Executive Summary

Cascade represents a technically ambitious but operationally opaque attempt to build the first 24/7 cross-asset neo-brokerage, leveraging $15M in tier-1 venture backing to unify perpetual markets across crypto, equities, and private assets through a single margin account. The protocol demonstrates strong early demand with $26M+ in liquidity commitments but faces significant architectural and regulatory uncertainties regarding its risk modeling, revenue sustainability, and compliance framework for 24/7 synthetic equity exposure.

1. Project Overview & Strategic Positioning

Cascade is building a full-stack neo-brokerage that aims to bridge traditional finance and crypto-native perpetual trading. Backed by Polychain Capital, Variant Fund, Coinbase Ventures, and Archetype Ventures with a $15M seed round (December 2025), the platform targets Q1 2026 mainnet launch with 10+ perpetual markets including Bitcoin, Tesla, OpenAI, and Stripe. The Block

Core Value Proposition: Replace fragmented brokerage and exchange infrastructure with a unified account offering:

24/7 perpetual trading across asset classes

Direct fiat onboarding via Stripe's Bridge integration

Unified margin pooling across positions

Zero-fee trading at launch

Current Stage: Invite-only "First Wave" program with $8M pre-allocated to Cascade's Liquidity Strategy (CLS) from over 4,000 traders representing $26M+ in demand. X

2. Technical Architecture & System Design

Unified Margin Engine

Cascade's architecture centers on a single collateral pool that spans multiple asset classes, though specific risk offset parameters remain undisclosed. The system employs:

Execution Layer: Non-custodial off-chain matching for sub-second execution speeds Settlement Layer: On-chain perpetual contracts enforcing trade settlement Oracle Infrastructure: Authenticated price feeds from Stork for real-time pricing Liquidation Mechanism: Auto-deleveraging (ADL) triggered by oracle prices with margin requirements

Architectural Assessment: The design appears competent but lacks public documentation of critical risk parameters. The off-chain/on-chain hybrid model follows established patterns from Perennial Labs (see Team Origins), but the cross-asset margin system represents novel territory without proven stress testing.

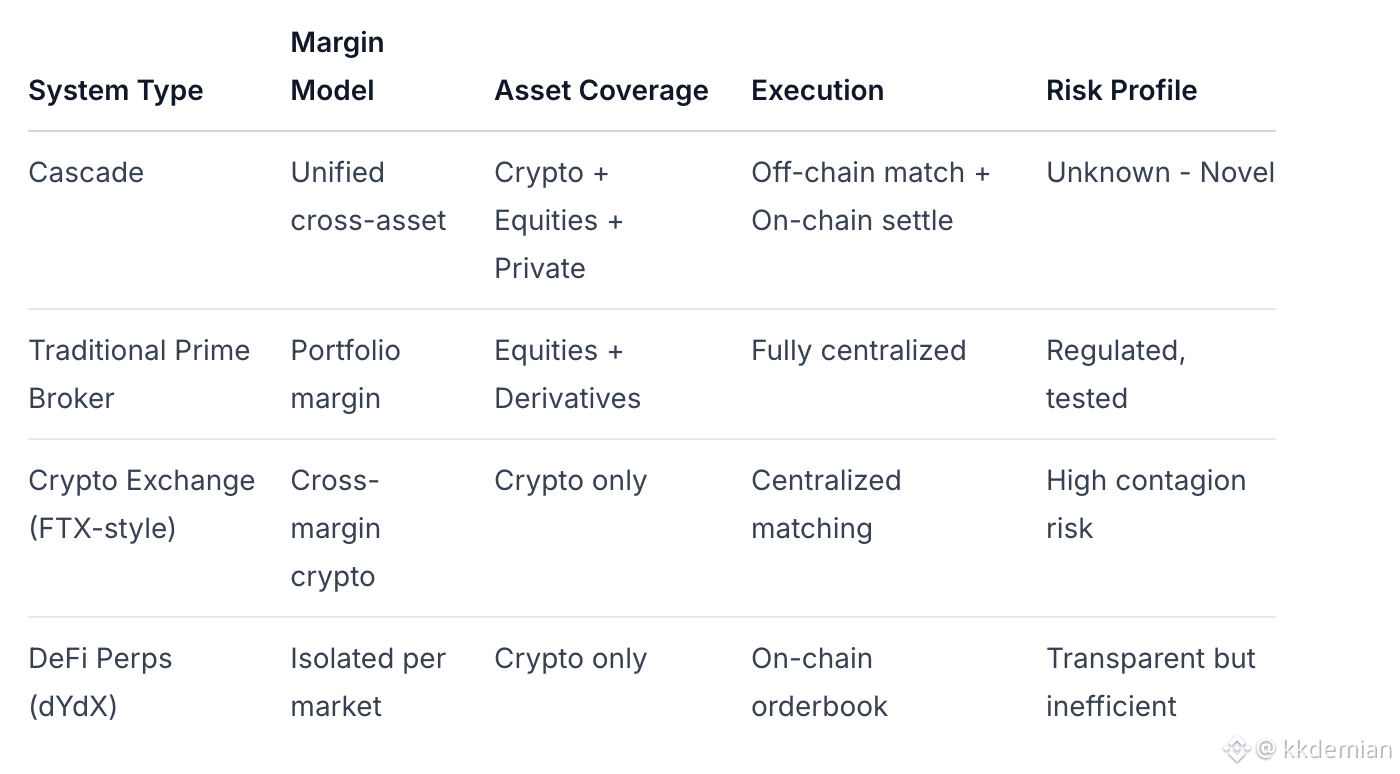

Comparative Architecture Analysis

3. Team Origins & Execution Capability

Critical Finding: Cascade represents a strategic pivot from Perennial Labs, a DeFi derivatives protocol that raised $12.6M in December 2022 from the exact same investor syndicate (Polychain, Variant, Archetype, Coinbase Ventures). X

Leadership: Kevin Britz (@kbrizzle_) serves as CEO and primary architectural lead. His background includes:

Co-founder of Perennial Labs (DeFi perpetuals protocol)

Experience with DeFi derivatives architecture

Demonstrated understanding of perpetual market design

Team Assessment: While technically competent in DeFi derivatives, the team lacks publicly verifiable experience in traditional prime brokerage, cross-asset risk modeling, or regulated equity markets. The Perennial pivot suggests adaptability but also raises questions about sustainable product-market fit.

4. Economic Model & Incentive Structure

Revenue Strategy

Cascade employs a multi-phase monetization approach:

Launch Phase (2026): Zero trading fees to drive adoption Future Revenue Streams:

Margin lending through CLS evolution

Potential funding rate spreads

Payment for order flow (theoretically possible but unconfirmed)

Liquidity Strategy (CLS): The $8M pre-allocated capital serves as:

Liquidity backstop for orderbook depth

Liquidation flow underwriter

Precursor to margin lending system

Points-based rewards mechanism for early users

Economic Assessment: The zero-fee model creates initial adoption incentives but lacks clear path to sustainable revenue generation. Dependence on CLS for critical market functions introduces potential conflicts between profit maximization and risk management.

5. Risk Analysis & Regulatory Considerations

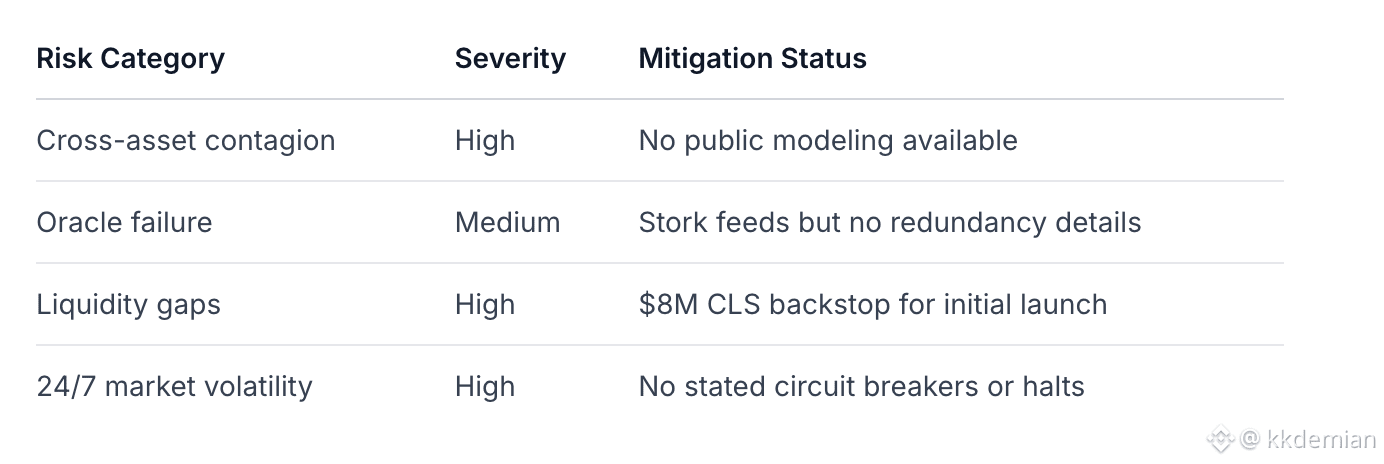

Technical Risk Factors

Regulatory Uncertainty

Critical Concern: Cascade's offering of 24/7 synthetic equity perpetuals to US retail users via Stripe/Bridge integration creates significant regulatory exposure:

Wash trading rules: How monitored for 24/7 markets?

Pattern day trading: How enforced across continuous sessions?

SEC jurisdiction: Synthetic equity derivatives likely fall under securities regulations

CFTC overlap: Crypto components under commodity jurisdiction

No public filings or regulatory approvals were identified in available data, suggesting either early-stage compliance work or potential regulatory risk.

6. Adoption Signals & Market Validation

Strong Demand Indicators:

$26M+ requested for $8M CLS allocation (3.25x oversubscription)

63,917 Twitter followers with high engagement (800K+ views on announcement)

4,000+ early traders in First Wave program

Strategic Positioning: Cascade targets the convergence of three trends:

Crypto traders seeking equity exposure

Traditional investors wanting 24/7 access

Portfolio managers seeking cross-asset capital efficiency

Market Assessment: Demand appears genuine but concentrated among crypto-native users rather than traditional finance participants. The value proposition resonates strongest with those already familiar with perpetual trading mechanics.

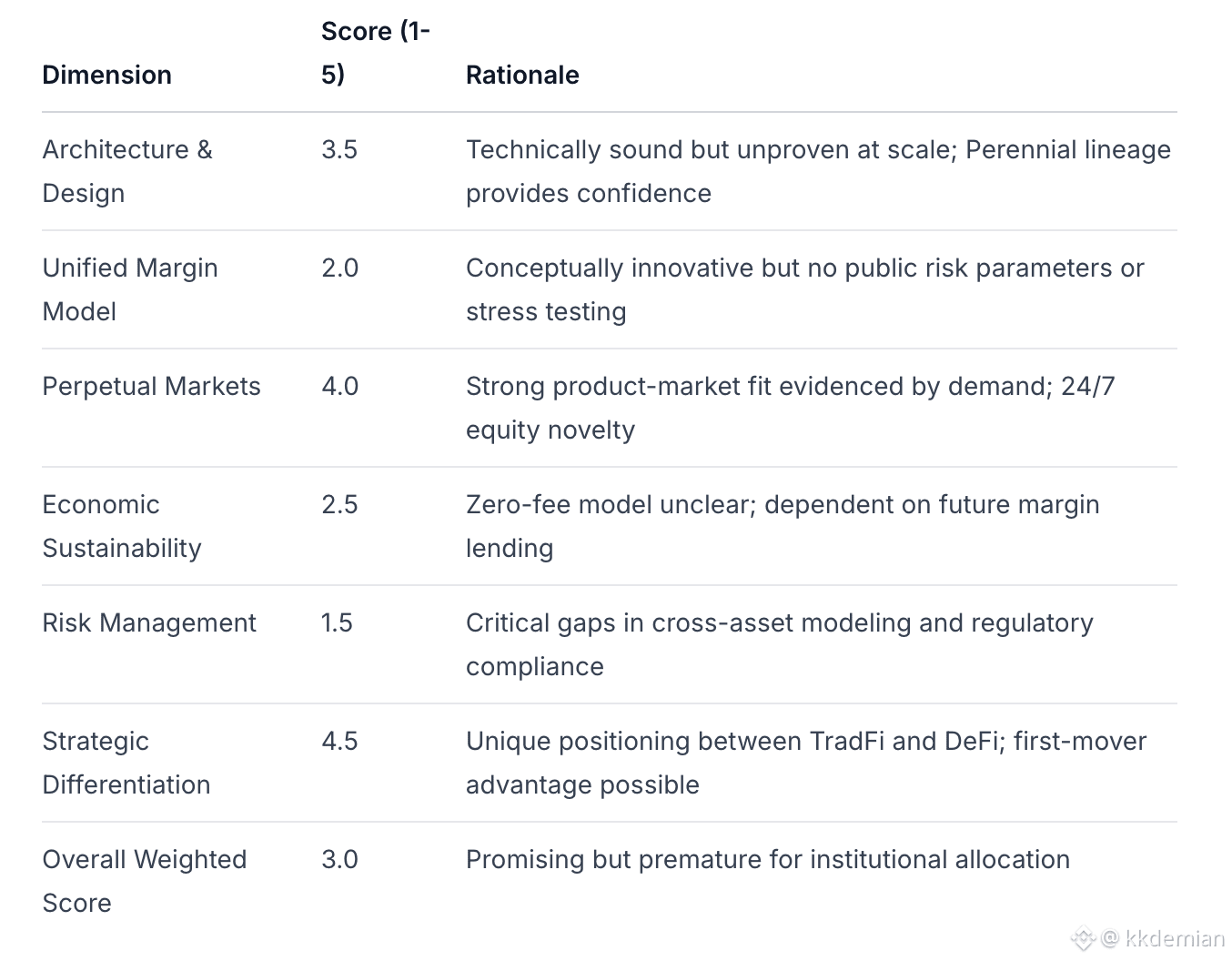

7. Investment Assessment Scorecard

8. Strategic Verdict & Recommendations

For Tier-1 Investment Institutions: HOLD - High Potential, Higher Risk

Cascade represents a genuinely innovative approach to market structure with strong initial traction, but the combination of unproven risk models, regulatory uncertainties, and team gaps in traditional finance experience makes it unsuitable for direct investment at this stage.

Recommended Engagement Strategy:

Monitoring Position: Track mainnet launch (Q1 2026) and initial risk performance

Technical Due Diligence: Request detailed margin model documentation and stress test results

Regulatory Clarity: Await SEC/CFTC positioning on 24/7 synthetic equity products

Competitive Analysis: Monitor traditional brokers (Robinhood, Interactive Brokers) response to 24/7 trading demand

Key Risk Catalysts to Monitor:

Cascade represents a genuinely innovative approach to market structure with strong initial traction, but the combination of unproven risk models, regulatory uncertainties, and team gaps in traditional finance experience makes it unsuitable for direct investment at this stage.

Recommended Engagement Strategy:

Monitoring Position: Track mainnet launch (Q1 2026) and initial risk performance

Technical Due Diligence: Request detailed margin model documentation and stress test results

Regulatory Clarity: Await SEC/CFTC positioning on 24/7 synthetic equity products

Competitive Analysis: Monitor traditional brokers (Robinhood, Interactive Brokers) response to 24/7 trading demand

Key Risk Catalysts to Monitor:

March 2026: Mainnet launch and initial trading volume

Q2 2026: Regulatory scrutiny or enforcement actions

Q3 2026: CLS transition to margin lending and revenue model clarity

Any major cross-asset liquidation events testing risk models

Bottom Line: Cascade's architectural ambition is commendable and market demand is validated, but the protocol remains in "proof of concept" stage regarding its core risk innovation. The Perennial pivot demonstrates adaptability but also highlights the challenges of finding sustainable product-market fit in derivatives infrastructure. Institutional capital should wait for demonstrable risk management and regulatory clearance before allocation.