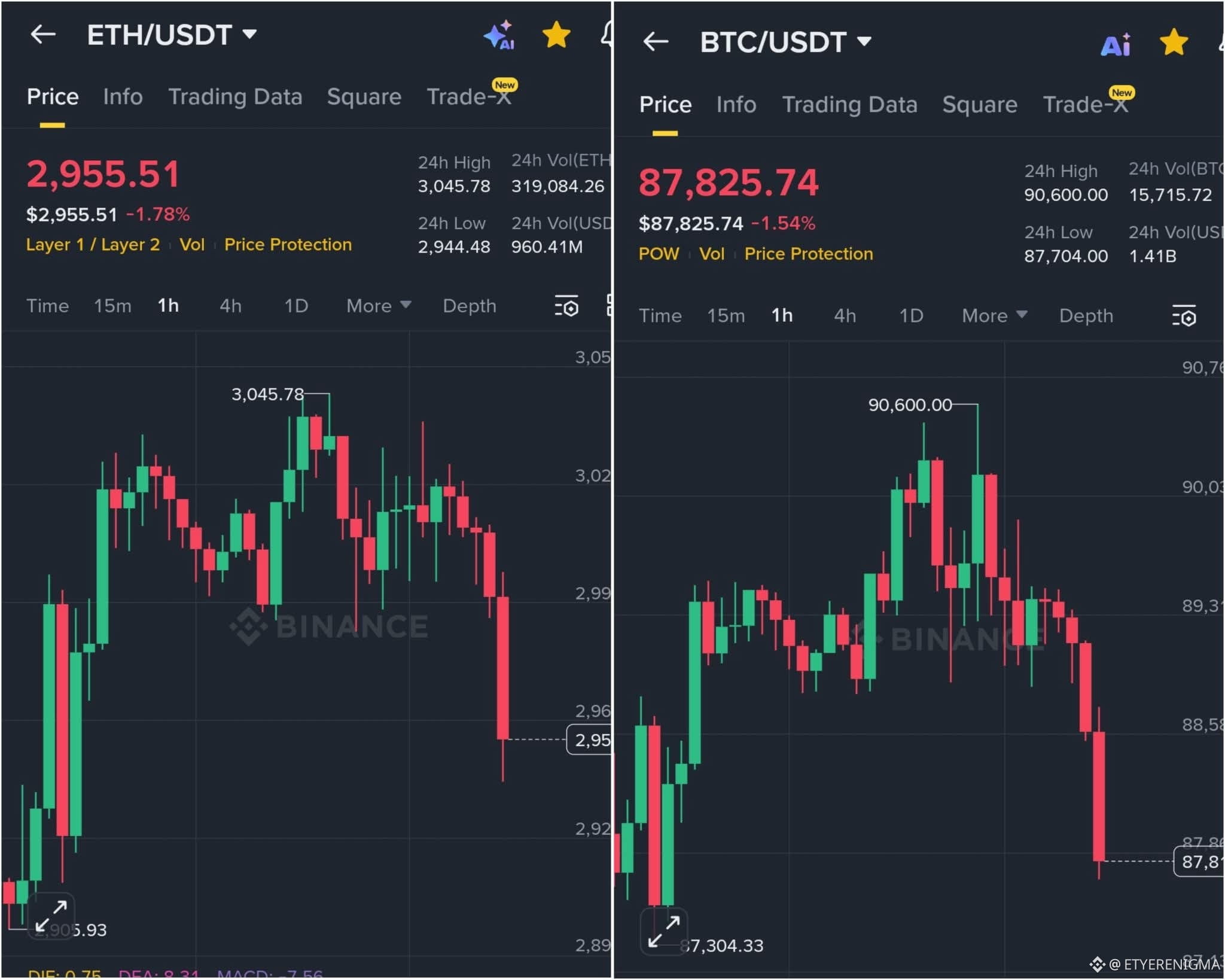

The current sell-off in Bitcoin and Ethereum is not random, and it is not caused by a single headline.

It is the result of macro pressure, liquidity tightening, and risk rotation happening at the same time.

Here are the real reasons behind the dump:

1️⃣ LIQUIDITY IS TIGHTENING

Crypto is a high-beta, liquidity-sensitive asset class.

When global liquidity tightens:

→ Risk assets are sold first

→ Crypto absorbs the impact faster than stocks

Dollar liquidity is constrained, funding conditions are tightening, and leverage is being reduced across markets.

2️⃣ PROFIT TAKING + LEVERAGE CLEAN-UP

Bitcoin and Ethereum had strong upside moves earlier.

Large players:

→ Lock in profits near key resistance levels

→ Trigger liquidations of over-leveraged long positions

Once liquidations begin, they create a cascading sell-off driven by forced selling, not fear.

3️⃣ MACRO UNCERTAINTY IS HIGH

Markets are currently pricing risk, not growth:

→ Fed policy uncertainty

→ Bond market volatility

→ Yield instability

→ Unclear dollar direction

In this environment, capital moves out of speculative assets and into defensive positioning.

4️⃣ GOLD AND SILVER RALLY = RISK-OFF SIGNAL

When gold and silver move aggressively higher:

→ It signals capital preservation, not economic strength

This rotation is classic:

Gold ↑

Silver ↑

Crypto ↓

Crypto typically underperforms during the first phase of risk-off behavior.

5️⃣ ALGORITHMIC AND SYSTEMATIC DE-RISKING

Institutional funds and trading algorithms automatically reduce exposure when:

→ Volatility spikes

→ Liquidity drops

→ Correlations increase

Crypto is sold first because it is liquid, 24/7, and easy to hedge.

🔑 THE KEY TAKEAWAY

This is not a structural collapse.

This is a liquidity reset and risk rotation phase.

Historically:

→ Crypto dumps during uncertainty

→ Crypto leads once liquidity stabilizes and policy shifts

Those who understand structure don’t panic during volatility.

They prepare for the next phase.

Markets are not broken — they are transitioning.