Plasma is mindshare since it is not aiming to be everything for everyone. Plasma has a strongly opinionated position in a market full of generic Layer-1 blockchains vying on abstract criteria such as TPS and modularity: Financial infrastructure should be built around how stablecoins are really used in the real world; they are the most often used on-chain commodity. Plasma is transformed from "just another L1" into a sophisticated settlement network designed for dollars, payments, and institutional-grade money movement by this design thinking.

Plasma is essentially a Layer-1 blockchain developed particularly for stablecoin transactions. Plasma views stablecoins as first-class citizens, unlike conventional L1s where they are just smart contracts vying for blockspace. Users' desire to move stable value rapidly, affordably, and reliably guides everything from consensus design to fee structure, UX assumptions to security anchoring. This approach matters. Plasma's full on-chain programmability aligns it more closely with payment rails like Visa, SWIFT, and ACH than with experimental DeFi sandboxes while yet retaining full on-chain programmability.

Plasma technically combines a high-performance BFT consensus called PlasmaBFT with complete EVM compatibility. Plasma guarantees that current Solidity contracts, wallets, and utilities operate out of the box by means of a contemporary Ethereum execution stack (Reth-based). Developers may simply utilize the existing knowledge of the Ethereum environment; they need not relearn concepts or modify software. plasmaBFT is also set for quick and deterministic settlement. The network promotes low-latency finality over probabilistic confirmations so that transaction results are obvious in a flash. When making payments, this difference is very important: Organizations, PSPs, and stores care much more about finality promises than they do about basic throughput statistics.

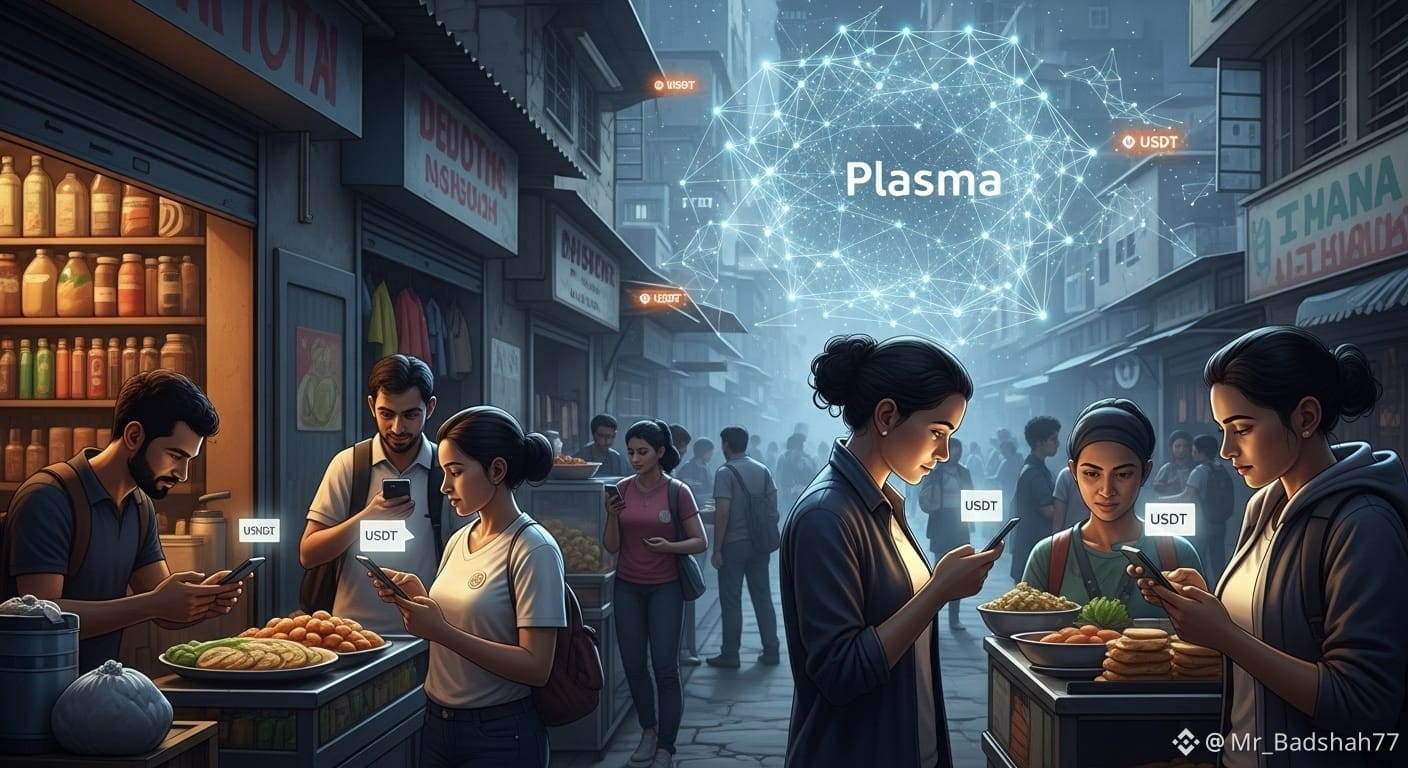

Plasma's handling of transaction costs is among its most upsetting design decisions. Most blockchains need users to hold a volatile local token simply to transfer stable value, a UX design mistake that has quietly stopped widespread use for years. By facilitating gasless stablecoin transfers across paymaster infrastructure and by encouraging stablecoin-denominated gas, plasma eliminates this resistance. This implies in reality that a user can send USDT without ever interacting with the native coin of the network and without having to be concerned about gas price fluctuation. This makes sense for retail consumers. For companies, it's revolutionary. Accounting gets easier, onboarding friction vanishes, and the blockchain disappears into the background—just as financial infrastructure should operate.

With like pragmatism is considered security. Plasma uses Proof-of-Stake for daily functioning. This makes sure that validators are rewarded for their work by making them stake, delegate, and slash. Plasma also adds Bitcoin-anchored security, which can either check or confirm the network's status every so often by connecting it to Bitcoin. Plasma does not inherit Bitcoin's execution model; instead, it borrows Bitcoin's unrivaled impartiality and immutability as a cryptographic anchor. The outcome is a settlement layer with a history hard to change and outside auditability on the most reliable blockchain currently in use. This hybrid approach presents a strong trust narrative for organizations assessing censorship resistance and long-term integrity.

Plasma distinguishes protocol durability from user experience from an economic perspective. Near-zero-friction transfers help end users, whereas validators and infrastructure providers are paid with a mix of sponsored fees, staking rewards, and network incentives expressed in the native token. This decoupling is deliberate. Plasma knows consumers want to avoid guessing about gas tokens, but infrastructure companies still require strong financial assurances. Plasma reflects how successful financial networks function off-chain by driving complexity to the infrastructure layer and simplifying the user layer.

This attitude is reflected in the target consumer. Plasma is made especially for places where people use a lot of stablecoins, send money to other countries, pay businesses, settle payments with the government, and handle money coming from big companies. For these users, auditability, compliance flexibility, cost predictability, and speed take precedence over composability testing. Plasma's design facilitates on-chain treasury management, payroll rails, exchange settlement, and point-of--sale applications when dollars, not governance tokens, serve as the unit of account. Plasma sees itself more as programmable financial infrastructure than as a "crypto network" in this regard.

Plasma is narratively clear from a mindshare standpoint. Plasma talks the language of money, but many L1s speak in abstractions. Gasless USDT. under-second conclusion. Bitcoin-anchored safety. These are ideas that go beyond the crypto-native community. CFOs, fintech companies, payment processors, and regulators looking at blockchain as infrastructure—not as an idea—can read them. Plasma's clarity lets it fill a unique mental niche: the stablecoin settlement chain.

Trade-offs undoubtedly occur. Sponsored gas models bring about dependency on paymasters and infrastructure providers, which has to be dispersed over time. Bitcoin anchoring adds cost factors and outside dependencies. Stablecoin regulatory environments stay flexible and might affect adoption trajectories differently across several countries. These are not blind spots, though; they are accepted conflicts that come with creating actual financial infrastructure rather than imaginary platforms.

Plasma is making a simple but big bet: Stablecoins are currently the most popular cryptocurrency item; the next phase of adoption will be motivated by improved rails rather than fresh tokens. If that hypothesis is correct, Plasma does not have to fight every L1. It just has to be absolutely necessary for the flow of digital money. In a world where people are looking for something more than just stories, a blockchain that is made just to show how money really moves could be just what makes it last.