There's a particular moment in every revolutionary technology's lifecycle when the rubber meets the road, when the whiteboard theories of venture backed engineers confront the messy reality of actual human needs. For Vanar Chain, that moment came not in a sleek San Francisco co-working space, but in the grinding frustration of watching mainstream brands struggle, fail, and ultimately abandon Web3 after being burned one too many times.

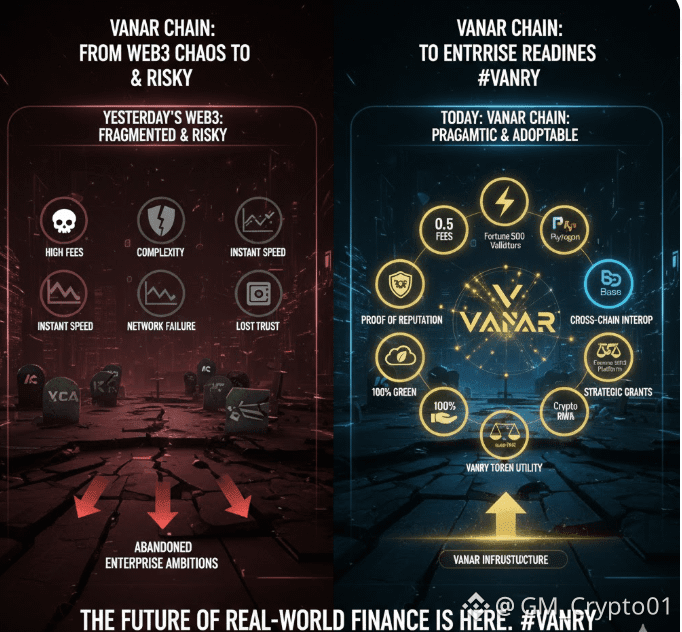

The team behind Vanar had spent years in the trenches of entertainment, gaming, and immersive technology, watching an uncomfortable pattern repeat itself. A major brand would dip its toe into blockchain, excited by the promise of digital ownership and decentralized economies. Six months later, they'd quietly shutter the project, nursing wounds from exorbitant transaction costs, technical complexity that alienated their customer base, or worse, discovering the platform they'd built on had simply evaporated overnight. The web3 graveyard grew crowded with corporate ambitions, each tombstone representing millions in wasted capital and irreparably damaged trust.

What emerged from this battlefield assessment wasn't just another blockchain promising faster speeds or lower costs. Vanar represents something more fundamental: a recognition that the existing blockchain infrastructure was solving problems that enterprise users didn't actually have, while ignoring the ones keeping their executives awake at night. When a gaming company can't implement microtransactions because the blockchain fee exceeds the transaction value itself, or when a luxury brand's NFT drop crashes because the network can't handle the traffic, the issue isn't philosophical, it's existential for mass adoption.

The architecture Vanar constructed reflects this hard-won wisdom. Transaction fees hovering around half a penny aren't just a technical achievement; they're the difference between a loyalty program that works and one that bleeds money with every customer interaction. The speed improvements aren't about bragging rights in developer forums; they're about ensuring that a metaverse concert doesn't lag, that a real-time gaming experience doesn't stutter, that the digital economy can pulse with the same immediacy consumers expect from their traditional apps.

But perhaps the most telling aspect of Vanar's approach lies in what they chose to govern differently. The Vanar Foundation's Proof of Reputation system for validator selection represents a pragmatic departure from crypto orthodoxy. Rather than pure decentralization at all costs, they recognized that mainstream brands need recognizable, accountable partners running network infrastructure. When a Fortune 500 company considers blockchain integration, they're not comforted by anonymous validators in unknown jurisdictions; they need entities with reputations on the line, legal accountability, and institutional staying power.

This thinking extends to their environmental stance, which reads less like virtue signaling and more like risk management. Running entirely on Google Cloud Platform's renewable energy infrastructure isn't just about carbon footprints, it's about anticipating the ESG requirements that increasingly govern corporate decision making. A brand can't launch a sustainability initiative on infrastructure that contradicts its stated values. Vanar understood that in 2025 and beyond, being green isn't optional for enterprise adoption; it's prerequisite.

The VANRY token's design philosophy further illuminates this practical orientation. While many blockchain projects create tokens that feel like solutions searching for problems, VANRY emerged from clear functional requirements. Gas fees need payment. Network security requires incentives. Decentralized governance demands a mechanism. The token wasn't conceptualized in isolation and then retrofitted to the ecosystem; it grew organically from what the infrastructure genuinely needed to operate sustainably.

What makes this particularly interesting is how Vanar bridges the chasm between crypto-native applications and traditional business operations. The decision to deploy ERC20 versions of VANRY on Ethereum and Polygon networks acknowledges a reality many blockchain maximalists resist: interoperability isn't a nice-to-have feature, it's fundamental infrastructure. Businesses operate across multiple ecosystems, and forcing them into walled gardens, even efficient ones, creates the same friction that drove them away from earlier blockchain attempts.

The grant and funding structure administered by the Vanar Foundation reveals another layer of sophistication. Rather than simply throwing tokens at projects and hoping something sticks, they're providing operational support across technical, advisory, marketing, and business development functions. This recognizes what startup operators know viscerally: capital is rarely the binding constraint. Expertise, connections, and strategic guidance typically matter more than another million in funding, especially in emerging technology sectors where navigating uncharted territory separates success from expensive failure.

As institutional interest in tokenized real-world assets accelerates, Vanar's positioning becomes increasingly relevant. The introduction of infrastructure supporting overcollateralized synthetic dollars like USDf suggests they're anticipating the next phase of blockchain maturation, one where digital and physical assets intermingle seamlessly, where liquidity creation doesn't require asset liquidation, where the blockchain layer becomes invisible to end users who simply want stable, efficient financial tools.

This evolution toward universal collateralization infrastructure represents more than feature expansion; it's a thesis about blockchain's ultimate role in the global economy. The vision isn't crypto replacing traditional finance through disruption, but rather blockchain becoming the connective tissue enabling more efficient capital markets, more accessible liquidity, and more flexible financial instruments. It's a fundamentally integrationist rather than revolutionary stance, and arguably a more realistic path to the mass adoption that's remained perpetually five years away since Bitcoin's genesis block.

The Vanar story ultimately illustrates how emerging technologies mature. The first wave solves theoretical problems with elegant technical solutions. The second wave solves actual problems with practical compromises. Vanar arrived firmly in the second wave, battle-tested by watching the first wave's wreckage and clear-eyed about what mainstream adoption actually requires. Whether this approach succeeds remains to be seen, but it represents a marked evolution in blockchain thinking, from ideological purity toward pragmatic utility, from decentralization as dogma toward decentralization as tool, from building for crypto enthusiasts toward building for everyone else.