Payments were not a design consideration in most blockchains. Originally made for experimentation, conjecture, and composability, they were only after suited for money transfer. Plasma moves the other way. It starts with a definite presumption: Stablecoins are the most popular way to trade on-chain right now, so the infrastructure should be made better for how people really use them. Plasma presents itself from this angle as a Layer-1 blockchain designed for stablecoin settlement rather than a broad tokens playground.

Built on the Reth client, plasma executes a whole Ethereum-compatible environment so developers would not have to learn new languages or change current smart contracts. This decision is conscious. Plasma connects straight into the tools, wallets, and developer processes currently in use around Ethereum rather than building a fresh ecosystem from scratch. For designers, the familiarity reduces resistance; for developers, it closes the gap between a concept and a live financial product.

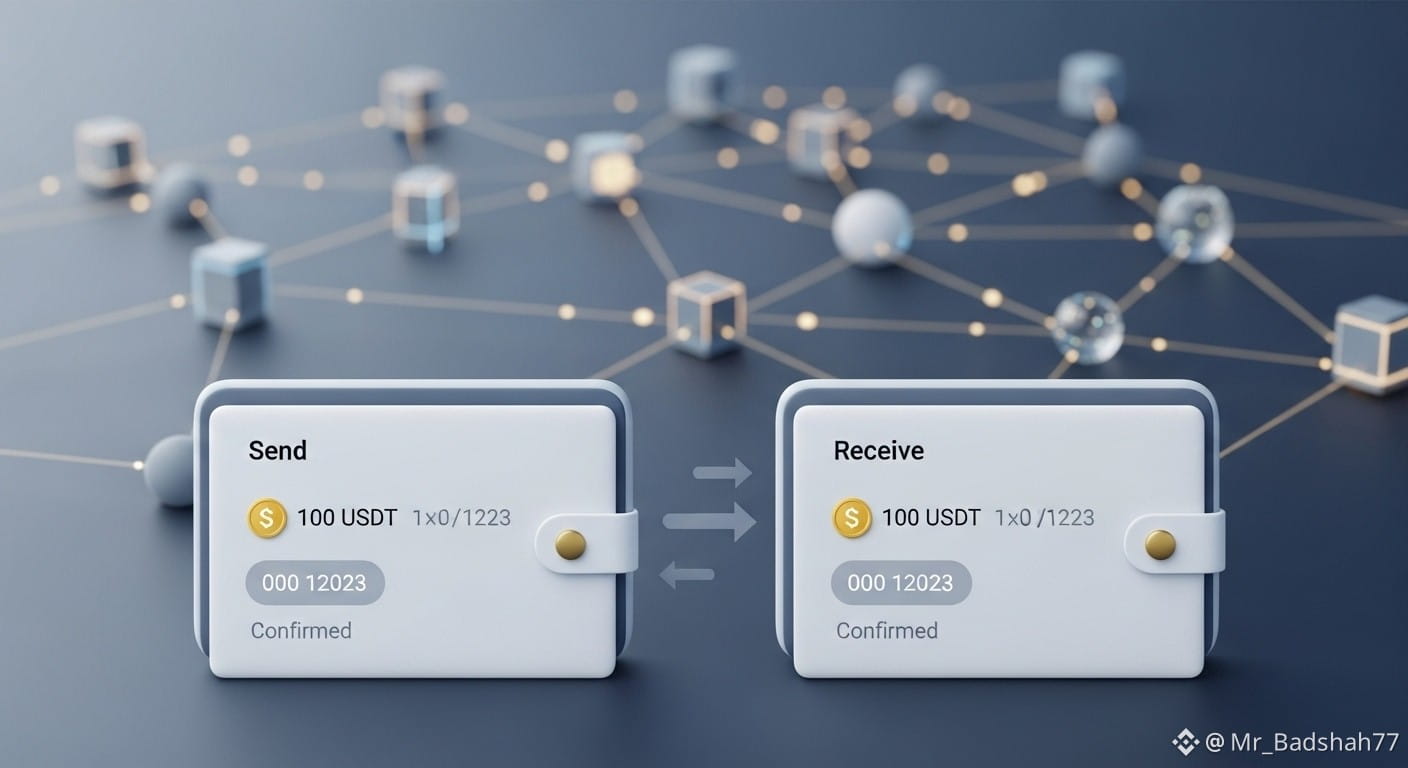

Plasma differs from conventional Layer-1s most obviously in the end. PlasmaBFT, its consensus layer, is made to verify transactions in almost real time with deterministic finality. When it comes to payments, this is more important than simply how much data you can send. Payroll systems, treasuries, and merchants cannot afford to wait for several confirmations or run the risk of reorganization. PlasmaBFT sends a definite signal: once a transaction is completed, it is settled. This reflects the expectations of actual financial systems as opposed to volatile markets.

Throughout the network, stablecoins are regarded as top-notch assets. Gasless transfers let users send stablecoins without owning a native token, therefore eliminating one of the main UX challenges in crypto. Stablecoins can be used to pay fees, therefore enabling consistent and straightforward pricing. This seems normal for users in areas where stablecoins serve as daily currency. It helps institutions to streamline accounting and lower token volatility risk. The blockchain is infrastructure instead of a barrier.

Through Bitcoin anchoring, plasma also underlines neutrality and long-term trust. Plasma draws from the most well-known and tried-and-true blockchain by relating pieces of its settlement guarantees to Bitcoin. The aim is to reinforce trustworthiness and resilience to censorship rather than to change its own agreement. This outside anchor gives institutions and major players more assurance that settlement policies are not subject to arbitrary modification.

The local currency serves as a supplement to, not as the primary focus of, the user experience. It is utilized for governance, staking, and validator incentives to guarantee the network stays safe and financially aligned. But regular users are not compelled to own or administer it only to transfer value. This division between protocol economics and user payments shows a more developed design approach that gives use above publicity.

Plasma is made to be simple to incorporate from a practical point of view. Standard Ethereum RPCs, well-known node operations, and current monitoring systems all find use. Payment apps, wallet developers, and infrastructure providers can implement without changing their whole stack. Often where technically remarkable chains fall short, this lowers operational risk and speeds up real-world acceptance.

Seen through the perspective of world payments, plasma's importance most clearly shows itself. Stablecoins are presently used in many areas for remittances, savings, and commercial transactions. Something that has been lacking is a settlement layer that is both quick, cheap, and reliable enough to go along with this use. Plasma seeks to close that gap by concentrating less on innovation and more on implementation.

There will still be difficulties to overcome. Careful design and continuous monitoring are needed for bridges, validator decentralization, gas sponsorship models, and institutional custodial integrations all. Plasma's long-term performance will rely on how these systems function under actual demand rather than on design pledges. However, it is consistent and based on real market activity as a theory.

Plasma seeks not to change what money is on-chain. It begs a more basic query, then: if the main aim is moving stable value, how ought a blockchain act? Plasma comes out as financial infrastructure instead of experimental experimentation by matching its user experience, economics, and technology around that issue. Plasma is aiming to be the settlement layer that at last seems ready for regular use if stablecoins are the rails of the current crypto economy.