In 2026, Dusk Network feels less like a flashy blockchain chasing hype and more like a carefully constructed foundation for serious finance. While most chains scramble for attention with token launches or influencer hype, Dusk has quietly focused on solving one of the toughest puzzles in crypto: how to handle real-world assets in a way that protects privacy, meets compliance, and still gives you verifiable confidence. The paradox it solves is obvious to anyone who’s ever watched a hedge fund or sovereign wealth manager: you can’t just broadcast your positions or trading strategy to the world, but you also can’t hide everything and expect regulators to nod along. Dusk doesn’t force you to pick one extreme. Instead, it feels like a bank with tinted windows you can keep things private by default, but the right people can always verify what’s happening when they need to. This mindset isn’t a slogan; it’s reflected in every layer of the network, from settlement to governance.

The architecture itself tells the story. Settlement and execution are separated, ensuring that finality and transaction integrity remain untouchable even as developers build applications on top. Dusk offers two lanes for value: Moonlight, for flows that should be visible, and Phoenix, for shielded transfers where confidentiality matters. Both reach the same ledger, which keeps the network coherent and avoids splitting users across different worlds whenever privacy is needed. This dual-lane design shows why Dusk keeps talking about security tokens and regulated assets instead of just private payments: it’s not about flashy demos, it’s about making privacy compatible with real-world issuance, ownership rules, and asset lifecycles, exactly where most tokenization projects falter when they leave the sandbox.

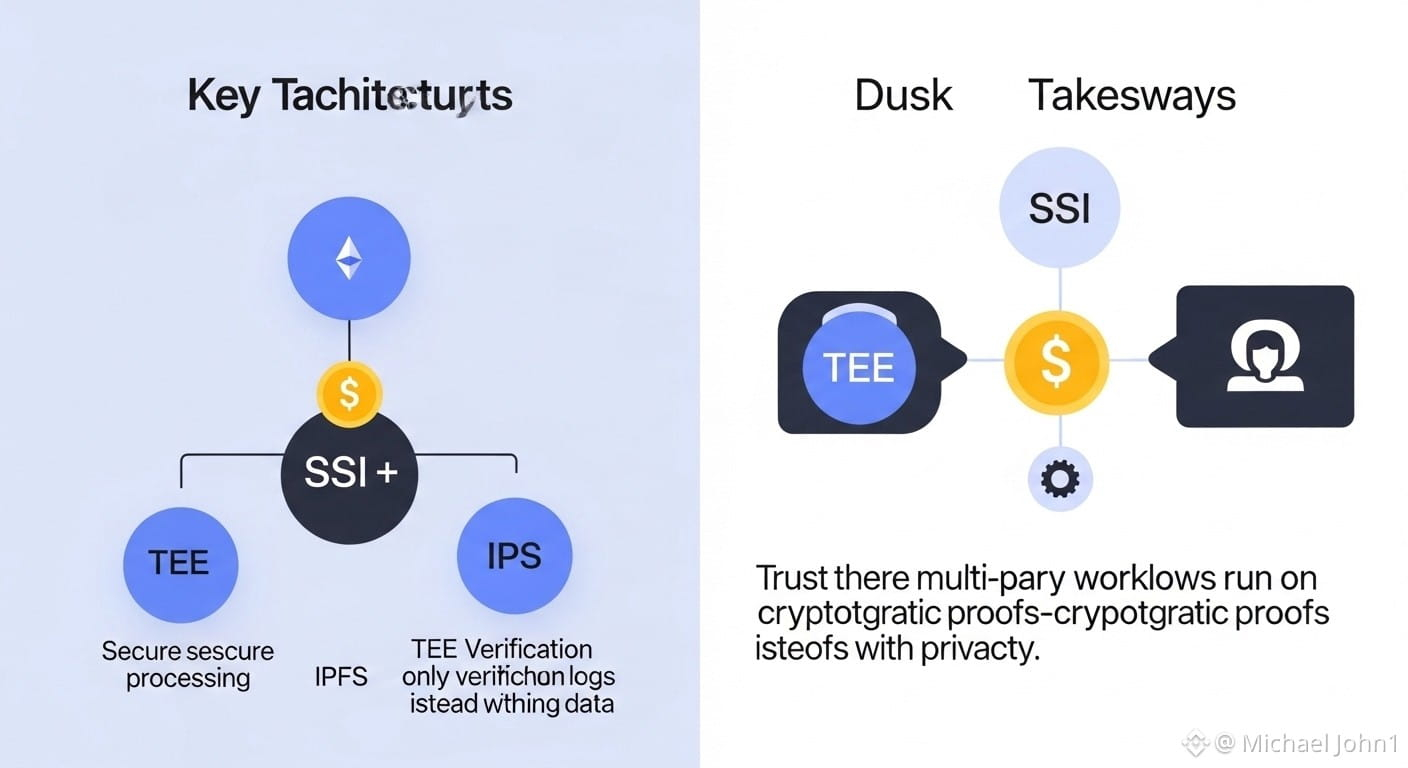

Underpinning it all is the PIE Virtual Machine. Unlike Ethereum, which exposes contract data, PIE verifies transactions through zero-knowledge proofs, never revealing identities, amounts, or balances. Optimized PLONK circuits let institutions run complex compliance operations without sacrificing user privacy or experience. The Phoenix model decouples privacy from smart contract logic, while Citadel enables decentralized, sovereign identity. Your personal data never leaves your device; what the network sees are encrypted compliance labels, proving KYC and AML compliance without exposing sensitive details. This combination lets Dusk handle institutional-scale assets while keeping regulators and security teams happy.

Finality is baked into the consensus too. Dusk’s Succinct Attestation ensures transactions are not just fast but irreversible, which matters when millions or billions are at stake. Settlement is deterministic, predictable, and auditable, so no compliance officer wakes up to find a million-dollar trade rolled back minutes later. Meanwhile, committee refresh cycles maintain diversity without erasing institutional memory, keeping the network resistant to capture but still benefiting from accumulated expertise.

The “boring” infrastructure is what actually matters. Node software, wallet tooling, staking mechanics, and fee models all reflect real operational thinking. Over 200 million DUSK are actively staked by more than 200 provisioners, and the token plays an operational role beyond speculation. Early transaction stats show that privacy and public rails are both used, even if volumes aren’t headline-grabbing. That’s meaningful because real adoption isn’t measured in clicks or hype; it’s measured in processes that institutions can trust to run day after day.

Bridges and interoperability are treated with the same discipline. Expanding access increases risk, but when issues arise, the team pauses, investigates, communicates, and reinforces before resuming. DuskEVM and the Hedger privacy engine let developers work with familiar Ethereum tooling while inheriting native privacy and settlement guarantees. Unlike other chains, Dusk doesn’t force you to relearn the universe. It balances privacy, compliance, and programmability in a way that Ethereum, Polymesh, Mina, Secret Network, and Solana do not. Ethereum is transparent but privacy-limited, Polymesh is semi-centralized, Mina focuses on lightweight decentralization, Secret relies on potentially vulnerable hardware, and Solana prioritizes speed over confidentiality. Dusk marries cryptographic security, decentralization, and regulatory alignment, creating a moat around institutional adoption.

Ultimately, Dusk’s appeal isn’t hype or viral marketing; it’s consistency. Privacy is native, finality is guaranteed, compliance is embedded, and developers don’t have to reinvent every contract. Dual transaction lanes, the PIE virtual machine, Phoenix, Citadel, and Succinct Attestation converge into a single principle: financial systems can run on a public chain without compromising confidentiality or legal obligations. In 2026, Dusk isn’t just another privacy blockchain. It is quietly positioning itself as the backbone for regulated asset tokenization, bridging the gap between crypto innovation and institutional standards, showing that blockchain can be rigorous, efficient, and legally compliant all at once.