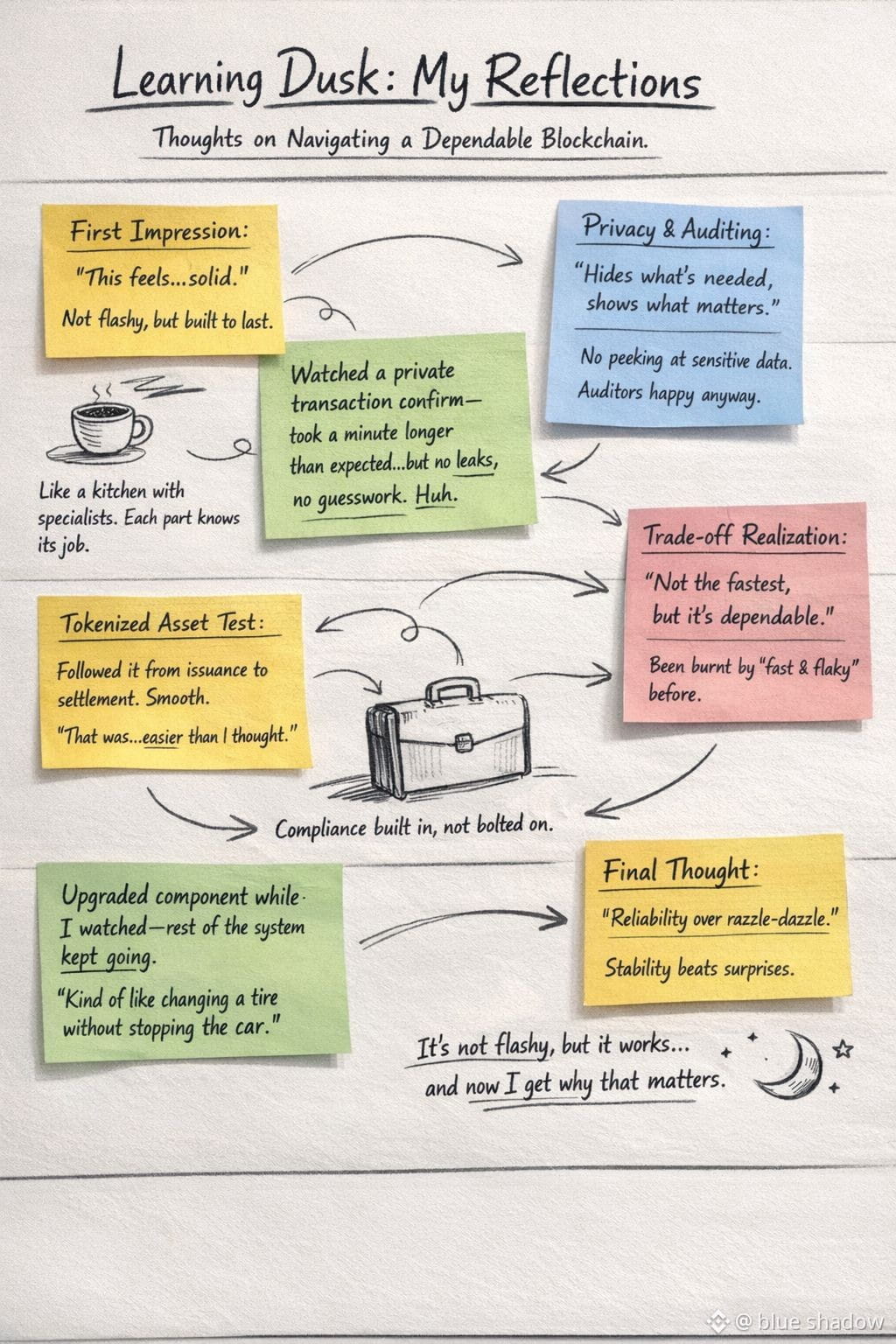

When I first stumbled onto Dusk, I have to admit, I wasn’t thinking about blockchain at all. I was thinking about how messy finance can be—how often systems promise things that sound great on paper but fall apart in practice. What immediately struck me about Dusk wasn’t a speed benchmark or a fancy feature list. It was the quiet thoughtfulness of its design. Everything seemed built around a simple question: “How do we make this reliable?” And for some reason, that felt refreshing.

The more I dug in, the more I noticed its modular approach. I like to think of it like a restaurant kitchen. There’s one cook handling consensus, another handling transactions, another ensuring privacy. They all have clear roles, and there’s a rhythm to how they pass information between each other. It’s not flashy, but it works. If one station upgrades its process, the kitchen doesn’t collapse; dinner still gets served. In blockchain terms, this means that updates or changes to one part of the system don’t break everything else, which is something I often wish more projects prioritized.

Privacy and auditability usually feel like they’re at odds. Hide too much, and auditors can’t see anything; expose too much, and you lose privacy. Watching Dusk handle this was almost meditative. Cryptographic proofs let auditors verify compliance without ever seeing sensitive details. It slows things down a little, yes, but it also makes the system predictable. Each transaction behaves the way it’s supposed to. You don’t have to guess if it’s going to stick or wait for a day to reconcile a surprise failure. For anyone dealing with real money and regulations, that kind of certainty is worth more than raw speed.

I found myself thinking about what this actually looks like in practice. Say a financial firm wants to issue tokenized assets. On a typical chain, compliance is an afterthought—something layered on afterward with spreadsheets, scripts, or off-chain checks. That always felt fragile to me. On Dusk, compliance and privacy are baked in. Trades settle when expected, auditors can verify results without slowing anything down, and operational errors are minimized. It’s the kind of predictability that lets someone sleep a little easier at night, knowing the system won’t throw unexpected surprises at them.

Of course, there are trade-offs. Transactions aren’t instantaneous. It’s not the fastest chain on the block. But I’ve learned that in financial workflows, a slightly slower transaction that you can count on is far more valuable than a fast one that might need hours of manual correction. That choice—slightly slower but more reliable—is baked into how Dusk is built. And thinking about it, that’s the kind of decision I wish more technology teams made consciously.

I kept circling back to modularity. If one component needs an upgrade, the rest of the system doesn’t fall apart. It’s like replacing the engine in a car while leaving the brakes, steering, and electronics untouched. The car keeps driving. That predictability—knowing that something will keep working even when it’s being improved—is rare, and it’s quietly impressive.

By the time I was done poking around, I realized Dusk’s real strength isn’t in any single flashy feature or headline stat. It’s in the way it behaves when you use it, the thoughtfulness in how the pieces fit together, and the consistency it provides. Watching it in action reminded me that in finance, especially regulated finance, reliability isn’t sexy—but it’s everything. And it left me thinking: if more systems were built this way, how much easier would life be for the people who actually rely on them every day?