Stablecoins like USDT and USDC are no longer experimental crypto assets. They now represent hundreds of billions in circulating supply and trillions in yearly transaction volume. Yet, the blockchains carrying them—Ethereum, Tron, Solana—were never built with stablecoins as the primary financial layer. They prioritize smart contracts, speculation, and native token economics, often making money transfers slower, more expensive, and less predictable than they should be.

Plasma flips this model.

It is a Layer-1 blockchain designed with one core mission: make stablecoins behave like real money.

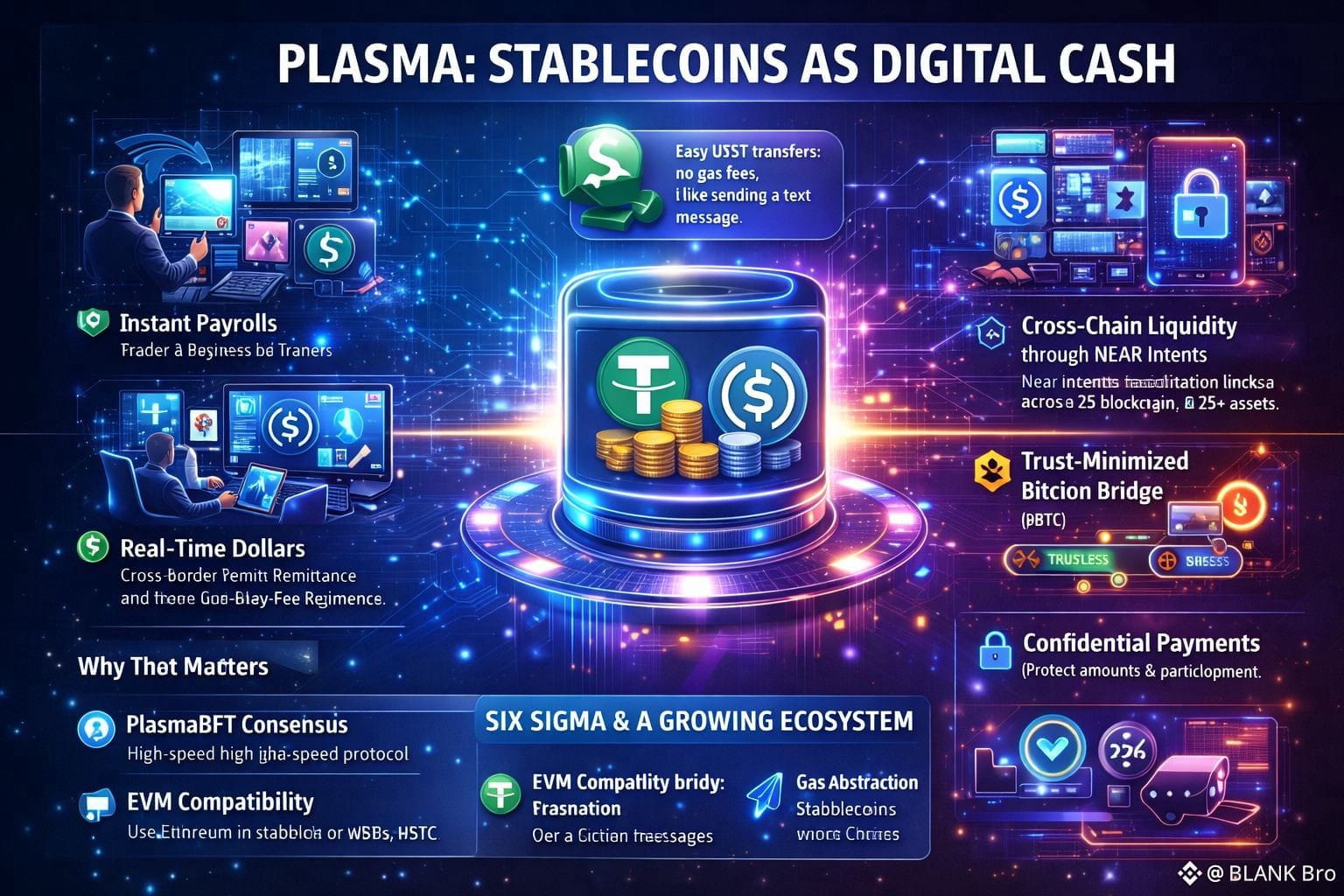

Stablecoins as True Digital Cash

Most blockchains force users to pay fees in volatile native tokens, meaning users must buy speculative assets just to send dollars. Plasma removes this friction.

Through protocol-level gas abstraction, USDT transfers can be free by default, making digital dollar payments as seamless as sending a text message.

No speculative asset. No unnecessary friction. Just money that moves.

Why This Matters in the Real World

Plasma enables a future where:

Businesses run instant global payroll

Merchants accept real-time stablecoin payments

Cross-border remittances cost near zero

Users avoid exposure to volatile crypto assets

Stablecoins finally function like everyday cash

Plasma is not trying to be everything.

It is focused on doing money movement right.

Technology Built for Financial Scale

1. PlasmaBFT Consensus

A high-speed consensus system offering sub-second finality, near-instant confirmations, and thousands of transactions per second—a necessity for real financial infrastructure.

2. Full EVM Compatibility

Developers can deploy existing Ethereum tools (MetaMask, Hardhat, Solidity) without friction, accelerating adoption and ecosystem growth.

3. Gas Abstraction

Users can pay fees in stablecoins or bridged Bitcoin, while XPL remains optional for basic transfers and required only for advanced operations.

Beyond Transfers: Building a Financial Network

Cross-Chain Liquidity via NEAR Intents

As of January 23, 2026, Plasma became the first liquidity protocol integrated with NEAR Intents, enabling seamless routing across 25+ blockchains and 125+ assets.

This dramatically expands liquidity depth, capital efficiency, and real commercial usability.

Liquidity is the bloodstream of financial systems—and Plasma is engineering it at scale.

Trust-Minimized Bitcoin Bridge

Plasma introduces a trust-reduced BTC bridge, issuing pBTC—a 1:1 Bitcoin-backed asset usable in DeFi, payments, and programmable finance without centralized custody.

This connects Bitcoin’s store-of-value power to stablecoin-driven financial flows.

Confidential Payments (In Progress)

Plasma is developing a privacy layer that enables confidential transactions while maintaining compliance—unlocking real-world use cases such as payroll, treasury management, and enterprise settlements.

Plasma One: Stablecoin Neobank

Plasma extends beyond infrastructure into consumer finance through Plasma One, offering:

Zero-fee transfers

Virtual payment cards

Multi-country rewards

A stablecoin-native banking experience

This proves Plasma is not just a blockchain—it’s becoming a financial product ecosystem.

XPL: A Purpose-Driven Token, Not a Toll Booth

Unlike many chains, Plasma does not force users to buy XPL to transact.

XPL exists for real utility:

Validator staking & network security

Advanced smart-contract execution

Governance & ecosystem development

It supports the system without becoming a barrier to everyday users.

Plasma in 2026: A Money-First Blockchain

Plasma is rapidly evolving with:

Expanding cross-chain liquidity

Consumer-focused financial products

Bitcoin integration

Privacy-enhanced payments

A singular focus on real-world money movement over speculation

Final Thought: Why Plasma’s Thesis Matters

Blockchain wins when it solves real problems.

Email solved communication.

The web solved information access.

Plasma aims to solve how money moves.

Stablecoins are already the most widely used crypto asset.

Plasma asks the obvious question:

If stablecoins are already money—why not build infrastructure that treats them like money?

Instead of hype, Plasma delivers technology, liquidity, products, and real utility.

In a world redefining global finance, Plasma isn’t trying to do everything.

It’s focused on doing one thing extremely well: making money move like the internet moves data.

And that could change everything.

Stablecoins like USDT and USDC are no longer experimental crypto assets. They now represent hundreds of billions in circulating supply and trillions in yearly transaction volume. Yet, the blockchains carrying them—Ethereum, Tron, Solana—were never built with stablecoins as the primary financial layer. They prioritize smart contracts, speculation, and native token economics, often making money transfers slower, more expensive, and less predictable than they should be.

Plasma flips this model.

It is a Layer-1 blockchain designed with one core mission: make stablecoins behave like real money.

Stablecoins as True Digital Cash

Most blockchains force users to pay fees in volatile native tokens, meaning users must buy speculative assets just to send dollars. Plasma removes this friction.

Through protocol-level gas abstraction, USDT transfers can be free by default, making digital dollar payments as seamless as sending a text message.

No speculative asset. No unnecessary friction. Just money that moves.

Why This Matters in the Real World

Plasma enables a future where:

Businesses run instant global payroll

Merchants accept real-time stablecoin payments

Cross-border remittances cost near zero

Users avoid exposure to volatile crypto assets

Stablecoins finally function like everyday cash

Plasma is not trying to be everything.

It is focused on doing money movement right.

Technology Built for Financial Scale

1. PlasmaBFT Consensus

A high-speed consensus system offering sub-second finality, near-instant confirmations, and thousands of transactions per second—a necessity for real financial infrastructure.

2. Full EVM Compatibility

Developers can deploy existing Ethereum tools (MetaMask, Hardhat, Solidity) without friction, accelerating adoption and ecosystem growth.

3. Gas Abstraction

Users can pay fees in stablecoins or bridged Bitcoin, while XPL remains optional for basic transfers and required only for advanced operations.

Beyond Transfers: Building a Financial Network

Cross-Chain Liquidity via NEAR Intents

As of January 23, 2026, Plasma became the first liquidity protocol integrated with NEAR Intents, enabling seamless routing across 25+ blockchains and 125+ assets.

This dramatically expands liquidity depth, capital efficiency, and real commercial usability.

Liquidity is the bloodstream of financial systems—and Plasma is engineering it at scale.

Trust-Minimized Bitcoin Bridge

Plasma introduces a trust-reduced BTC bridge, issuing pBTC—a 1:1 Bitcoin-backed asset usable in DeFi, payments, and programmable finance without centralized custody.

This connects Bitcoin’s store-of-value power to stablecoin-driven financial flows.

Confidential Payments (In Progress)

Plasma is developing a privacy layer that enables confidential transactions while maintaining compliance—unlocking real-world use cases such as payroll, treasury management, and enterprise settlements.

Plasma One: Stablecoin Neobank

Plasma extends beyond infrastructure into consumer finance through Plasma One, offering:

Zero-fee transfers

Virtual payment cards

Multi-country rewards

A stablecoin-native banking experience

This proves Plasma is not just a blockchain—it’s becoming a financial product ecosystem.

XPL: A Purpose-Driven Token, Not a Toll Booth

Unlike many chains, Plasma does not force users to buy XPL to transact.

XPL exists for real utility:

Validator staking & network security

Advanced smart-contract execution

Governance & ecosystem development

It supports the system without becoming a barrier to everyday users.

Plasma in 2026: A Money-First Blockchain

Plasma is rapidly evolving with:

Expanding cross-chain liquidity

Consumer-focused financial products

Bitcoin integration

Privacy-enhanced payments

A singular focus on real-world money movement over speculation

Final Thought: Why Plasma’s Thesis Matters

Blockchain wins when it solves real problems.

Email solved communication.

The web solved information access.

Plasma aims to solve how money moves.

Stablecoins are already the most widely used crypto asset.

Plasma asks the obvious question:

If stablecoins are already money—why not build infrastructure that treats them like money?

Instead of hype, Plasma delivers technology, liquidity, products, and real utility.

In a world redefining global finance, Plasma isn’t trying to do everything.

It’s focused on doing one thing extremely well: making money move like the internet moves data.