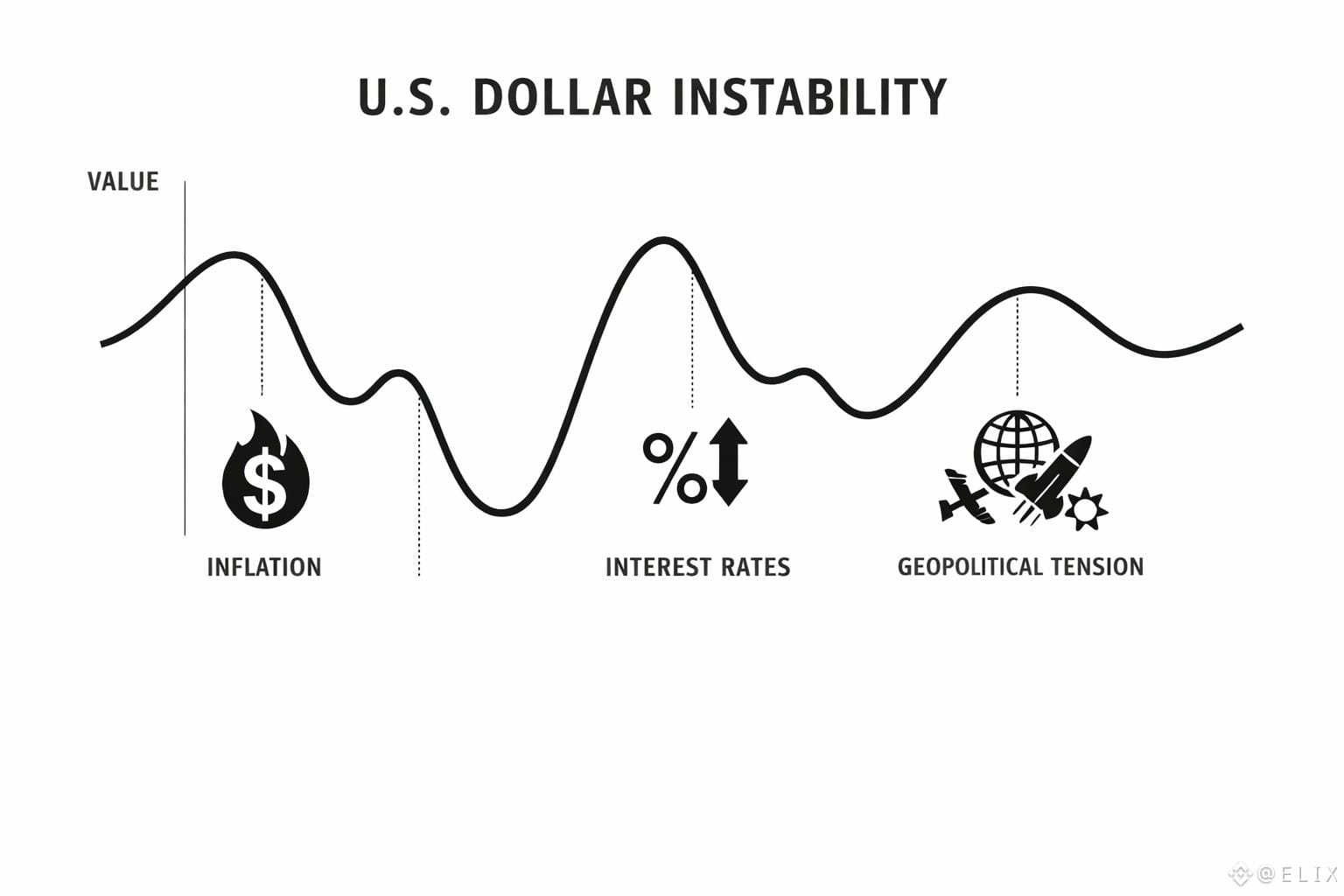

The U.S. dollar has long been regarded as the bedrock of global finance. It is the currency against which international trade is measured, a benchmark for investments, and a symbol of economic stability. Yet, in recent years, even this supposedly unshakable pillar has shown signs of instability. Inflationary pressures, shifting interest rates, and geopolitical tensions have combined to create periods of heightened volatility, shaking confidence in a currency that millions rely on daily. For businesses, traders, and ordinary citizens, this volatility translates into uncertainty, unpredictability, and increased financial risk. While traditional financial systems struggle to adapt to these fluctuations, an emerging technology quietly offers a way to restore stability and predictability in money: Plasma.

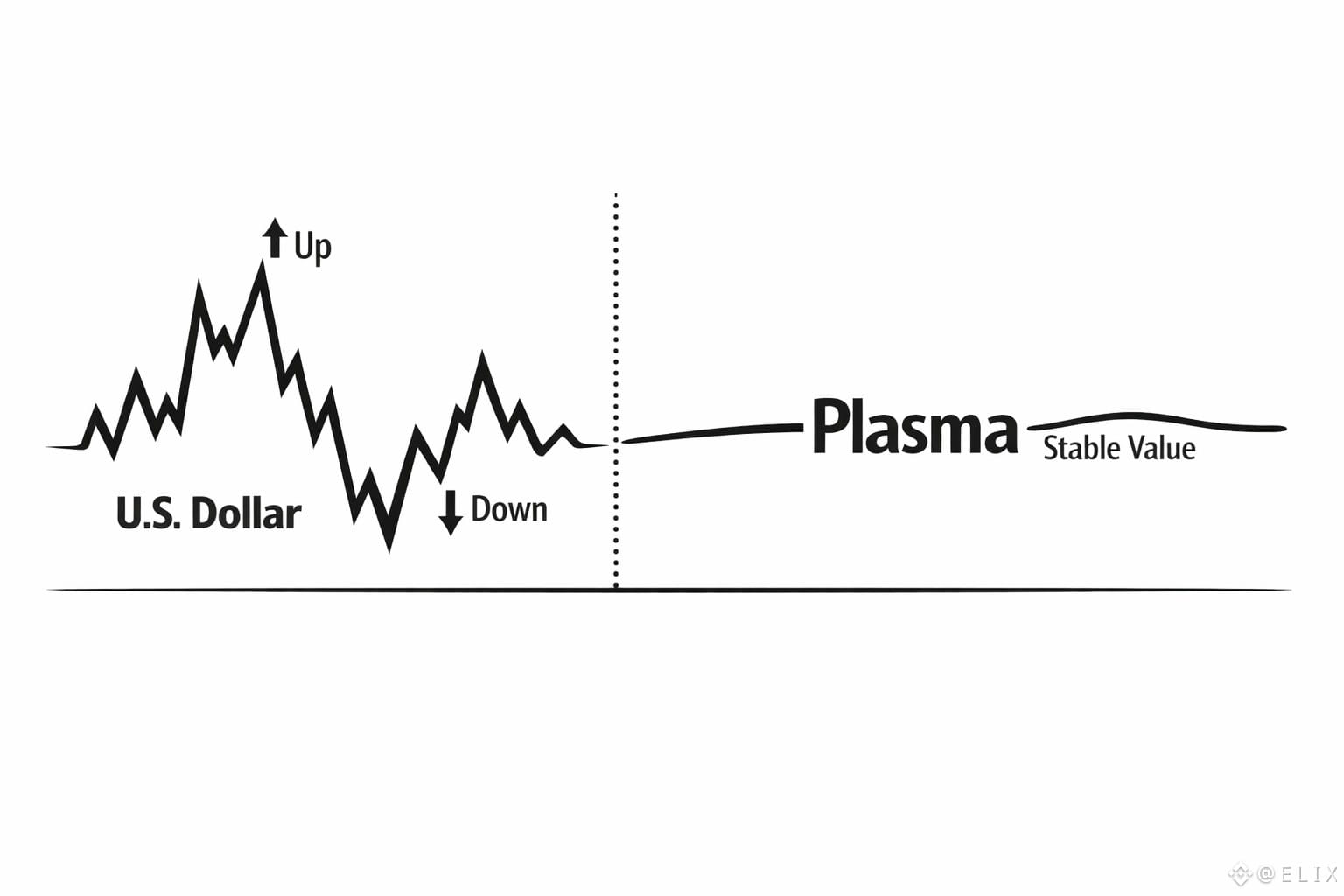

Plasma represents a subtle yet profound shift in the way money is created, moved, and secured. At its core, Plasma is a blockchain-based financial infrastructure designed to combine the reliability of traditional systems with the speed, transparency, and efficiency of modern digital technology. Unlike conventional banking networks, which rely on centralized institutions and multiple intermediaries, Plasma operates on a decentralized architecture that ensures transactions are executed quickly and securely. Its design prioritizes predictable costs, so users are no longer at the mercy of unpredictable fees or sudden shifts in transaction expenses. This level of certainty is crucial in a world where the value of fiat currencies like the dollar can fluctuate dramatically from day to day.

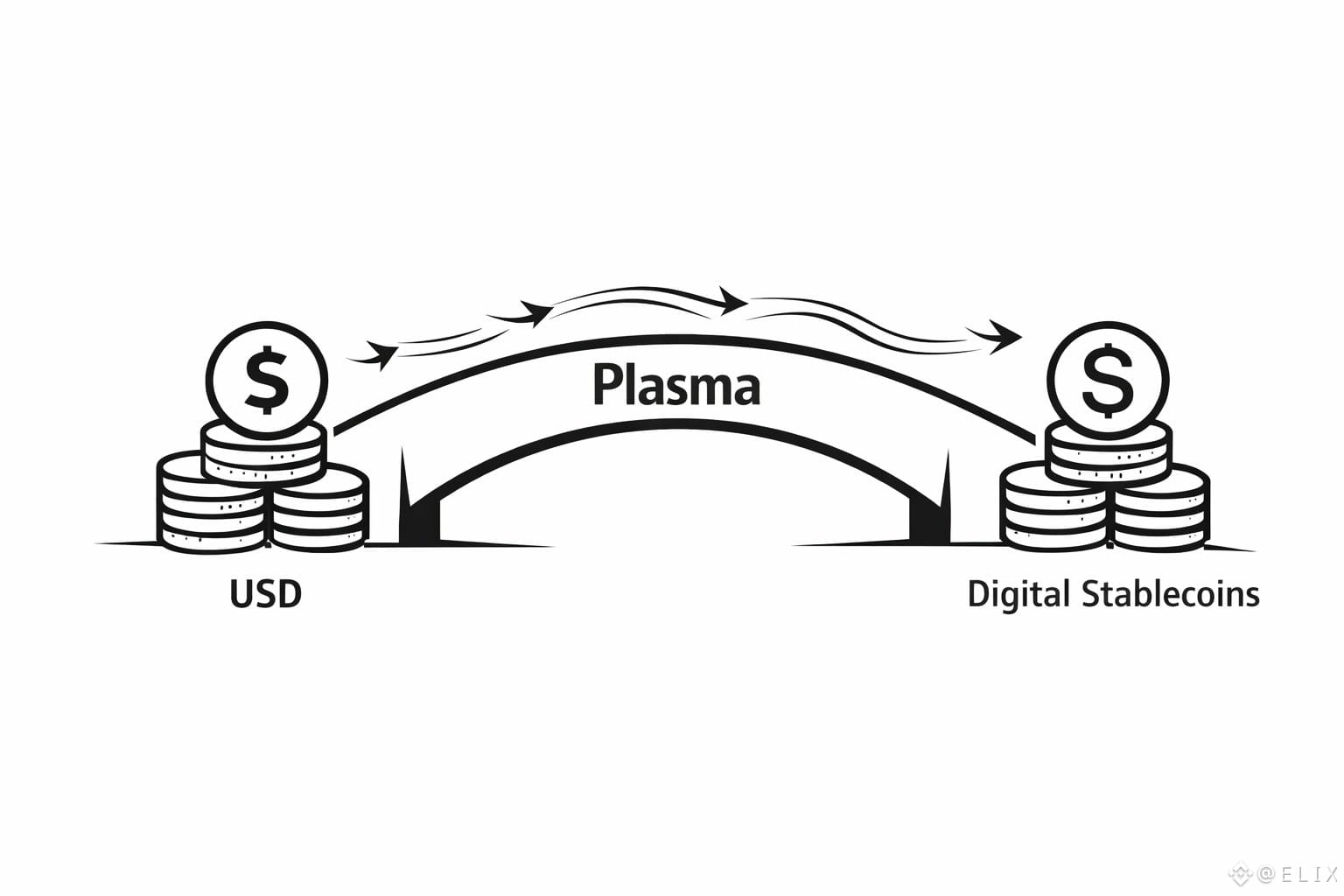

One of Plasma’s key innovations is its integration with stable digital assets. These assets are engineered to maintain a consistent value relative to traditional currencies, providing a bridge between the old and new financial worlds. When the dollar wavers, stablecoins on Plasma’s network can serve as a reliable alternative, allowing businesses and individuals to transact confidently without fear of sudden devaluation. This opens the door for a wide range of applications—from seamless cross-border payments to global e-commerce and financial services that operate 24/7 without interruption.

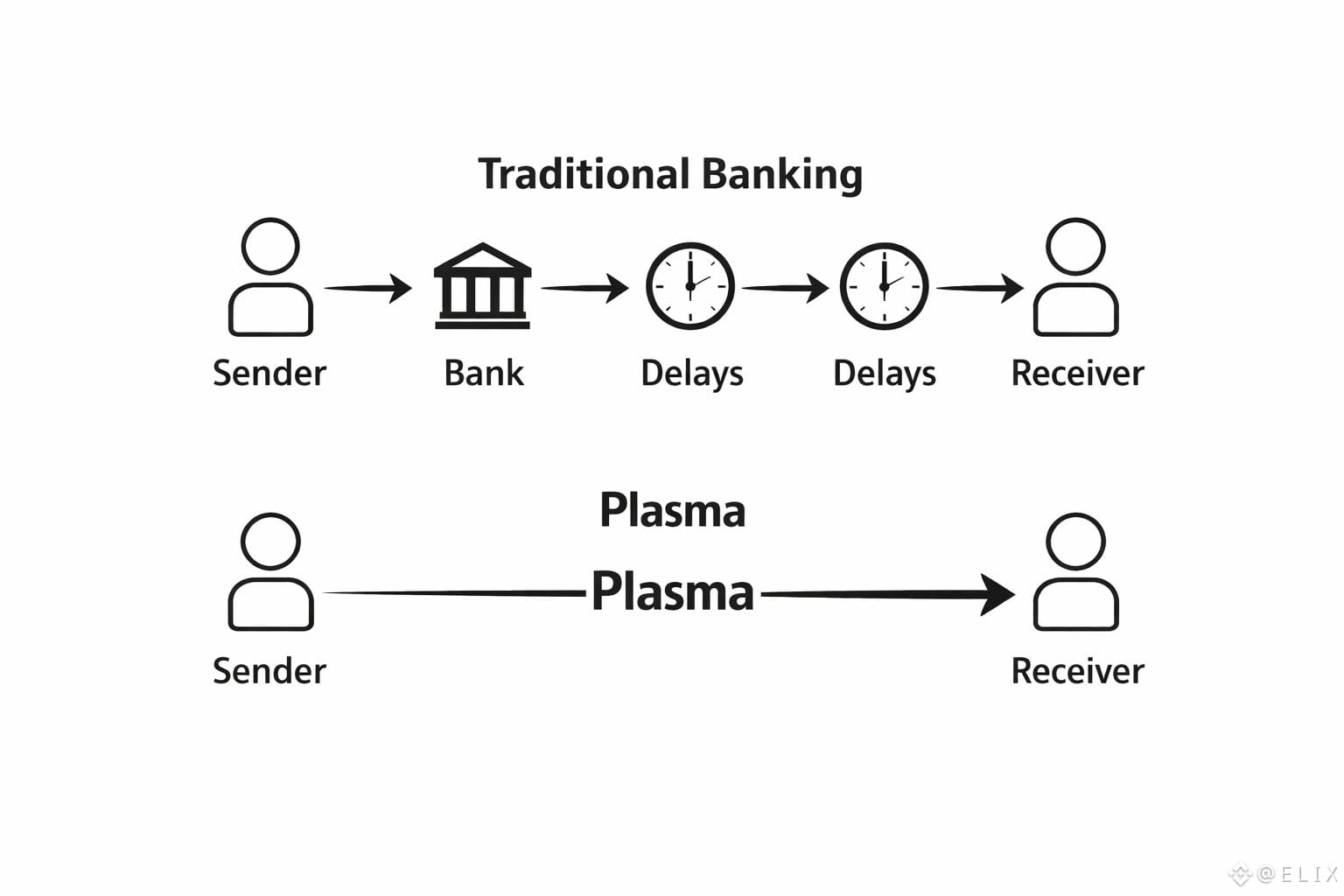

The efficiency of Plasma extends beyond mere transaction speed. By minimizing friction and reducing reliance on intermediaries, it significantly lowers operational costs for businesses and institutions. Traditional financial networks are often plagued by delays, manual reconciliation processes, and hidden fees that make international transfers cumbersome and expensive. Plasma addresses these inefficiencies by creating a network where value moves directly, securely, and instantly. Users experience a system that feels intuitive and reliable, even if the underlying technology is highly complex.

Perhaps the most compelling aspect of Plasma is its quiet nature. Unlike many financial innovations that seek attention through flashy marketing or dramatic claims, Plasma focuses on solving practical problems. It does not aim to replace the dollar outright or create radical disruption overnight. Instead, it strengthens the foundations of financial infrastructure, ensuring that money remains functional, accessible, and stable even when global currencies experience turbulence. By providing a predictable, resilient system, Plasma empowers users to plan, trade, and innovate without constantly worrying about the instability of traditional fiat currencies.

The implications of Plasma’s adoption are far-reaching. For multinational corporations, it can streamline treasury operations, reduce exposure to currency risk, and improve liquidity management. For consumers, it promises faster, cheaper, and more transparent financial services, eliminating the frustration of slow international transfers or fluctuating fees. For the broader financial ecosystem, Plasma represents a path toward modernization without sacrificing reliability—bridging the gap between the speed and innovation of digital assets and the security and trustworthiness of established financial systems.

As the global economy continues to navigate uncertainty, @Plasma quietly demonstrates that the future of money does not have to mirror the instability of fiat currencies. It introduces a system where speed, transparency, and predictability coexist, providing both security and flexibility. While the dollar refuses to sit still, Plasma offers a framework in which value can flow smoothly, securely, and reliably. It is not merely a technological innovation; it is a fundamental evolution in how money operates in a world increasingly defined by volatility and uncertainty. By addressing both the weaknesses of traditional finance and the limitations of existing digital solutions, Plasma is quietly reshaping the financial landscape, ensuring that money can remain both functional and trustworthy, even when the currencies upon which it was once built are anything but stable.