The conversation around blockchains has always leaned toward speed. Every new cycle brings a new narrative that tells us faster blocks, cheaper gas, or higher throughput is the milestone the industry must chase. It became a tradition in crypto to measure technical progress as a race toward efficiency. But this mindset missed the deeper truth that real world finance does not evolve on speed alone. It evolves on certainty, accountability, and the ability to minimize risk. That is exactly why Dusk Foundation has emerged as the most important Layer 1 for regulated on chain markets. And most people still do not understand the scale of the shift happening in front of them.

When you study how traditional financial systems function you realize that activity is not the core concern. Stability is. Real world money spends most of its lifespan staying still. It sits in treasuries, settlement buffers, clearing accounts, collateral pools, and controlled environments that must pass audits. Every minute of delay in settlement has a cost. Every unnecessary data exposure is a liability. Every incorrect disclosure harms institutions. This is why banks and financial infrastructures require systems that protect against downside before chasing performance. Dusk Foundation understood that deep structural need long before the broader industry did.

@dusk_foundation did not try to become a general purpose chain. It did not try to win short term hype or volume contests. It built a highly specialized ecosystem where compliance level infrastructure and privacy preserving tooling exist together without compromising each other. That combination is extremely rare. It is also extremely difficult. But it is the combination that matters most to institutions, auditors, asset issuers, regulated markets, and jurisdictions that want the benefits of blockchain without exposing sensitive data. This is the differentiation that positions $DUSK as one of the most important foundation level blockchains of the next decade.

The core idea that Dusk operates on is simple but powerful. Financial systems fail not because they lack speed but because they leak information or fail to create trust. Markets do not break because a block took one extra second to confirm. They break because of settlement failures, operational leakage, identity exposure, regulatory incompatibility, lack of accountability mechanisms, or insufficient privacy controls. The problem was never throughput. The problem was always data control and verifiable compliance. Dusk was built for that reality.

Dusk uses zero knowledge technology as a native part of its architecture rather than an add on. This means applications can guarantee confidentiality without isolating themselves from regulatory visibility. Transactions remain auditable but identities and sensitive business information stay protected. It is a model where privacy does not contradict compliance. It supports it. The result is a chain where institutions can operate with the certainty they expect and the privacy they require.

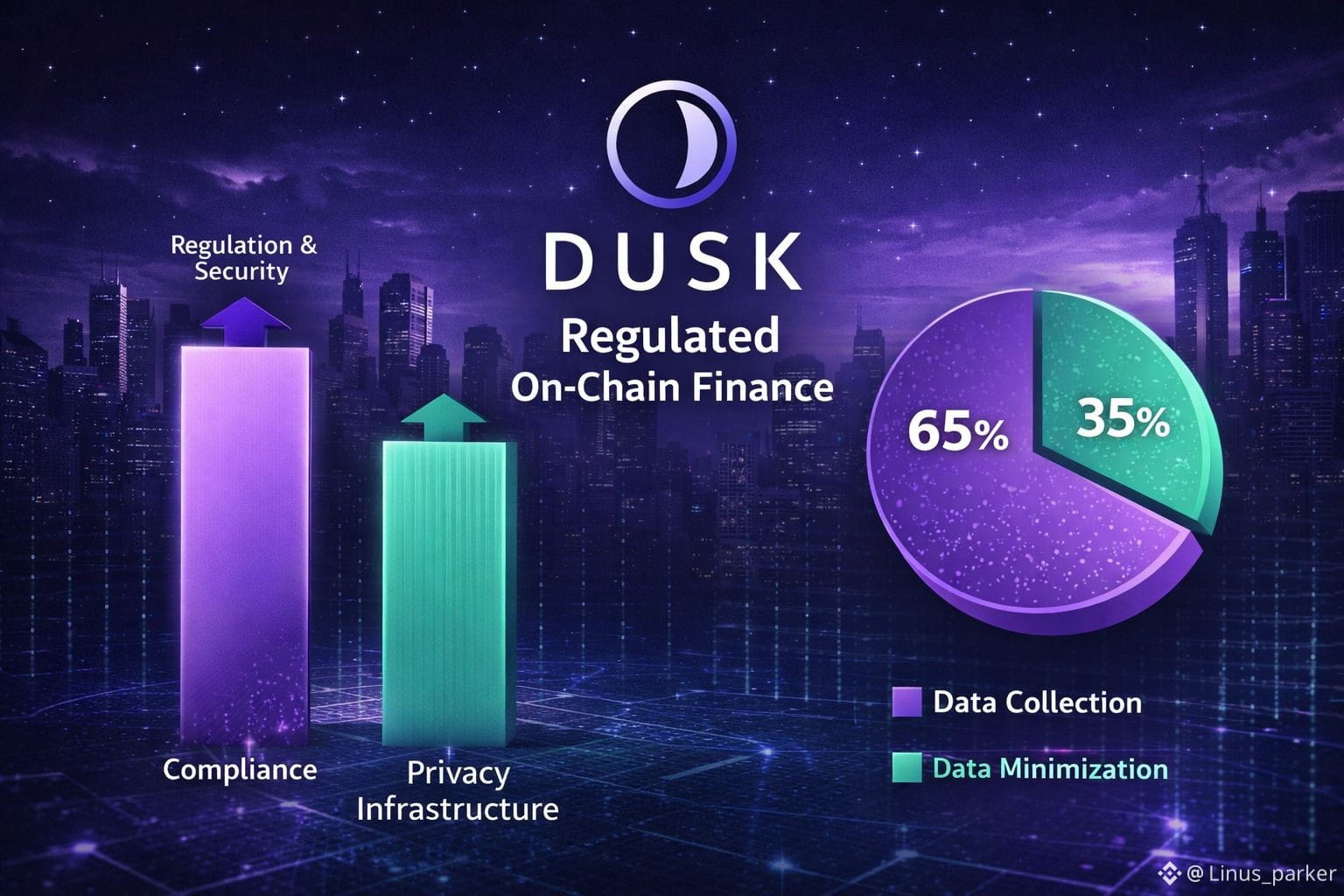

This is where the visuals you asked for play a very important role. When you break down what Dusk solves, it becomes clear that modern blockchain design forces a tradeoff. Either you optimize for compliance by collecting large amounts of data or you optimize for privacy and lose the ability to satisfy regulated requirements. Dusk breaks the tradeoff by building a system where both needs are fulfilled through design rather than sacrificed through compromise. The comparison between compliance infrastructure and privacy infrastructure makes this shift visible. You see how traditional blockchains overload users with unnecessary data exposure while Dusk minimizes and compartmentalizes it.

The visual showing data collection versus data minimization highlights the same point. Regulated markets cannot survive when every actor’s sensitive information is visible to competitors or the public. They cannot operate inside a system that permanently exposes operational, financial, or strategic data. Dusk recognizes this fundamental requirement and creates a model where only the minimum amount of information required for compliance is ever revealed and everything else is cryptographically protected. That is the foundation of a regulated on chain economy.

The future of finance is not built on open visibility of every detail. It is built on verifiable confidentiality. That is exactly what Dusk Foundation is enabling. And it is why the narrative around $DUSK continues to strengthen. Institutions do not want hype. They want systems that help them reduce their operational risk. They want settlement frameworks that prevent leaks. They want infrastructures that can be audited without exposing private business logic. They want predictable behaviour in environments where billions of dollars move silently every day. Dusk is the only chain that fully matches those needs at the architectural level.

What makes the Dusk ecosystem even more compelling is its developer experience. Builders can write applications that automatically benefit from zero knowledge proofs without manually implementing complex cryptographic logic. This lowers the barrier for real world financial tools to be deployed on chain. It also accelerates the adoption cycle for developers who need privacy, compliance guarantees, deterministic settlement behaviour, and security that can withstand institutional requirements.

In a world where financial markets are steadily migrating on chain, the demand for a chain that respects both privacy and accountability is only going to rise. Governments are defining new regulatory frameworks. Corporations are preparing digital asset strategies. Payment systems are integrating blockchain rails. Custodians are expanding their digital offerings. And asset issuers are exploring new forms of tokenization. All of these actors require a chain that meets the highest standards of compliance while providing the privacy that real world business operations demand. Dusk is one of the only ecosystems that genuinely satisfies both conditions simultaneously.

Every major adoption wave in crypto has introduced its own category of infrastructure. There was the era of transaction speed. Then came the era of smart contracts. Followed by the era of stablecoins. Then came the era of multi chain networks. The next era is the regulated financial infrastructure layer. That is where the largest markets, the largest institutions, and the largest capital pools will operate. And that is where Dusk Foundation has been quietly building for years.

The reason this is happening quietly is because real financial infrastructure does not make noise. It does not chase trends. It solves deep structural problems. That is exactly what Dusk is focused on. And once adoption reaches a certain point the market will recognize that the chain built for regulated privacy is the chain that will scale where others cannot.

The world is now moving toward regulated on chain markets. Dusk is already positioned for that future. The visuals representing compliance versus privacy and data collection versus data minimization reflect exactly why $DUSK stands out. It is not another general purpose chain. It is the backbone of a new financial architecture built on certainty, confidentiality, security, and regulatory alignment. And that is what makes it one of the most important infrastructures being built today.