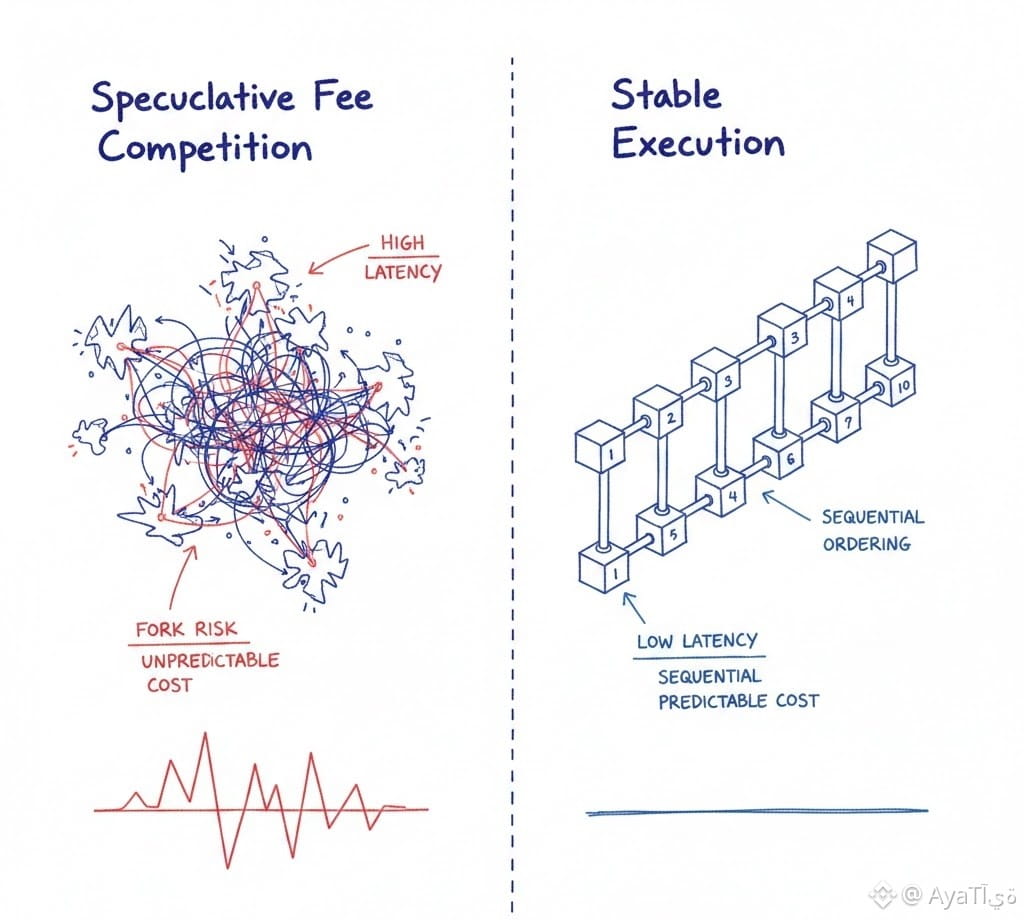

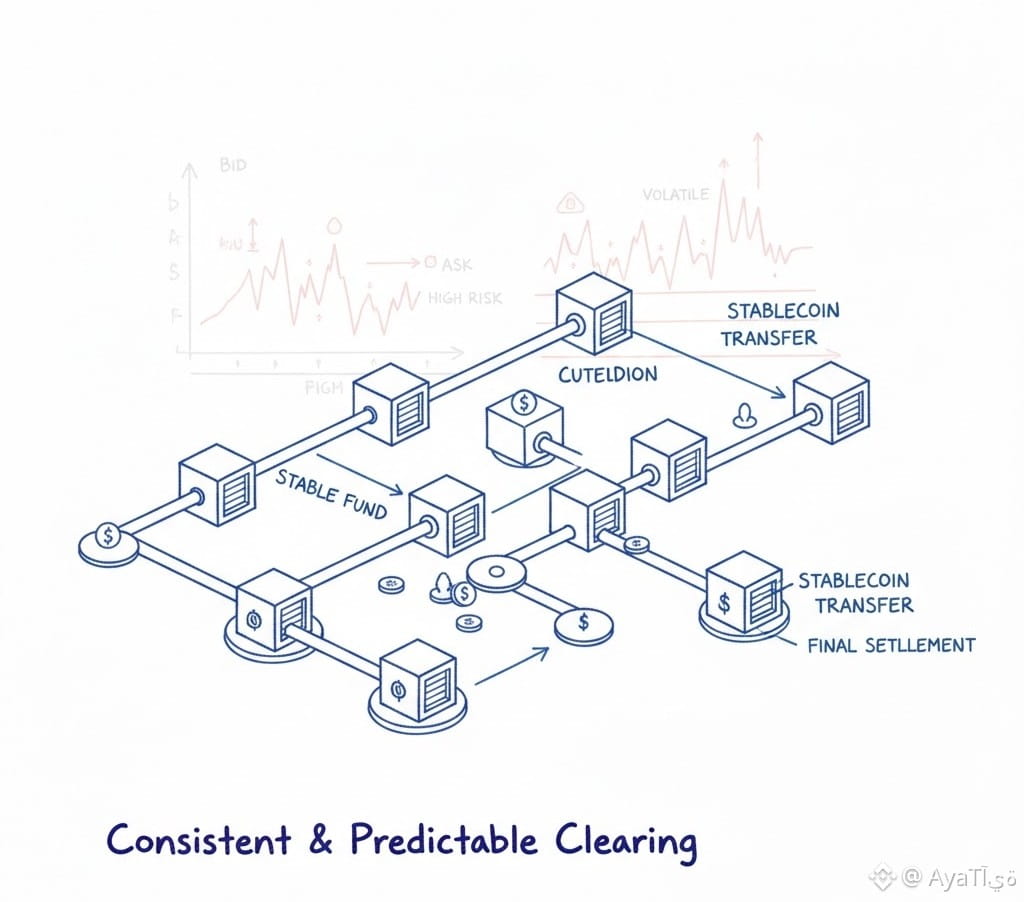

One thing I’ve been thinking about is how @Plasma subtly alters the social behavior of blockspace. In most chains, execution is competitive by design: users bid against each other, congestion becomes a feature, and volatility leaks into every application layer. Plasma’s stablecoin-first execution removes that tension. Blockspace feels less like a marketplace and more like a clearing mechanism.

This changes developer psychology in ways that aren’t obvious at first glance. When costs are predictable, systems get designed for throughput and reliability rather than defensive optimization. You stop building around fee spikes and start building around flows. In that sense, @Plasma resembles payment rails more than programmable commodities.

What’s interesting is how this interacts with Bitcoin-anchored security. The chain’s neutrality doesn’t come from governance narratives, but from the absence of incentives to manipulate execution. When fees don’t surge, there’s less reason to crowd, censor, or extract.

Over time, this model suggests a future where some blockchains are judged not by excitement or activity spikes, but by how quietly and consistently they clear value; much like financial infrastructure that only gets noticed when it fails.