Every market cycle has one constant: fear headlines.

📉 “Recession is coming”

📉 “Wars will crash markets”

📉 “Rates will stay high”

📉 “Crypto is risky”

And every time fear dominates the narrative, people rush to defensive assets or stay out completely.

But history shows something very different when it comes to Bitcoin.

Let’s slow down and look at facts, not feelings.

What People Expect Bitcoin to Do

When uncertainty rises, most people believe:

• Bitcoin will crash

• Risk assets will bleed

• Crypto should be avoided

So they either: 👉 Panic sell

👉 Sit on cash

👉 Wait for “perfect clarity”

Sounds logical — but markets don’t reward logic based on emotion.

What Bitcoin Actually Did in Major Crises

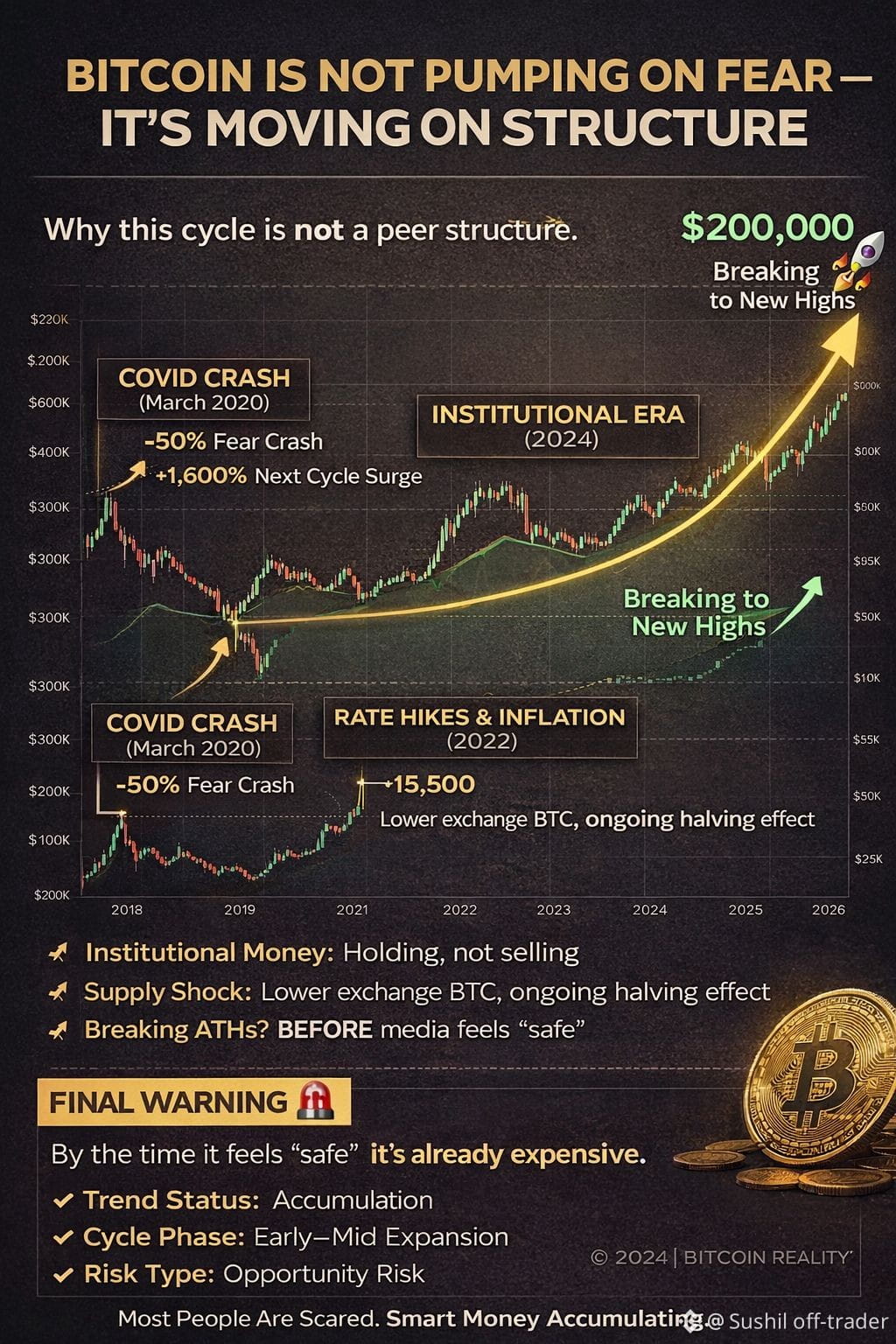

COVID Crash (2020)

• BTC dropped ~50% in days

• Fear was extreme

• “Bitcoin is dead” headlines everywhere

Then what happened?

• BTC recovered faster than stocks

• Went from ~$4,000 to ~$69,000 in the next cycle

Fear marked the bottom, not the end.

Rate Hikes & Inflation Era (2022)

• Aggressive rate hikes

• Liquidity tightening

• Crypto winter

• Cleaned out leverage

• Strong hands accumulated quietly

• Weak projects died

This wasn’t destruction — it was reset.

What’s Different in 2025–2026

This cycle is not like the previous ones.

1. Institutional Money Is Here

• Spot Bitcoin ETFs

• Traditional funds allocating BTC

• Long-term holding behavior

This isn’t retail hype. This is structural demand.

2. Supply Shock Is Real

• Bitcoin halving reduced new supply

• Exchanges hold less BTC than ever

• Long-term holders are not selling

Demand up.

Supply down.

That’s not emotion — that’s economics.

3. Bitcoin Is Being Treated as Digital Infrastructure

Not just “digital gold”, but:

• A hedge against currency debasement

• A global settlement asset

• A neutral monetary network

This is why Bitcoin moves before fear disappears — not after.

The Real Risk Most People Miss

The biggest danger isn’t Bitcoin crashing.

❌ It’s staying out while accumulation happens

❌ It’s waiting for “confirmation” that comes at higher prices

❌ It’s reacting emotionally instead of positioning logically

Historically:

Bitcoin rewards patience, not prediction.

Final Thought

Bitcoin doesn’t pump because of fear. It pumps after fear has already done its job.

Fear shakes out weak hands.

Structure builds silently.

Price follows later.

Bitcoin is not a reactionary asset anymore.

It’s becoming foundational.

And history suggests:

By the time it feels safe — it’s already expensive.

📌 Trend Status: Accumulation

📌 Cycle Phase: Early–Mid Expansion

📌 Risk Type: Opportunity Risk, not Crash Risk