The silver market has recently experienced dramatic price swings, including sharp declines that wiped out hundreds of billions in value. These moves have reignited a familiar question among traders and precious metals investors: Is JPMorgan Chase manipulating silver again, just like it did in the past?

A History of Proven Manipulation

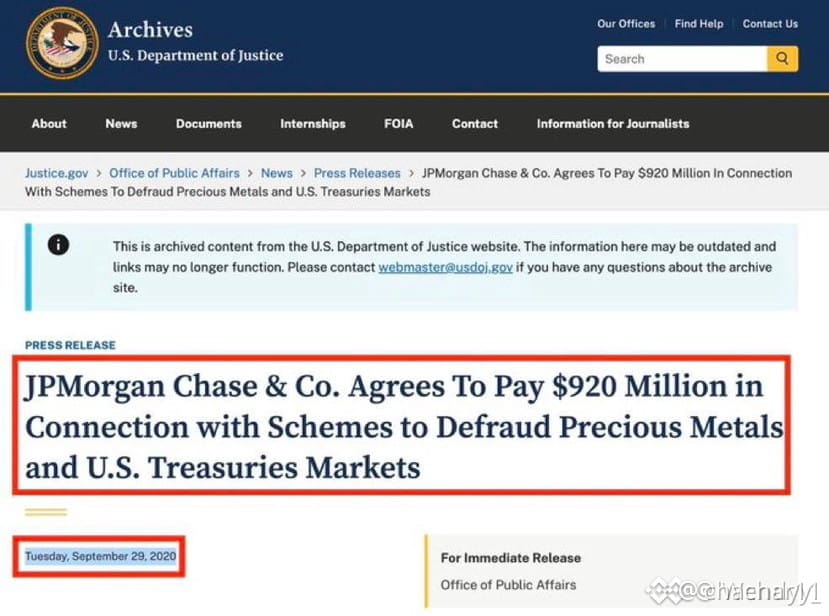

Let’s start with the facts. JPMorgan was legally found to have manipulated precious metals markets in the past, including silver. In a landmark enforcement action in 2020, the U.S. Commodity Futures Trading Commission (CFTC) ordered JPMorgan Chase & Co. to pay $920 million for engaging in spoofing and manipulative trading practices over many years. Spoofing involves placing large, deceptive buy or sell orders with no intention of executing them, to create false price signals and benefit other trades. (CFTC)

This investigation found that, between 2008 and 2016, traders at JPMorgan placed hundreds of thousands of orders designed to mislead the market and profit from artificial price movements — ultimately harming other investors in the futures space. (CFTC)

Why the Silver Market Still Draws Scrutiny

Despite that settlement and JPMorgan’s claims of strengthened compliance, the silver market remains fragile and highly sensitive, especially during periods of volatility. Recent sharp drops in silver prices — including one notable plunge wiping out nearly $600 billion of market value over 24 hours — have sparked fresh accusations on social media and trading forums that large institutions might be exerting undue influence. (Binance)

Critics point out a recurring theme:

Silver often behaves in ways that seem disconnected from fundamentals like industrial demand and physical shortages.

Paper futures prices (traded electronically on exchanges) can move violently even as physical bullion markets in Asia, the Middle East, and elsewhere show much higher premiums. (Reddit)

These patterns fuel speculation that the paper market — dominated by large banks and derivative traders — can overwhelm the physical market and distort price discovery.

What Regulators Say — and Don’t Say

Importantly, no current regulatory enforcement has charged JPMorgan with new manipulation in 2025 or 2026. The legal action that resulted in the $920 million fine was tied to historical activity, and while it highlighted real misconduct, regulators have not publicly confirmed or prosecuted new wrongdoing this year. (AInvest)

Legal scholars and regulators often point out that price volatility and large price swings do not, by themselves, prove manipulation. Markets can move sharply due to technical trading, liquidity shifts, margin changes, or macroeconomic factors. For instance, COMEX inventory levels and derivatives leverage have been cited as structural risks that can amplify price moves without illegal intent. (AInvest)

Is History Repeating Itself?

Here’s the bottom line:

✅ Past manipulation by JPMorgan has been proven and penalized.

❓ Current accusations of manipulation in 2026 are circulating online, but have not been legally confirmed by regulators.

⚠️ Silver market structure — heavy paper derivatives, concentrated holdings, and volatile price behavior — can look like manipulation but may also reflect normal market mechanics gone extreme.

In other words, while JPMorgan once engaged in illegal practices in the silver market, it’s not yet settled that those same practices are happening again today — even though traders and commentators are asking the question loudly.

What Investors Should Know

Understand the difference between legal fact and online speculation. Social media can amplify hypotheses that aren’t grounded in verified evidence.

Market volatility doesn’t always mean manipulation. Sudden moves can result from algorithmic trading, risk off events, liquidity squeeze, or systemic market dynamics.

Follow regulatory updates. If the CFTC or SEC were to launch an enforcement action, it would be a major development that could reshape investor expectations.

For now, the story of silver in 2026 remains part historical lesson, part ongoing debate — a reminder that markets are complex, powerful institutions aren’t always perfectly behaved, and skepticism is healthy but should be tempered with facts.

#SilverMarket

#MarketManipulation

#JPMorgan

#PreciousMetals

#MacroAnalysis