Executive Summary

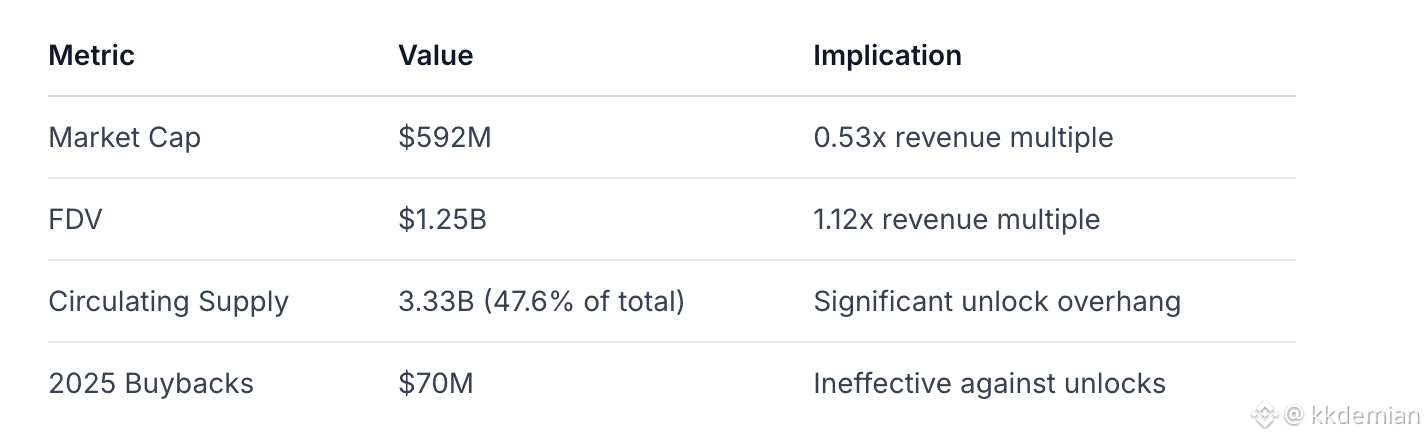

operates as Solana's dominant execution layer, processing $27.7M daily volume (2.2% of Solana's $1.27B ecosystem DEX volume) with $3.5-3.8B TVL. The protocol generated $1.11B in fee revenue during 2025, primarily from perpetual trading, positioning it as essential Solana infrastructure. Despite this fundamental strength, JUP token faces significant structural headwinds: $70M in 2025 buybacks proved ineffective against $1.2B in upcoming unlocks, resulting in only 6.3% value capture from protocol revenue. Current valuation at 0.53x MC/Revenue and 1.12x FDV/Revenue suggests undervaluation if sustainable fee generation continues, but token economics remain misaligned with protocol performance.

1. Project Overview

Jupiter has evolved from DEX aggregator to Solana's DeFi superapp, expanding into perpetuals, lending, stablecoins (JupUSD), ecosystem analytics (explore.ag), and global payments (Jupiter Global). Founded by Meow, Ben Chow, and Siong, the protocol has matured through sustained Solana ecosystem development since 2021, with no venture funding beyond a $137.5M IDO in January 2024.

Core Thesis Validation: Jupiter functions as meta-execution infrastructure rather than mere aggregation. The protocol abstracts Solana's liquidity fragmentation through sophisticated routing while expanding into complementary financial primitives, creating a defensible position as Solana's default execution layer.

2. System Architecture & Execution Routing

Routing Engine Hierarchy

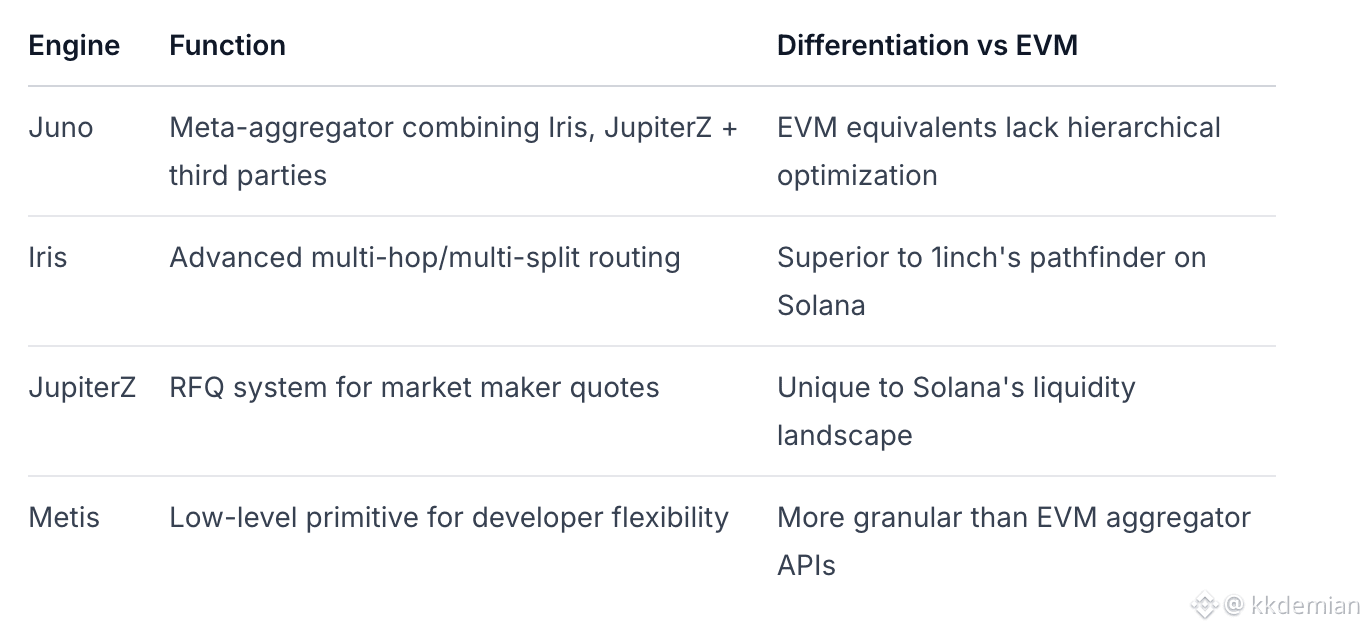

Jupiter employs a multi-layered routing architecture optimized for Solana's high-throughput environment:

Key Innovation - Jupiter Beam: Proprietary transaction landing engine achieving sub-second latency (0-1 blocks vs 1-3 blocks previously) with complete MEV protection through private mempool routing. Dev Documentation

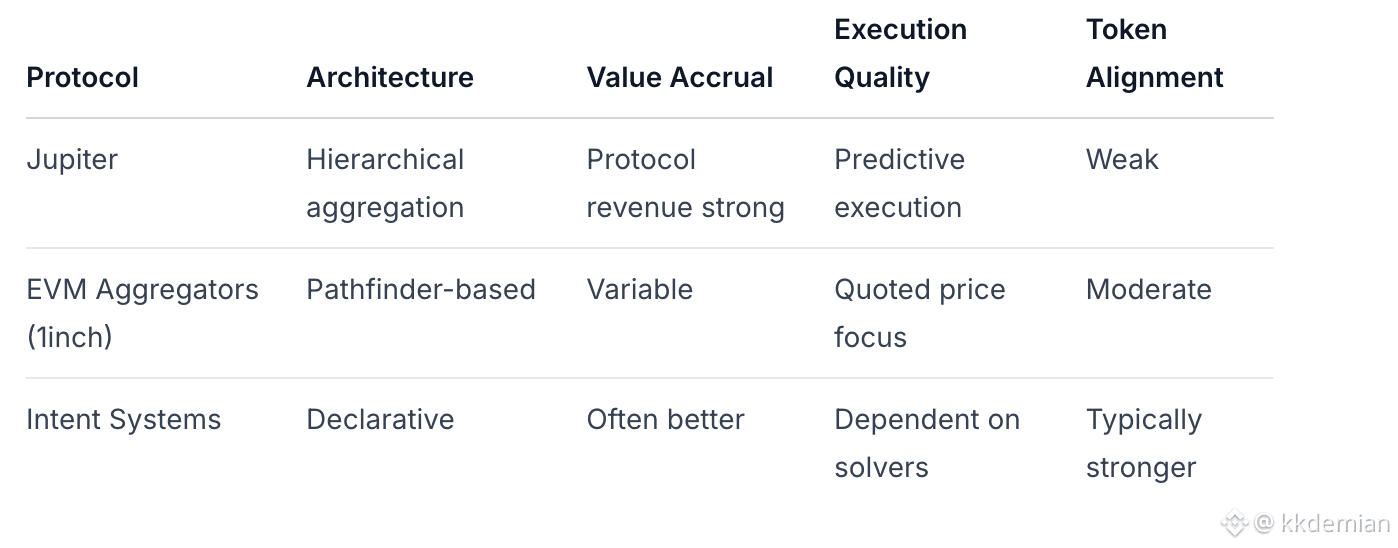

Architectural Assessment: Jupiter operates as a execution coordination layer rather than pure aggregation. The system translates user parameters into optimized on-chain execution through:

Predictive Execution: Simulates routes for actual executed price vs quoted price

Ultra Signaling: Identifies "non-toxic" flow to Prop AMMs for better pricing

Slippage-aware routing: Prioritizes routes with least realized slippage

Compared to EVM aggregators, Jupiter's architecture leverages Solana's parallel execution capabilities for more sophisticated routing logic and faster settlement.

3. Asset Flow & Product Expansion

Current Product Suite

Core Aggregation: Processes $27.7M daily volume across Solana DEXs JupUSD Stablecoin: Backed by 90% BlackRock BUIDL via Ethena partnership, serving as protocol unit of account News Source Ondo Partnership: Enabled trading of 200+ tokenized stocks on Solana through Jupiter gateway News Source Jupiter Offerbook: Permissionless P2P lending marketplace for tokens/RWA/NFTs News Source explore.ag: Solana ecosystem explorer integrating Solscan/DefiLlama data News Source

Asset Flow Analysis: Jupiter functions as an implicit intent system - users specify desired outcome (token swap, stock purchase, loan) rather than explicit execution path. The protocol's expansion into diverse asset classes demonstrates strategic positioning as Solana's financial gateway.

4. Routing Logic & Capital Efficiency

Execution Optimization

Predictive Execution: Jupiter's key differentiator - routes are simulated on-chain before execution to compare actual executed price rather than relying on quoted prices. This addresses the critical issue of Prop AMMs showing attractive quotes but delivering poor execution.

Data-Driven Efficiency: Jupiter's swap volume to value extracted ratio shows 34x better efficiency than top trading terminals, demonstrating superior execution quality despite higher volume.

Capital Efficiency Priorities:

Best executed price over theoretical best quote

Execution success rate maximization

MEV protection through private transaction routing

Network liquidity utilization across fragmented venues

The protocol's routing logic prioritizes actual user outcomes over vanity metrics, creating sustainable competitive advantage.

5. Protocol Economics & JUP Token Design

Revenue Generation & Value Capture

2025 Performance: $1.11B in fee revenue, ranking #2 among DeFi protocols News Source Current Metrics: $200K-600K daily fees, $3.5-3.8B TVL TokenTerminal Value Capture Mechanism: Only 6.3% of 2025 revenue ($70M) distributed via buybacks

Tokenomics Analysis:

Token Utility: JUP functions primarily as governance token with Active Staking Rewards (ASR). The recent Litterbox Burn (November 2025) removed ~4% of circulating supply, but token lacks direct fee capture mechanism. DAO Twitter

Economic Assessment: Protocol economics are robust ($1.11B revenue), but token value accrual remains weak. The 0.53x MC/revenue multiple suggests undervaluation if sustainable, but structural issues persist.

6. Governance, Security & Risk Analysis

DAO Governance Structure

Active Staking Rewards: Q4 2025 ASR distributed based on time-weighted stake Twitter Jupuary 2026 Allocation: 700M JUP distribution (200M to fee-paying users/stakers, 200M bonus pool, 300M Jupnet incentives) Support Documentation Governance Process: Proposals voted through vote.jup.ag, including recent Litterbox Burn approval

Risk Assessment

High Severity Risks:

Token Unlocks: $1.2B in upcoming unlocks through 2026 News Source

Solana Dependency: Network outages directly impact Jupiter's operation

Value Accrual Misalignment: Robust protocol revenue doesn't translate to token value

Medium Severity Risks:

Competition: Raydium ($525M volume), Orca ($453M volume) as direct competitors Recommend Data

Margin Compression: Aggregation typically compresses fees over time

Risk Mitigation: Jupiter's infrastructure ownership (Jupiter Beam) reduces MEV risks, and protocol diversification (beyond pure aggregation) creates additional revenue streams.

7. Adoption Signals & Ecosystem Centrality

Market Position

Volume Ranking: #9 among all DEX protocols with $370M recent volume Recommend Data Solana Dominance: 2.2% of Solana's $1.27B daily DEX volume, but dominant aggregator position Strategic Integrations: Coinbase integration for Solana token trading News Source

Ecosystem Role: Jupiter functions as infrastructural middleware rather than consumer-facing product. The protocol's APIs power numerous wallets and applications across Solana, creating embedded distribution.

8. Strategic Trajectory & Market Fit

Future Development Vectors

Jupiter Labs: Experimental division focused on AI and privacy technologies Twitter Jupiter Global: Payments infrastructure with QR pay, global fiat rails, and crypto card Twitter Vertical Integration: Expansion into stablecoins, lending, and analytics creates comprehensive DeFi suite

Market Fit Assessment: Jupiter addresses critical Solana infrastructure needs:

Solves liquidity fragmentation through sophisticated aggregation

Reduces execution complexity for both retail and institutional users

Provides reliable execution quality despite network congestion

The protocol's expansion into adjacent financial primitives demonstrates understanding of ecosystem needs beyond pure trading.

9. Investment Assessment

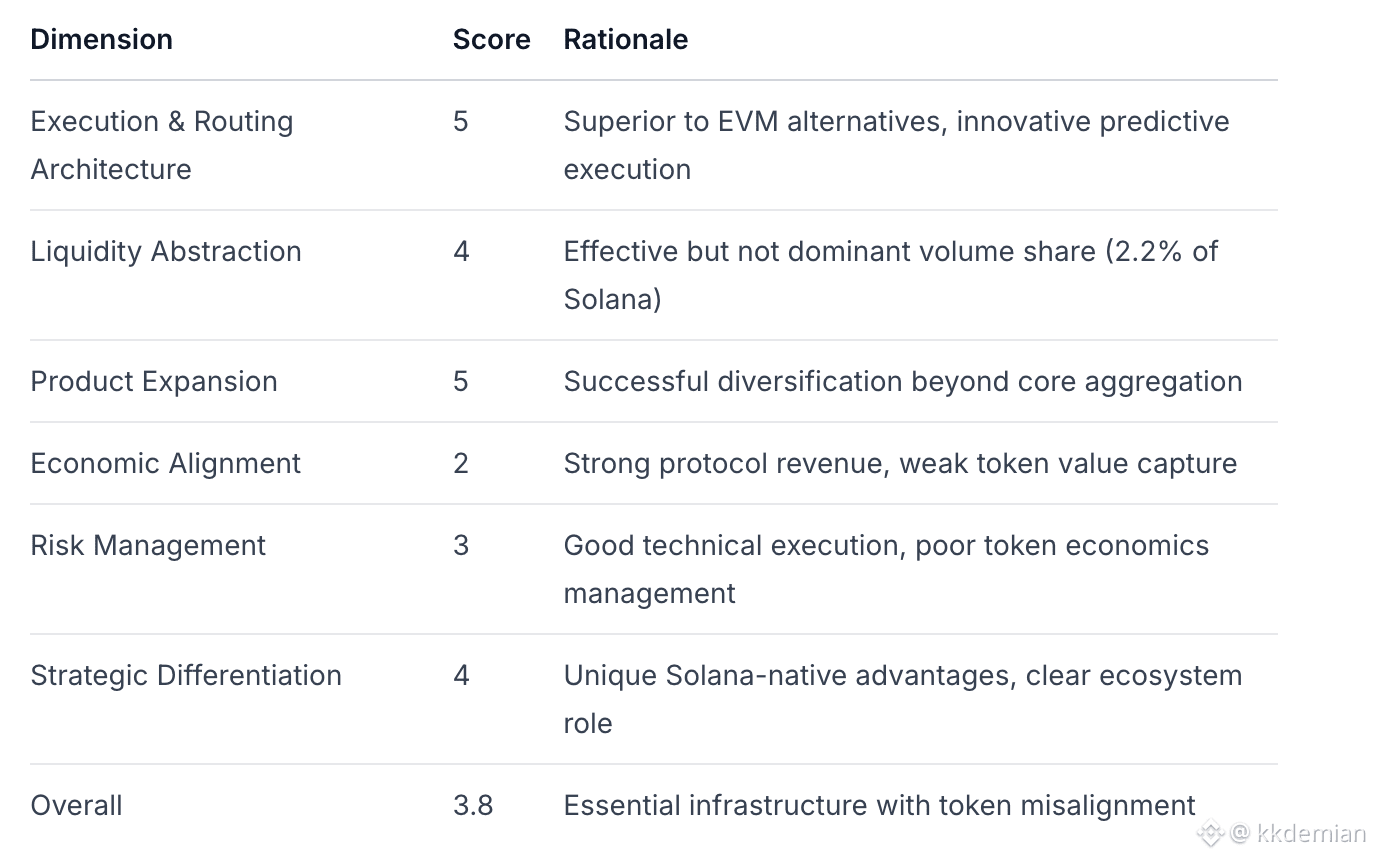

Dimension Scoring (1-5 Scale)

Comparative Analysis

Final Verdict

Jupiter represents essential Solana infrastructure with sophisticated execution capabilities and strategic positioning. The protocol's $1.11B annual revenue demonstrates product-market fit and ecosystem importance. However, JUP token suffers from structural misalignment - despite robust protocol economics, only 6.3% of revenue reaches token holders through ineffective buybacks.

Investment Recommendation:

Infrastructure Investment: WARRANTED - Jupiter is critical Solana middleware

Token Investment: NOT WARRANTED - Poor value accrual mechanics and unlock overhang

Integration: HIGHLY RECOMMENDED - Best-in-class execution for Solana applications

The protocol deserves monitoring for improved tokenomics, but current structure favors infrastructure usage over token investment. Jupiter's fundamental strength as execution layer makes it indispensable Solana infrastructure, but token investors should wait for better value accrual mechanisms.

Data Limitations: This analysis is based on data available through January 30, 2026. Specific congestion performance metrics during Solana network stress were unavailable. DAO treasury control mechanisms require further documentation review.