2018

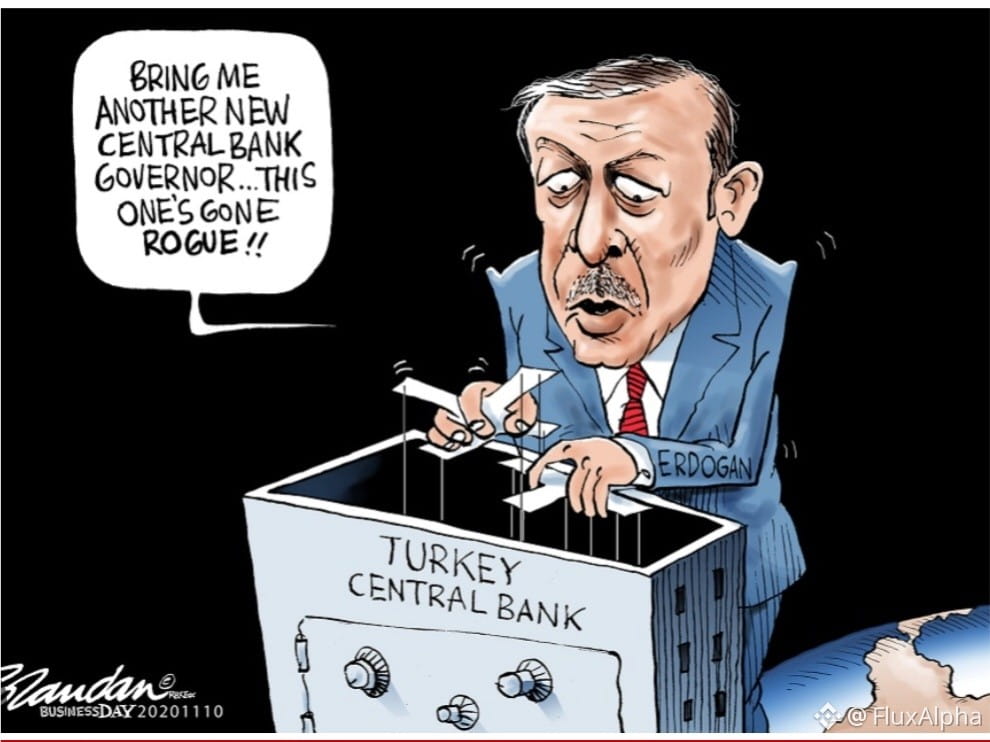

Turkey’s economy became fragile due to excessive current account deficits and high foreign currency debt. President Erdoğan’s unusual remarks on interest rates, claiming “don’t worry, interest is not the cause but the result,” were met with skepticism and humor by markets—but the crisis was real. The 2018 currency crisis hit hard, destabilizing the economy. The shift to a centralized presidential system worsened decision-making bottlenecks, increasing economic vulnerability.

Exchange rate approx. 1 USD = 3.5 TRY. Inflation peaked around 20.3%.

2019

Efforts to recover continued, but uncertainty remained high. Lack of transparency in official data resembled a new season of “smoke and mirrors.” The centralized governance of the Presidential System limited policy diversity and balance, making the economy riskier under a single voice rule.

Exchange rate approx. 1 USD = 5.7 TRY. Inflation slowed slightly to about 11.8%.

2020

Berat Albayrak’s “we have reserves but won’t show them” attitude raised doubts among the public. The COVID-19 pandemic turned the economy into a tragicomic scene. The presidential system’s reduced checks and transparency deepened the impact of crises.

Exchange rate approx. 1 USD = 7.0 TRY. Inflation rose again to about 14.6%.

2021

Lütfi Elvan served under tough conditions but resigned on December 2, unable to change the political game. Nureddin Nebati succeeded him, persistently promoting Erdoğan’s low-interest policy. Nebati’s phrase “interest is the cause, inflation is the result” amused economists but frustrated the public. The presidential system’s suppression of dissenting economic views made it easier to insist on flawed policies.

Exchange rate approx. 1 USD = 13.5 TRY. Inflation surged to 36.1%.

2022

Inflation soared to 72.3%. Nebati’s stubborn commitment to low rates deepened the crisis. Citizens’ purchasing power eroded as prices skyrocketed. The centralized presidential system attempted control over the economy, ignoring market dynamics.

Exchange rate approx. 1 USD = 18.5 TRY.

2023

The Exchange Rate Protected Deposit (KKM) scheme was introduced as a temporary fix, masking deeper issues. Mehmet Şimşek became Minister of Treasury and Finance; tax burdens on citizens increased while large corporations enjoyed tax cuts and incentives. The message was clear: “Tax fairness is a luxury we don’t afford.” Economic decisions in the presidential system favored narrow interests, excluding wider society.

Exchange rate approx. 1 USD = 27 TRY. Inflation remained high around 50%.

2024

Inflation hovered around 58.5%. Economic growth stagnated. Doubts about TÜİK’s independence grew as it appeared to be part of Erdoğan and Şimşek’s “controlled economy” narrative. Wealth accumulated among the rich while low-income groups lost ground. Lack of accountability in the presidential system worsened policy failures.

Exchange rate approx. 1 USD = 32 TRY.

2025

Official inflation was reported at 30.9%, while independent ENAG data indicated 56.1%. As citizens’ money lost value, generous tax breaks and incentives were handed to the wealthy. Income inequality deepened and social injustice peaked. TÜİK’s skill in hiding the truth became a widespread rumor. The presidential system disabled accountability mechanisms, facilitating manipulation.

Exchange rate approx. 1 USD = 42 TRY.

2026 (Early Forecast)

Inflation may slow slightly but economic hardship remains. Tax burdens and cost of living continue to dominate public concerns. Serious reforms are needed to close income gaps, but a “wait and see” approach prevails. The centralized governance has lost its advantage of quick decision-making; solutions to economic crises are still distant.

Estimated exchange rate approx. 1 USD = 50-55 TRY.

SUMMARY

Turkey’s economy struggles under the centralized presidential system’s lack of democratic checks and balances. Political interference and the “low interest miracle” narratives strain the economy. TÜİK’s independence is mostly nominal, with real data often concealed. Mehmet Şimşek’s tax policies roll out the red carpet for big corporations while ordinary citizens feel the squeeze. The wealth gap widens: the rich get richer, the poor get poorer. This reality poses a serious threat to sustainable growth and social peace. At least the humor around the crisis offers some relief—beyond that, only time will tell.

$USDT #TürkiyeBinancesquare #BinanceSquareFamily #Write2Earn #CryptoAnalysis $BTC $BNB