🔓 Current unlock situation

According to on-chain/token data:

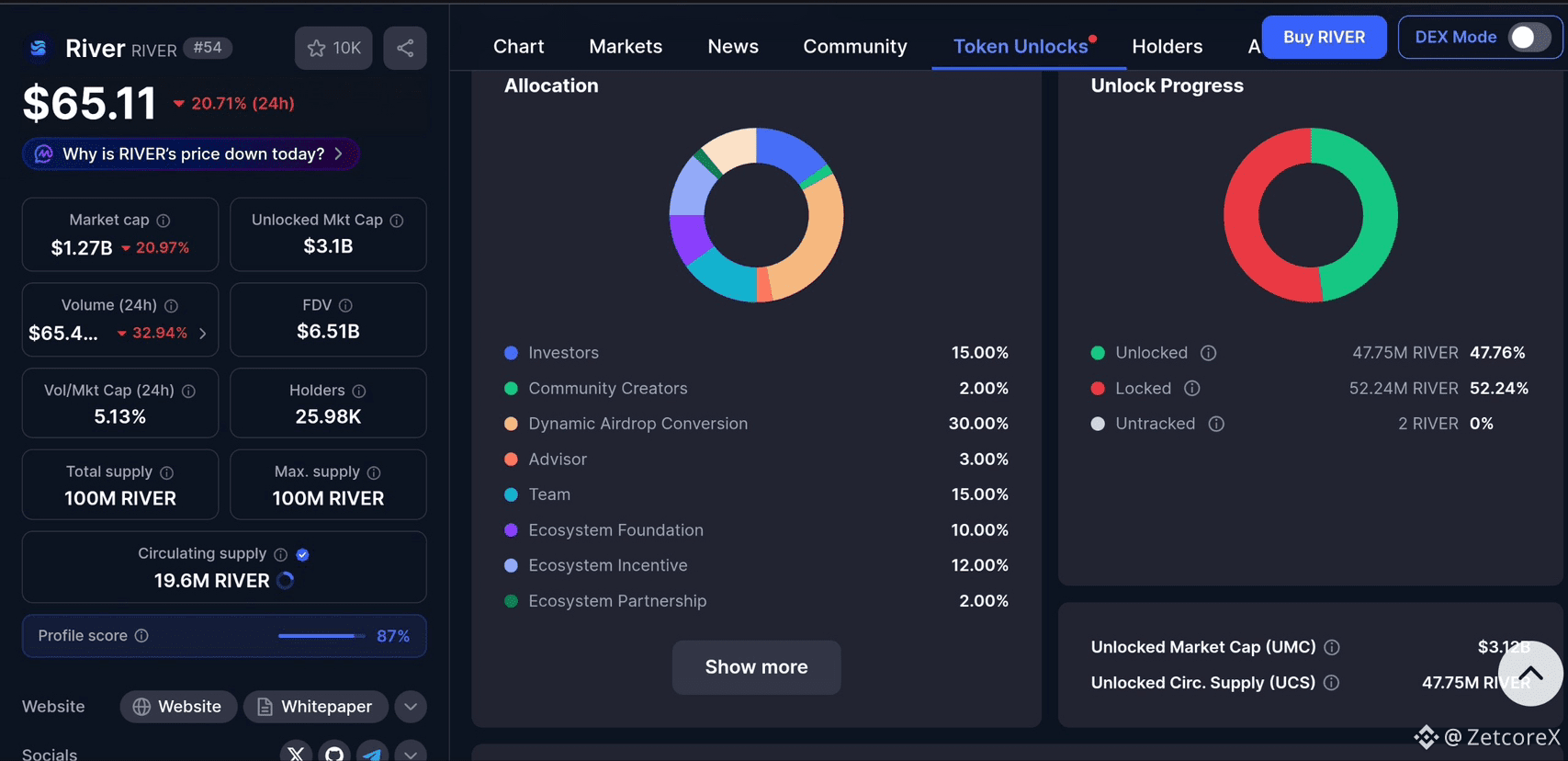

• Max supply: 100M $RIVER

• Unlocked: ~47.7M (≈ 47.7%)

• Locked: ~52.3M (≈ 52.3%)

• Circulating supply: still relatively low

• FDV is much higher than current market cap

📌 This means over half of the total supply is still locked.

Future unlocks = future supply entering the market.

⚠️ What this means professionally

Token unlocks are not automatically bearish —

but they change market dynamics.

They introduce:

• Potential sell pressure

• Liquidity shifts

• Trend instability

• Whale re-positioning

As more tokens unlock, price must find new real demand to absorb that supply.

If demand is weak → price adjusts downward.

If demand is strong → market can absorb unlocks.

🧠 Professional trader perspective

Professionals don’t only ask:

“Is price bullish?”

They ask:

• Who will receive unlocked tokens?

• Are they builders or sellers?

• Is volume strong enough to absorb new supply?

• Where is forced liquidity?

Unlock phases often create:

✔ fake breakouts

✔ distribution zones

✔ volatility spikes

✔ liquidity traps

This is when emotional traders get hurt.

🎯 Final assessment

$RIVER is entering a supply-sensitive phase.

Price will now depend less on hype

and more on real capital absorption.

This is no longer a simple momentum market.

It is becoming a structure market.

High opportunity.

High risk.

What matters most now is not prediction —

but reaction to unlock behavior.

👇

Do you think the market can absorb future $RIVER supply,

or will unlocks dominate price?

#RIVER #TokenUnlock #OnChainAnalysis #CryptoRisk #ProfessionalTrading #BinanceSquare #DYOR