The global financial system moves approximately $5 trillion daily through a labyrinth of intermediaries, settlement layers, and legacy infrastructure built decades before the internet existed. Every international wire transfer, every cross-border payment, every settlement between banks relies on systems where money doesn't actually move at the speed of light through fiber optic cables, it crawls through correspondent banking relationships, SWIFT messages, and clearing houses that close on weekends. The inefficiency isn't just academic; it's a tax on every economic participant, a friction cost measured in basis points that compounds into billions.

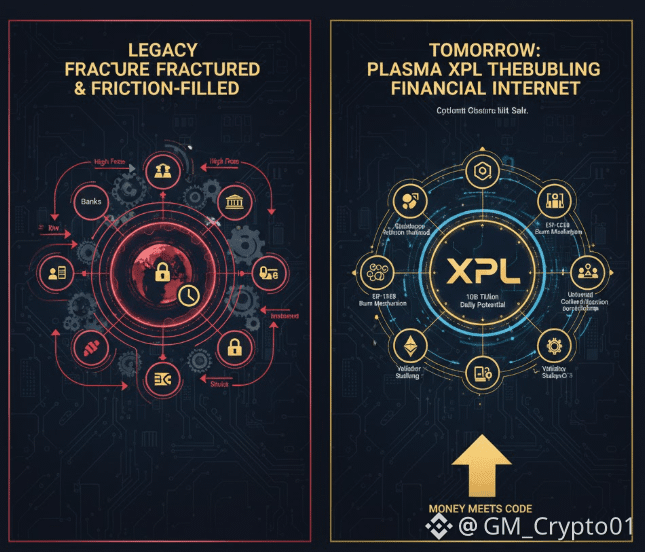

Plasma emerged from a deceptively simple observation: if information can move globally and instantly at near-zero cost, why can't money? The answer isn't technical capability, it's institutional inertia and the absence of foundational infrastructure designed for a world where value should flow as freely as data. What they're building isn't another cryptocurrency trying to replace the dollar or another DeFi protocol promising implausible yields. It's something more fundamental and potentially more transformative: the financial internet's equivalent of TCP/IP, the invisible layer that makes everything else possible.

The XPL token sits at the center of this architecture, but understanding its role requires stepping back from typical crypto narratives about digital gold or governance tokens. XPL functions as the economic security mechanism for a network designed to handle trillions in stablecoin transactions. Think of it less like a currency and more like the economic foundation ensuring validators have skin in the game, that the network remains censorship-resistant, that the infrastructure serving as plumbing for a new financial system has deep, aligned incentives preventing capture or corruption.

What makes Plasma's approach particularly interesting is how deliberately they've designed XPL distribution and emissions to avoid the pitfalls that have plagued earlier blockchain projects. The allocation split reveals strategic thinking about long-term sustainability versus short-term speculation. Forty percent dedicated to ecosystem growth isn't just marketing budget; it's recognition that building bridges into traditional finance, onboarding institutions that move serious capital, and creating network effects that extend beyond crypto Twitter requires sustained, capital-intensive effort over years, not months.

The team and investor allocations, both at 25% with identical three-year unlock schedules, signal something equally important: alignment. When founding teams and capital providers face the same lockup terms, when neither can dump tokens immediately after launch, it creates temporal alignment around building durable value rather than extracting quick returns. The one-year cliff followed by gradual unlocks means anyone involved is betting on 2027 and beyond, not the next quarterly pump.

Perhaps most tellingly, the 10% public sale represents a philosophical stance about who should participate in network upside. Traditional venture-backed projects often reserve the vast majority for insiders, leaving retail participants holding bags while early investors exit. Plasma's approach suggests they learned from those mistakes, though the differentiated treatment between US and non-US purchasers reflects the regulatory complexity of building compliant infrastructure in an environment where rules remain frustratingly ambiguous.

The validator economics reveal deeper sophistication in mechanism design. Starting at 5% annual inflation that gradually decreases to a 3% baseline creates a predictable security budget while limiting long-term dilution. But the real elegance lies in the EIP-1559 burn mechanism, where transaction fees are permanently destroyed rather than recycled. As network usage scales, as more stablecoins flow through Plasma's rails, as transaction volume grows from millions to billions to potentially trillions, the fee burn can counteract or even exceed new token emissions. The result could be a deflationary asset securing an inflationary stablecoin system, an economic engine where increased utility directly benefits token holders.

The timing of Plasma's launch intersects with a broader shift in how institutions think about blockchain technology. The 2021 crypto bubble promised financial revolution but delivered mostly speculation and leverage. The 2022 crash cleared away projects built on unsustainable economics and vaporware promises. What emerged in the aftermath is a more sober assessment of blockchain's actual value proposition: not replacing finance, but making it dramatically more efficient through better infrastructure.

Stablecoins represent the beachhead for this transition. They've already demonstrated product-market fit beyond any other crypto application, with hundreds of billions in circulation facilitating everything from remittances to trading to corporate treasury management. But existing stablecoins operate on infrastructure never designed for their scale. Ethereum's high fees make small transactions economically nonsensical. Other chains sacrifice decentralization for speed, creating single points of failure unacceptable for serious financial infrastructure.

Plasma's zero-fee architecture isn't just a competitive feature; it's a prerequisite for the use cases they're targeting. When a Philippine worker sends $100 home, a $2 fee matters enormously. When a multinational corporation moves $100 million between subsidiaries, even a $100 fee is noise, but settlement time and finality guarantees are paramount. The infrastructure has to serve both extremes, which requires rethinking how blockchains price transactions and allocate network resources.

The staked delegation model coming to Plasma addresses another practical reality: most XPL holders won't run validator infrastructure, but they should still participate in network security and earn rewards for doing so. By allowing token holders to delegate stake to professional validators, Plasma creates a flywheel where increased token value attracts more stake, which increases security, which makes the network more attractive for serious financial applications, which drives more usage and fee burn. It's capitalism's invisible hand applied to consensus mechanism design.

What distinguishes Plasma from earlier attempts at building financial infrastructure on blockchains is the acknowledgment that this is fundamentally a network adoption problem, not a technical one. The technology for fast, cheap, secure blockchain transactions has existed for years. What hasn't existed is the patient capital, institutional relationships, regulatory navigation, and operational excellence required to actually onboard the trillions of dollars sitting in legacy systems.

The Plasma team's partnerships with firms like Founders Fund and Framework signal they understand this isn't a typical crypto venture, it's infrastructure building on the scale of Visa or SWIFT, requiring decade-plus time horizons and capital deployment measured in strategic positioning rather than quarterly metrics. These aren't investors looking for 10x returns in eighteen months; they're betting on owning critical infrastructure for how money moves in 2030 and beyond.

The introduction of universal collateralization infrastructure and synthetic dollar issuance through overcollateralized positions represents the next evolution in Plasma's thesis. It's not enough to move money efficiently; the system needs to unlock liquidity from existing assets without forcing liquidation. When real-world assets get tokenized, when institutional portfolios exist on-chain, the ability to borrow against those positions while maintaining exposure becomes essential financial infrastructure, not optional functionality.

Whether Plasma succeeds in its ambition to handle trillions of dollars remains uncertain. The graveyard of blockchain projects that promised to revolutionize finance is vast and growing. But what's different here is the focus on solving actual pain points rather than imagined ones, on building for institutions that control real capital rather than crypto-native speculators, on patient infrastructure development rather than explosive hype cycles. The XPL token economy reflects this orientation, designed not for maximum short-term attention but for sustainable long-term value capture as the network it secures potentially becomes foundational to how modern finance operates.