validators. The token supply is designed with long-term emissions to support network security over time. There is an initial supply and additional emissions released gradually through staking rewards. The idea is to make sure the network stays secure even when transaction fees alone are not enough in the early years. Slashing is also part of the system, which means participants can lose stake if they act maliciously or fail to perform their duties. This creates strong incentives for honest behavior.

Around the core blockchain, Dusk is building an ecosystem of tools for users and developers. This includes wallets, node software, and developer documentation focused on confidential smart contracts. The codebase is open source, which allows anyone to inspect how the network works and contribute to it. The broader vision is to support real financial products on-chain, such as tokenized securities and compliant digital assets, without leaking private information.

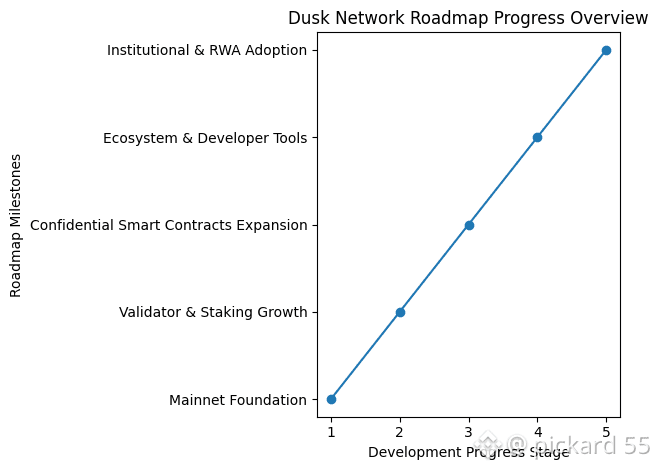

The roadmap shared by the team focuses on moving toward a mature mainnet that can handle real usage. This includes improving network stability, developer tooling, and usability. Like any roadmap in crypto, it should be seen as a direction rather than a promise, but it shows a clear focus on regulated finance instead of hype-driven trends.

There are also real challenges. Privacy technology is complex, and building systems that are both private and compliant is not easy. Developer adoption can be slower when tools are more advanced or different from common standards. Competition in the real-world asset and institutional blockchain space is growing fast. For Dusk to succeed, it needs real usage, not just good ideas.

From a practical point of view, Dusk feels like a long-term infrastructure project rather than a short-term narrative play. Its focus on confidential smart contracts and flexible transaction models makes sense for where regulated finance could be heading. If more real assets move on-chain, privacy will not be optional. That is where Dusk is trying to position itself.