The first time I looked closely at Plasma, I expected the usual performance story. Faster blocks. Bigger throughput numbers. Some claim about being “good enough” for payments. What struck me instead was how little Plasma seemed to care about records. No chest-thumping about peak TPS. No obsession with momentary benchmarks. Just a quiet insistence on behaving the same way, every time.

That felt odd in a market that still rewards screenshots of speed tests.

Most chains talk about speed as if it were a finish line. Hit a number, declare victory, move on. But speed in production systems has a texture to it. It is not the maximum you can hit once. It is what you can hold, hour after hour, when traffic is uneven and incentives are real. The difference sounds small. Underneath, it changes everything.

Fast enough is usually where the trouble starts. When a network can process ten thousand transactions per second in ideal conditions, that sounds impressive. But what happens when usage doubles unexpectedly. Or when validators begin optimizing for yield rather than uptime. Or when fee markets spike because demand arrives unevenly. Early signs across the market suggest this is where user trust erodes, quietly.

Plasma seems designed around that failure mode. On the surface, the system advertises predictable confirmation times and stable fees for stablecoin transfers. Zero-fee USD transfers are not a marketing trick here. They are a constraint. Removing fees removes a whole class of incentive games that show up during congestion. What remains is pressure on consistency.

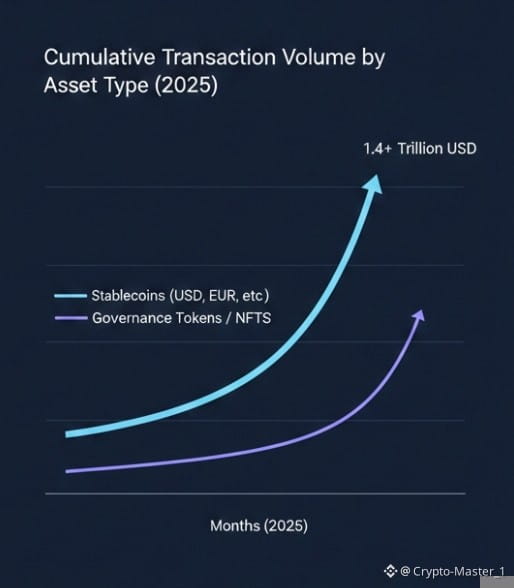

Underneath, Plasma runs a two-layer execution model that separates stablecoin flows from more speculative activity. Translated into plain language, this means the network does not ask payroll payments to compete with trading spikes. In January 2026, when stablecoin transfer volumes across major chains exceeded $1.4 trillion for the month, most of that flow was repetitive. Same amounts. Same destinations. Same timing. Businesses paying salaries. Platforms settling merchants. Remittances moving on schedule.

Those transactions do not need drama. They need sameness.

Plasma’s architecture leans into that reality. Validators are rewarded for uptime and steady block production rather than opportunistic behavior. That changes validator economics in subtle ways. Instead of chasing volatility, operators are incentivized to minimize variance. Over time, that produces a network that feels boring in the best sense.

Critics will argue that this sacrifices flexibility. They are not wrong. Designing for consistency narrows the design space. You give up the ability to chase short-term usage spikes or to monetize congestion aggressively. But that tradeoff is intentional. Plasma is not trying to extract value from momentary attention. It is trying to become infrastructure.

When I first ran the numbers on fee variance, the difference stood out. On several high-throughput chains, median transaction fees might sit below one cent, but the 95th percentile tells another story. Fees spiking 20x or 50x during periods of stress. For a trader, that is an annoyance. For a payroll system, it is a deal breaker.

Plasma’s zero-fee USD rail eliminates that tail risk entirely for a specific class of transactions. The cost is not hidden. It is paid elsewhere, through protocol design and validator discipline. What you gain is predictability. What you lose is the ability to monetize chaos.

That design choice reveals something deeper about how Plasma views adoption. Many networks still equate adoption with raw throughput metrics. More transactions equals more success. Plasma seems to be measuring something else. Regularity. Repetition. The quiet accumulation of trust.

In payments, trust compounds slowly. A system that works ninety nine times out of a hundred does not feel ninety nine percent reliable. It feels broken. The hundredth failure is the only one users remember. Plasma’s focus on consistency over records is an attempt to remove those moments entirely, or at least push them far enough out that users stop thinking about the network at all.

Meanwhile, the market around it is shifting. In 2025, over 90 percent of on-chain transaction volume by value was denominated in stablecoins. Not governance tokens. Not NFTs. Dollars. Euros. Units that people already understand. That shift changes what matters. Speed still matters, but variance matters more.

There is also a regulatory texture here. Stablecoin issuers and payment partners do not want surprises. A chain that behaves differently under stress creates compliance risk. Plasma’s design aligns with that reality. It is not chasing permissionless experimentation at the edge. It is building a foundation that institutions can reason about.

This does not mean Plasma is without risk. Consistency depends on validator behavior holding up over time. It depends on governance resisting pressure to reintroduce fees when volume grows. It depends on the assumption that most stablecoin usage will remain repetitive and low variance. If usage patterns shift dramatically, the design will be tested.

There is also the question of opportunity cost. Chains that monetize volatility can grow treasuries faster. Plasma is choosing a slower path. Whether that patience is rewarded remains to be seen.

But stepping back, this approach fits a broader pattern emerging across infrastructure. The early internet chased bandwidth records. What won was reliability. Cloud computing did not succeed by being the fastest once. It succeeded by being boring every day. Crypto is slowly relearning that lesson.

What Plasma seems to understand is that performance without consistency is not infrastructure. It is a demo. The hidden cost of fast enough is the erosion of trust that follows unpredictability. And trust, once lost, does not come back with a benchmark.

The quiet systems are the ones that last.