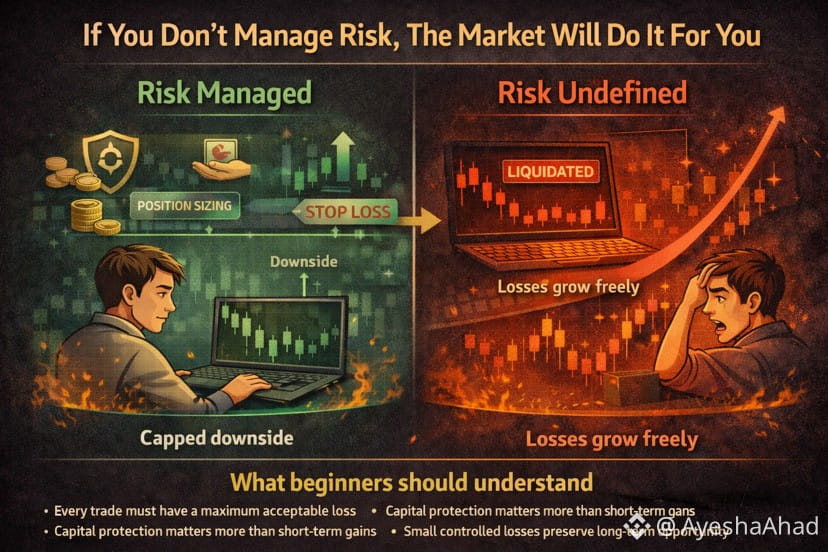

Many beginners focus on finding the right trade. Very few focus on managing the possible loss. This is where most accounts fail. Risk management is not about predicting the market. It is about deciding how much damage a single mistake is allowed to cause.

When traders enter positions without predefined risk, the market takes control.

Price moves, emotions react, and decisions become defensive instead of deliberate. Losses grow not because the trade was wrong, but because the risk was never defined. Professional traders do not win because they are always right.

They survive because they limit how wrong they can be.

What beginners should understand

Every trade must have a maximum acceptable loss

Capital protection matters more than short-term gains

Small controlled losses preserve long-term opportunity

Risk does not disappear when ignored.

It accumulates.

Takeaway

You do not control the market, but you do control your exposure to it.

Risk management is not a restriction.

It is the foundation that allows traders to stay in the game long enough to improve.

Educational content only. Not financial advice.