Executive Summary

$AZTEC represents a fundamental architectural innovation in Ethereum scaling - a privacy-first zk-rollup that enables programmable confidentiality as a native primitive. Unlike transparent zkEVMs that focus solely on scalability, Aztec's "ZK-ZK rollup" approach delivers both validity proofs and privacy guarantees through its novel hybrid state model and client-side proof generation. Aztec Network

The protocol is at an inflection point with its TGE vote concluding January 26-February 2, 2026, potentially unlocking mainnet trading on February 12, 2026. With 10.35B $AZTEC tokens distributed across team, investors, and community participants, and a fully decentralized testnet operating with 23,000+ validators, Aztec has achieved technical milestones that position it as the leading privacy infrastructure solution for Ethereum. Aztec Network

1. Project Overview

Core Thesis: Aztec solves Ethereum's transparency problem by building privacy as a first-class primitive into a zk-rollup, enabling confidential transactions and programmable privacy without compromising Ethereum's security or composability.

Protocol Vision: Create a world where privacy is permissionless, selective, and programmable - allowing developers to choose what data to expose while maintaining full verifiability through zero-knowledge proofs.

Stage: Late Testnet → Mainnet Transition

Ignition Chain testnet operational since November 2025

23,000+ operators across 6 continents

0.2 TPS current cap (theoretical scalability much higher)

TGE vote ongoing (Jan 26-Feb 2, 2026)

Target mainnet trading: February 12, 2026 Aztec Network

Team & Funding: Aztec Labs has raised $119M+ since 2018 from leading crypto investors. The team includes pioneers in practical zk-SNARK implementations, with CTO Zac Williamson co-authoring the PLONK proving system.

2. System Architecture & zk-Rollup Design

Core Architectural Components

zk-Rollup Construction: Aztec operates as a true zk-rollup (ZK-ZK) rather than a validity rollup (ZK-only). This distinction is critical:

Validity rollups (Starknet, zkSync): Prove correct execution but maintain transparency

ZK-ZK rollups (Aztec): Prove correct execution while preserving privacy Forum Post

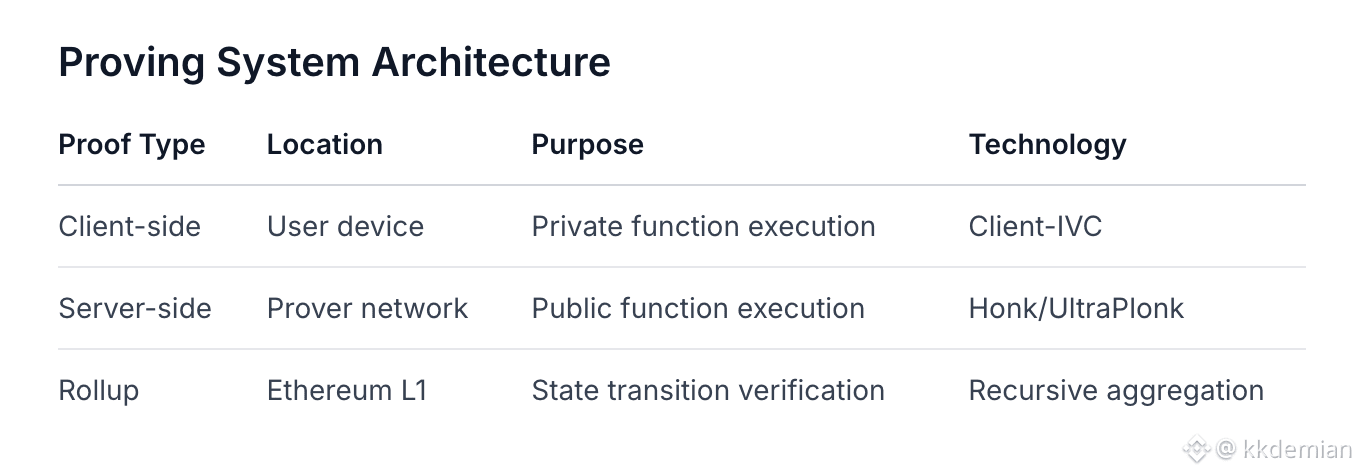

Execution Environment: Non-EVM Aztec Virtual Machine (AVM) optimized for zero-knowledge operations with:

Hybrid public/private state management

Client-side proof generation for private functions

Server-side proof aggregation for rollup verification

Sequencer Architecture: Fully decentralized from day one - no centralized sequencer phase

1,000 sequencer slots with 200,000 $AZTEC minimum stake

BLS signature aggregation for efficiency

Slashing mechanism with veto protection for home stakers Aztec Network

Proving System Architecture

Client-IVC Innovation: Enables mobile device compatibility with memory requirements reduced from 3.7GB to 1.3GB, making private transactions feasible on older smartphones. ZkCloud

3. Private State Model & Data Representation

Hybrid State Management

Public State: Account-based model (EVM-compatible)

Transparent and globally accessible

Managed by sequencers with traditional execution

Suitable for non-sensitive application components

Private State: UTXO-based model with encrypted notes

Notes: Encrypted data chunks owned by users

Nullifiers: Prevent double-spending without revealing spending patterns

Note commitments: Stored in Merkle trees for verification Aztec Docs

State Transition Mechanics

Private Transaction Flow:1. User creates transaction locally (PXE - Private Execution Environment)2. Client generates proof of valid execution (Client-IVC)3. Encrypted notes are created/destroyed with nullifiers4. Proof and nullifiers submitted to network5. Sequencer includes in block with aggregated proof

Security Properties:

Data privacy: Only transaction participants see plaintext data

Execution integrity: Zero-knowledge proofs guarantee correct execution

Anti-censorship: Decentralized sequencer network prevents transaction filtering

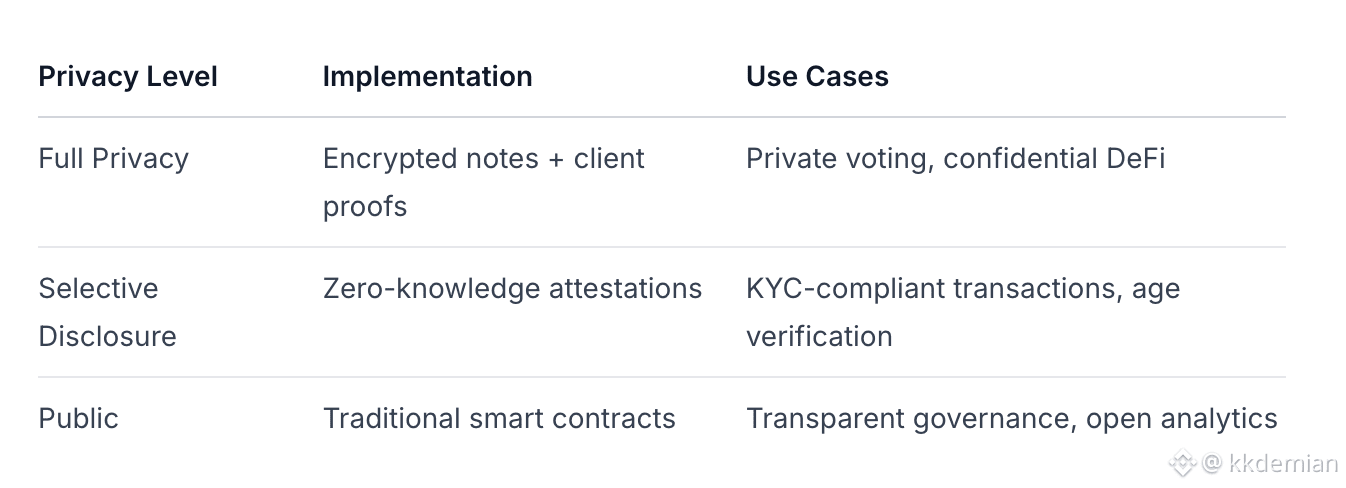

4. Programmable Privacy & Application Design

Privacy Spectrum Implementation

Aztec enables developers to choose along a privacy spectrum:

Composability: Private and public functions can interact within single applications:

Private balances can fuel public transactions

Public events can trigger private logic

Cross-contract calls maintain privacy boundaries

Application Categories with Highest Fit

Confidential DeFi: Private trading, lending without position exposure

Example: Hidden limit orders, confidential liquidity provision

Identity & Credentials: Selective disclosure of attributes

Example: zkPassport - prove citizenship without revealing passport number

Enterprise Applications: Compliance-friendly privacy

Example: Supply chain tracking with confidential business terms

Gaming & NFTs: Hidden attributes and private transactions

Example: Sealed-bid auctions, hidden game mechanics

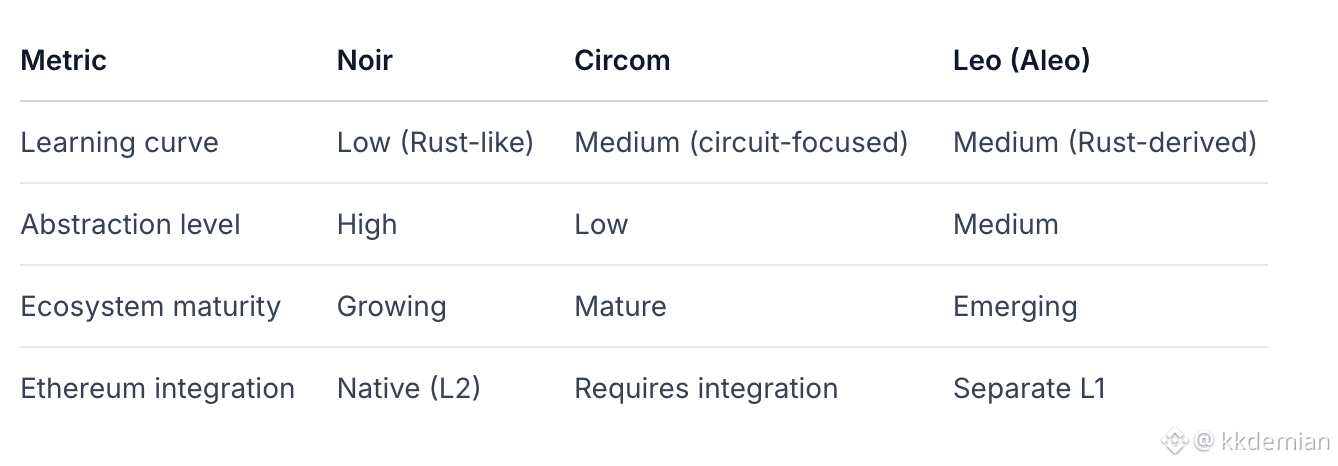

5. Developer Tooling & Ecosystem (Noir)

Noir Language Ecosystem

Language Design: Rust-inspired syntax with ZK-specific abstractions

Backend-agnostic: Works with multiple proving systems

High-level abstractions: Developers don't need cryptography expertise

Standard library: Common ZK primitives and patterns Noir Lang

Development Workflow:

Write logic in Noir (Rust-like syntax)

Compile to intermediate representation

Generate proofs client-side or server-side

Verify on-chain or off-chain

Comparative Advantage:

Tooling Maturity:

Documentation: Comprehensive but evolving

IDE support: VS Code extension available

Testing framework: Integrated testing utilities

Library ecosystem: Growing but limited compared to Solidity

6. Protocol Economics & Incentive Design

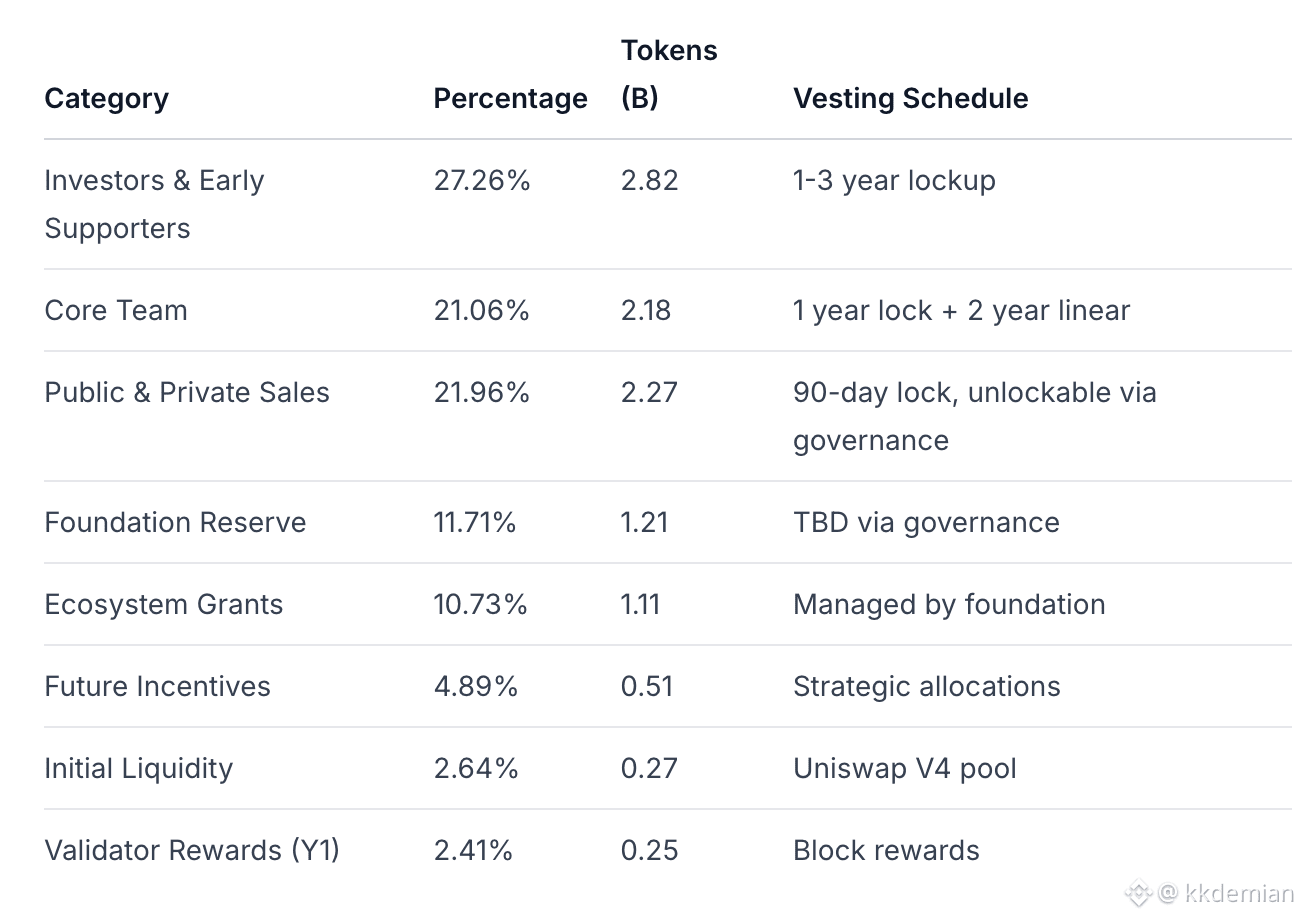

Tokenomics & Distribution

Total Supply: 10.35B $AZTEC Laika AI

Distribution Breakdown:

Public Sale Details:

$57M raised from 16.7k participants

1.547B tokens (14.95% of supply) sold

Continuous Clearing Auction mechanism prevented gas wars OKX

Fee Mechanics & Incentives

Transaction Fee Model:

Users pay fees in native asset or approved tokens

Protocol-level escrow handles fee collection

Sequencers earn fees for block production

Provers earn rewards for proof generation

Staking Economics:

Minimum sequencer stake: 200,000 $AZTEC

Block rewards funded from transaction fees and token inflation

Slashing protection for temporary outages (<20 minutes)

Veto mechanism prevents erroneous slashing Aztec Network

Cost Structure Analysis:

Client-side proving: User bears device computation cost

Server-side proving: Competitive marketplace determines prices

L1 verification: Fixed cost per rollup proof verification

7. Governance, Security & Risk Analysis

Governance Structure

Current State: Foundation-guided with community input

Aztec Foundation controls initial veto power on slashing

Community governance through token-weighted voting

Sequencer signaling required for proposal advancement

Decentralization Roadmap:

Phase 1: Foundation veto power (current)

Phase 2: Distributed veto committee

Phase 3: Fully decentralized slashing governance

Security Assessment

Cryptographic Assumptions:

PLONK/UltraPlonk proving system security

Honk proof system integrity

BLS signature aggregation safety

Client-side proof generation correctness

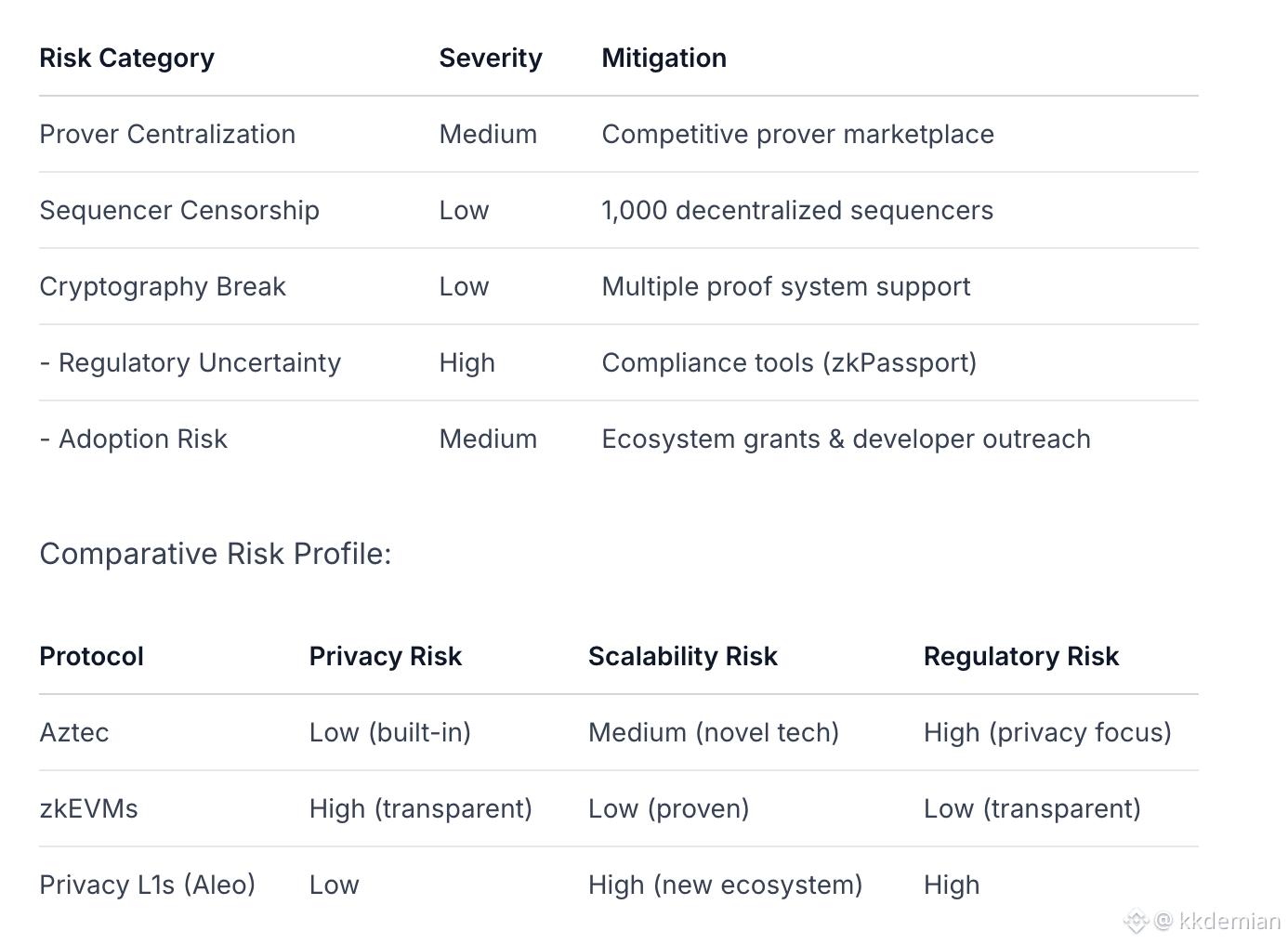

Risk Surface Analysis:

8. Adoption Signals & Ecosystem Potential

Current Ecosystem Development

Ignition Testnet Metrics:

23,000+ operators across 6 continents

7,600+ epoch proofs generated

0.2 TPS capacity (intentionally capped)

Successful Zypherpunk Hackathon with multiple privacy projects Aztec Network

Notable Projects Building:

zkPassport: KYC-compliant identity verification

Onyx (SerPepeXBT): Private DeFi primitives

NocomFinance (jp4g_): Confidential trading infrastructure

Private DAO Tools: Secure governance solutions

Confidential DeFi: Hidden liquidity protocols

Developer Activity:

Growing Noir language adoption

Active Discord community with 300k+ members

Regular hackathons and builder events

Enterprise partnership discussions underway

Market Fit Analysis

Ethereum Native Integration: Aztec's L2 approach provides key advantages:

Direct access to Ethereum liquidity and users

Composability with existing DeFi infrastructure

Regulatory clarity as Ethereum-based infrastructure

Institutional Demand: Growing need for compliant privacy solutions

Enterprise blockchain applications require confidentiality

Traditional finance migrating on-chain needs privacy features

Regulatory requirements driving demand for selective disclosure tools

9. Strategic Trajectory & Market Fit

Structural Problem Solution

Aztec addresses three fundamental gaps in Ethereum's current stack:

Native Privacy Deficiency: Transparent ledgers prevent many real-world applications

Institutional Adoption Barrier: Enterprises cannot operate with fully public data

Compliance Complexity: Traditional compliance tools don't work on transparent chains

Critical Milestones (12-24 Months)

Mainnet Launch Success: Stable operation with growing transaction volume

Ecosystem Expansion: 50+ live applications using privacy features

Enterprise Adoption: Major institutions using Aztec for confidential operations

Regulatory Clarity: Clear compliance frameworks for private transactions

Scalability Improvements: Achieving 100+ TPS with maintained privacy

Market Positioning

Aztec occupies a unique position between:

Transparent zkEVMs (Starknet, zkSync): Better privacy, similar scalability

Privacy L1s (Aleo, Miden): Better Ethereum integration, stronger security

Mixer-based solutions (Tornado Cash): Programmable privacy, not just mixing

10. Final Investment Assessment

Dimension Scoring (1-5 Scale)

zk-Rollup Architecture & Cryptographic Soundness: 4.5/5

Novel ZK-ZK approach with proven cryptography

Client-side proving enables mobile compatibility

Missing: Long-term battle testing at scale

Privacy Model & State Design: 5/5

Hybrid UTXO/account model is innovative and practical

Programmable privacy spectrum meets diverse needs

Excellent theoretical foundations

Developer Tooling & Ecosystem Maturity: 3.5/5

Noir language shows promise but ecosystem still young

Good documentation but limited production examples

Strong hackathon participation signals interest

Economic & Incentive Alignment: 4/5

Well-designed token distribution with proper vesting

Staking model protects against centralization

Unproven fee market dynamics at scale

Security & Risk Management: 4/5

Conservative cryptographic choices

Decentralized sequencer network from launch

Regulatory risk remains significant challenge

Strategic Differentiation: 5/5

Unique position in Ethereum privacy landscape

Solves fundamental transparency problem

First-mover advantage in programmable privacy L2

Investment Recommendation

BUILD & STRATEGIC PARTNERSHIP (Not Direct Investment)

Aztec represents foundational infrastructure that will enable the next generation of private applications on Ethereum. However, the regulatory uncertainty around privacy technologies and the early stage of ecosystem development suggest that strategic partnership and building on the platform offers better risk-adjusted returns than token speculation at this stage.

Key Investment Considerations:

Protocol Value: Aztec solves a real and growing need for programmable privacy

Technical Merit: Sound architecture with innovative approaches to hard problems

Execution Risk: Team has delivered complex cryptography systems before

Market Timing: Privacy narrative is accelerating with institutional demand

Regulatory Overhang: Significant uncertainty may impact adoption timeline

Optimal Strategy: Partner with Aztec Labs to build privacy-focused applications while monitoring regulatory developments. Accumulate tokens through ecosystem participation rather than speculative positioning.

Appendices

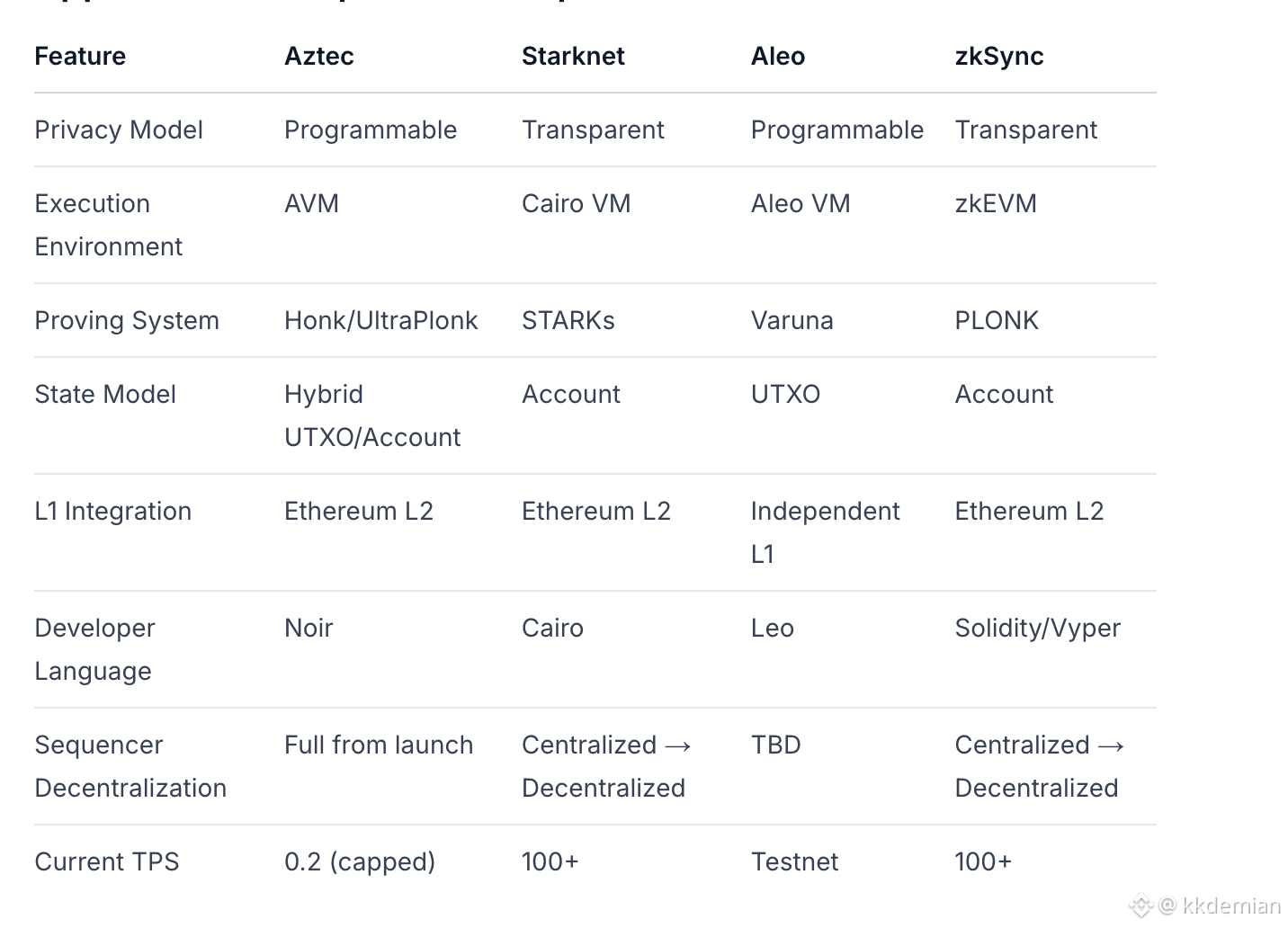

Appendix A: Competitive Comparison Table

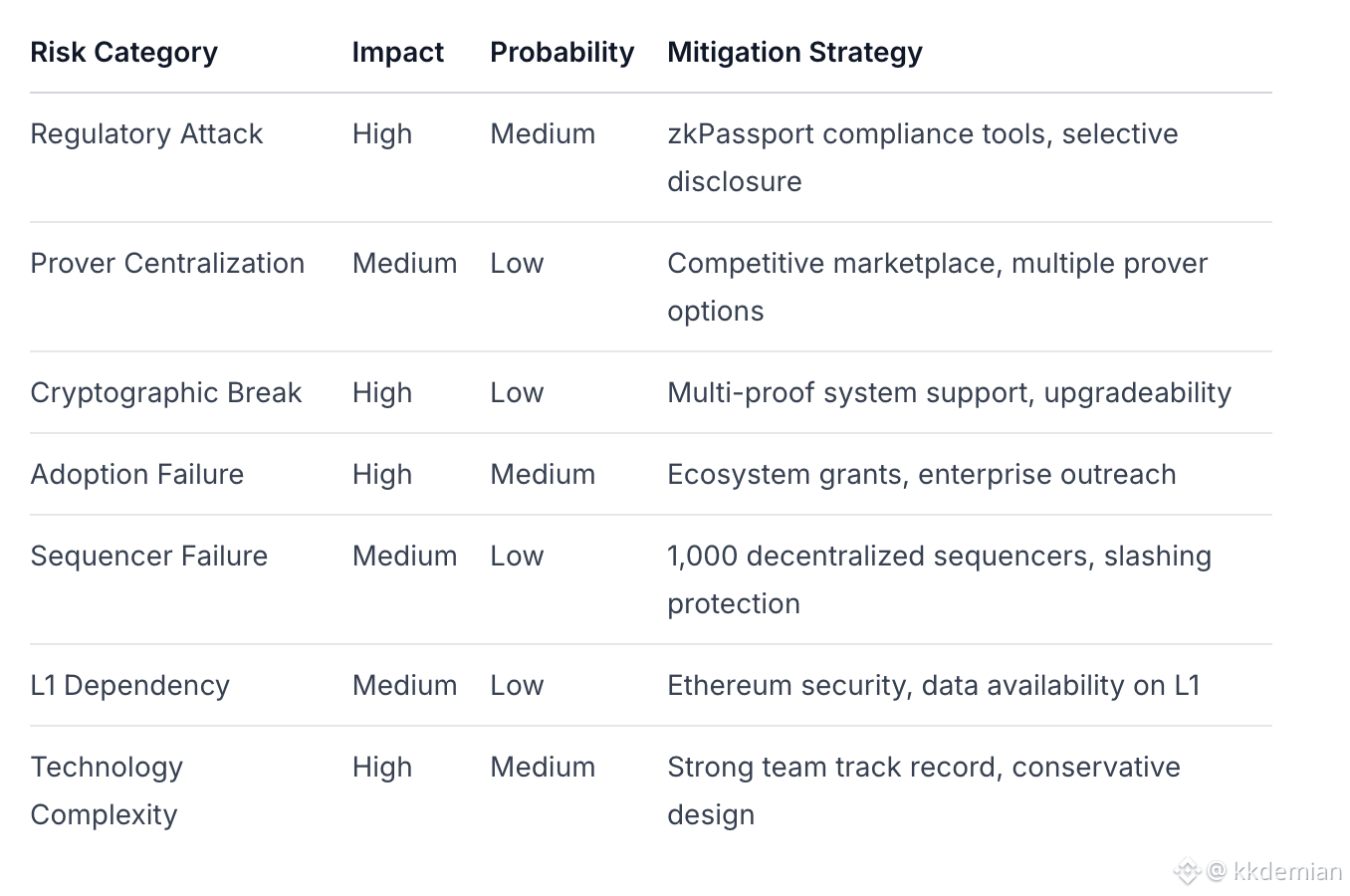

Appendix B: Risk Decomposition Matrix

Appendix C: Economic Model Scenarios

Base Case (2026-2027):

10 TPS average throughput

$0.50 average transaction fee

50% sequencer fee share

$45M annual protocol revenue

20% token inflation to validators

Bull Case:

50 TPS average throughput

$1.00 average transaction fee

60% sequencer fee share

$300M annual protocol revenue

15% token inflation to validators

Bear Case:

2 TPS average throughput

$0.20 average transaction fee

40% sequencer fee share

$5M annual protocol revenue

25% token inflation to validators

Report Conclusion: Aztec represents one of the most architecturally innovative approaches to solving Ethereum's privacy problem. While regulatory risks and adoption challenges remain, the protocol's technical merits and first-mover advantage in programmable privacy L2s position it as foundational infrastructure worthy of strategic partnership and building investment.