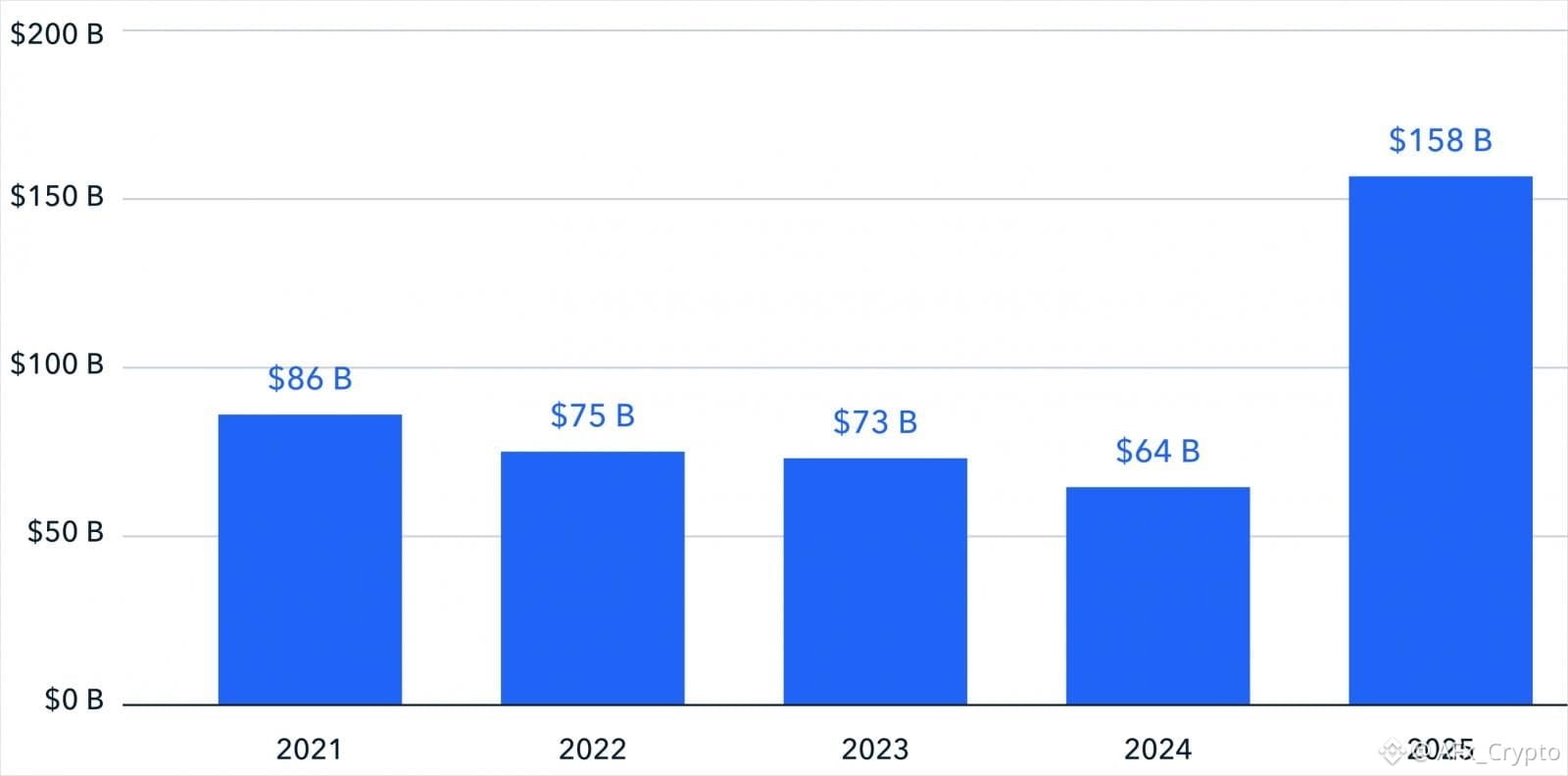

Recent reports indicating that crypto wallets received nearly $158 billion in illicit funds last year have sparked concern across the digital asset industry. While the figure is undeniably large, a closer look reveals a more nuanced — and in some ways encouraging — picture of how the crypto ecosystem is evolving.

Understanding the Headline Number

The $158 billion estimate comes from blockchain intelligence firms tracking wallets linked to sanctions evasion, fraud, hacks, and other illicit activities. Importantly, this figure reflects total value received by flagged addresses, not proven criminal convictions or direct losses borne by users.

As crypto adoption expands globally, overall transaction volumes have increased significantly — naturally pushing absolute numbers higher across both legitimate and illegitimate activity.

Context Matters: Share vs. Size

Despite the record dollar amount, illicit activity accounted for roughly 1–1.2% of total crypto transaction volume, according to multiple analytics reports. This means that while illicit flows grew in absolute terms, their share of the overall market actually declined compared to earlier years.

In other words, legitimate crypto usage is growing faster than misuse.

What’s Driving the Increase?

Several structural factors contributed to the rise:

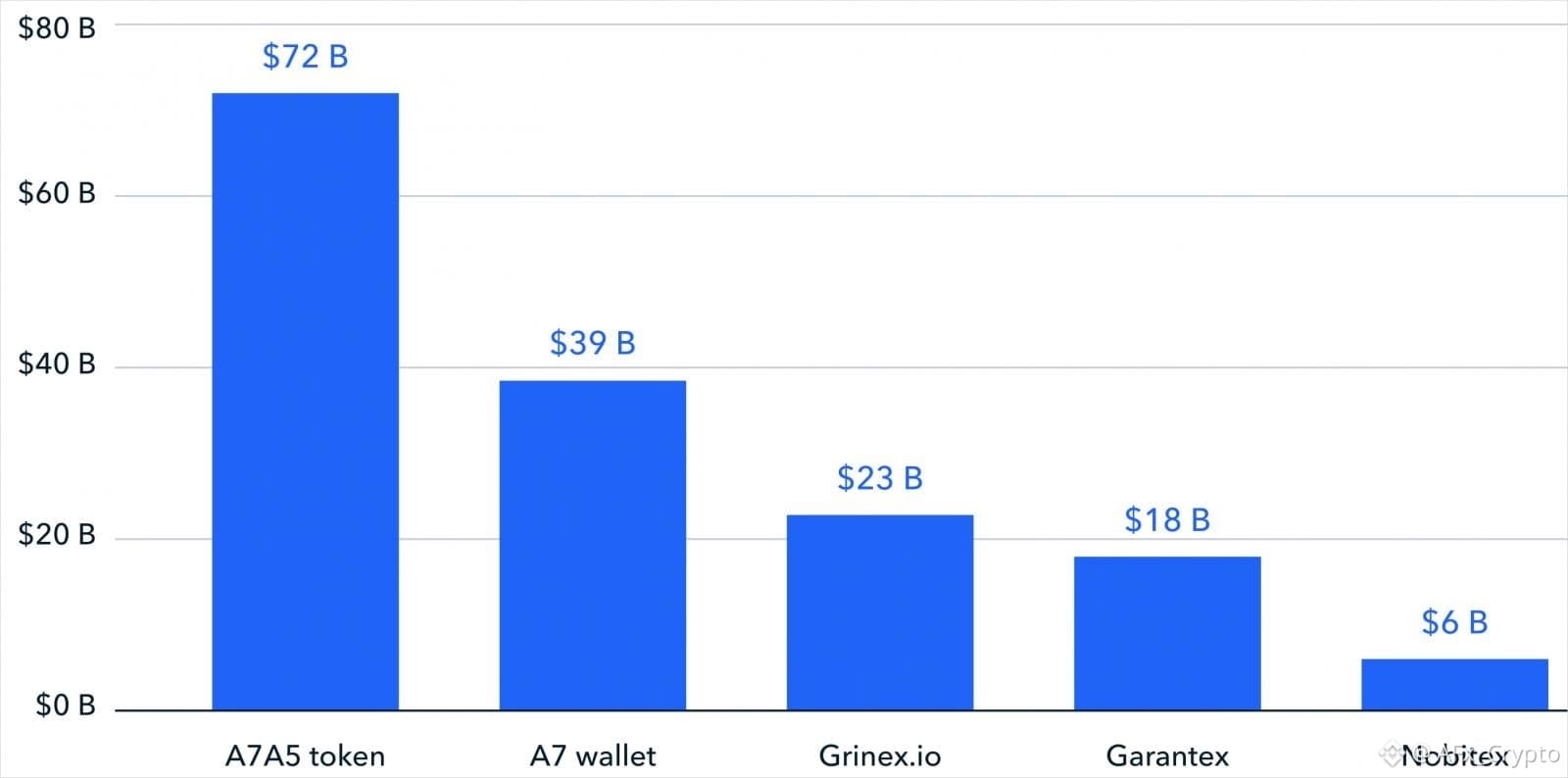

Sanctions-related transactions, particularly involving stablecoins and cross-border transfers

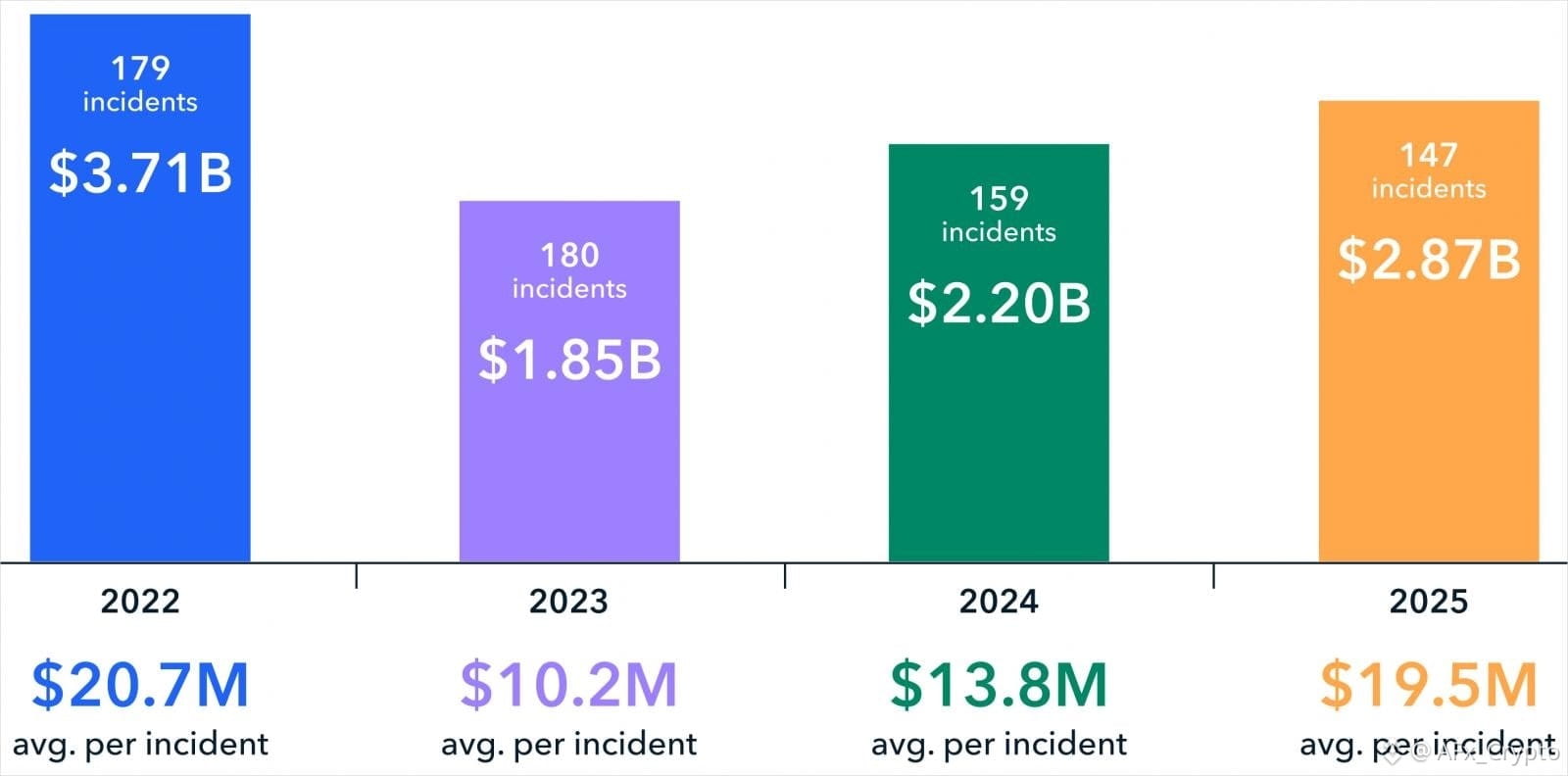

Large-scale hacks and exploit recoveries, which temporarily inflate illicit inflow metrics

Improved blockchain surveillance, allowing analysts to identify and label suspicious activity more accurately than in the past

This last point is often overlooked: better detection increases reported numbers, even if real-world criminal usage hasn’t grown at the same pace.

A Sign of a Maturing Industry

Paradoxically, the visibility of illicit flows reflects progress. Today’s crypto ecosystem is far more transparent than traditional finance, where comparable data on illicit money movement is often unavailable or delayed.

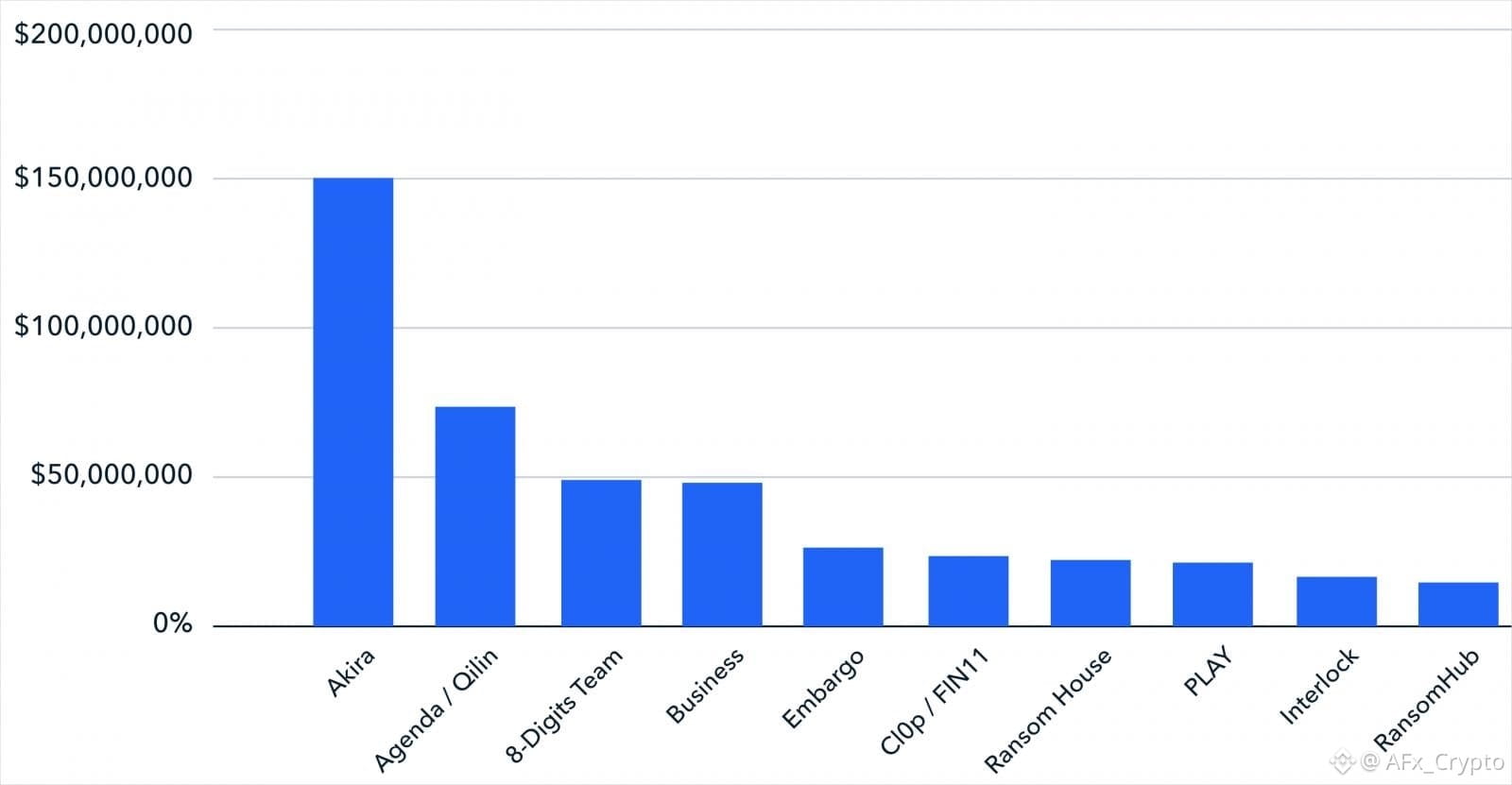

Exchanges, analytics firms, and regulators now collaborate more closely than ever, using on-chain data to:

Freeze suspicious funds

Track criminal networks

Strengthen compliance frameworks

This level of oversight was largely absent during crypto’s early growth phase.

Why This Doesn’t Undermine Crypto’s Long-Term Outlook

Illicit activity exists in every financial system. What matters is how effectively it is detected, measured, and mitigated. The fact that such data is publicly quantified — and represents a shrinking percentage of total activity — suggests improving market resilience rather than systemic weakness.

Final Perspective

The $158 billion figure is not a signal of crypto failure, but a reminder of scale. As digital assets integrate further into global finance, scrutiny will increase — and transparency will continue to expose both strengths and weaknesses.

For long-term participants, the key takeaway is clear:

Crypto is becoming more monitored, more regulated, and ultimately more institutional.

Disclaimer:

#crypto #CryptoUpdate #AFx_Crypto

This content is for informational purposes only and does not constitute financial advice.