Financial infrastructure rarely fails in dramatic ways. More often, it erodes slowly under pressures it was never designed to handle. By 2026, blockchain has reached that stage of maturity where its early assumptions are no longer enough. Public ledgers proved they could move value globally, but they also exposed a hard truth: in finance, uncontrolled transparency is not neutral. It changes behavior, distorts markets, and creates risks that regulated institutions simply cannot accept. At the same time, closed and opaque systems fail modern regulatory standards. Between these two realities, Dusk Network has emerged as a deliberate response rather than a reaction.

Dusk was never built to win attention in open markets or compete on raw transaction speed. It was built around a more uncomfortable question: how can regulated financial activity exist on-chain without destroying confidentiality, compliance, or predictability? The network’s architecture reflects a deep understanding of how financial systems actually function. Institutions survive on controlled disclosure, clear settlement, and legal certainty. Dusk does not try to change that reality. It encodes it.

At the core of the network is the idea that privacy and compliance are not opposites. They are complementary requirements. Dusk enables this through a dual transaction environment that allows different types of financial activity to coexist without friction. Confidential transactions can occur without exposing balances, counterparties, or intent, while public interactions remain visible where transparency is necessary. Both paths settle on the same base layer, under the same consensus, with the same finality guarantees. This is not fragmentation. It is intentional design that mirrors how real financial systems separate sensitive operations from public reporting.

This structure is reinforced by Dusk’s separation of execution from settlement. Smart contracts, trading logic, and application behavior can evolve without introducing uncertainty into final settlement. For institutions, this distinction matters more than headline performance metrics. Knowing exactly when a transaction is final, with no probabilistic rollback risk, is fundamental to risk management. Dusk’s deterministic finality aligns closely with how traditional markets think about settlement and reconciliation.

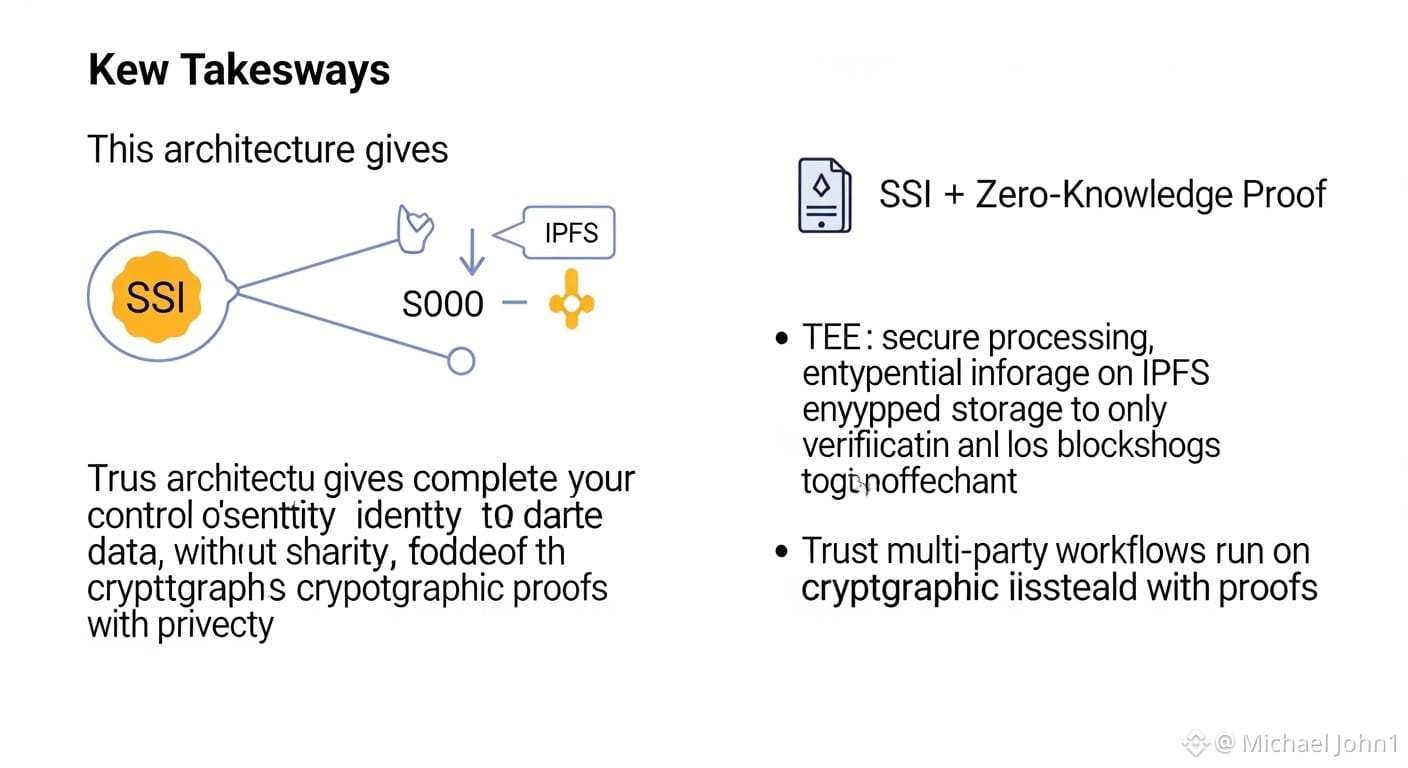

Privacy on Dusk is not achieved through trust in intermediaries or off-chain agreements. It is enforced cryptographically. The network’s native execution environment is designed for zero-knowledge computation, allowing contracts to operate on private state while still proving correctness to the network. This enables selective disclosure rather than blanket transparency. Developers can define precisely what is revealed, to whom, and under what conditions. In practice, this means institutions can deploy real-world asset logic, settlement workflows, and financial instruments without broadcasting sensitive internal data to the market.

Trading activity benefits particularly from this approach. Dusk’s confidential transaction model prevents order flow, balances, and strategic intent from leaking into the public domain. In traditional finance, this level of discretion is assumed. On most public blockchains, it is impossible. By restoring this property on-chain, Dusk removes one of the largest barriers preventing institutional participation.

Compliance is handled with equal care. Rather than centralizing identity data or relying on custodial gatekeepers, Dusk enables participants to prove regulatory eligibility using zero-knowledge proofs. Users can demonstrate that they meet KYC, AML, or jurisdictional requirements without revealing personal or corporate identities. This reduces systemic data risk for institutions while giving regulators verifiable assurances. Compliance becomes a cryptographic guarantee rather than a data collection exercise.

Dusk’s support for confidential EVM execution further reflects its pragmatic approach. Financial developers do not want to abandon existing tools and frameworks. By enabling privacy-preserving execution for familiar smart contract environments, Dusk lowers the cost of migration without compromising its core design principles. This balance between innovation and compatibility makes adoption practical rather than aspirational.

Underpinning all of this is a consensus mechanism designed for stability. Validator committees operate with predictable rotation cycles, reducing collusion risk while maintaining operational continuity. This predictability builds institutional confidence over time. Systems behave as expected, even under stress. In regulated finance, this consistency matters far more than novelty.

Equally important is the infrastructure work that rarely draws attention. Dusk places emphasis on stable node software, conservative bridge design, clear APIs, and understandable staking economics. These elements do not generate hype, but they are exactly what institutions audit before deploying capital. By 2026, Dusk’s focus on this unglamorous foundation work has become one of its strongest signals of seriousness.

When compared to other blockchain networks, Dusk occupies a narrow but powerful position. Some platforms offer programmability without privacy. Others emphasize compliance but limit flexibility. Some deliver advanced cryptography but struggle with real-world usability. Dusk integrates privacy, compliance, programmability, and finality into a single coherent system. None of these properties exist as afterthoughts. They are embedded at the protocol level.

Institutions do not avoid public blockchains because they fear decentralization. They avoid them because unmanaged exposure creates strategic, regulatory, and reputational risk. Dusk reduces that risk without reverting to centralized control. It provides a way for real-world assets to move on-chain while retaining the protections that have governed financial markets for decades.

Looking forward, Dusk’s role is unlikely to be loud or promotional. It is not built to dominate retail narratives or chase speculative cycles. It is built to be dependable. A network where privacy is native but accountability remains intact. Where settlement is final, compliance is seamless, and behavior is predictable. In a blockchain landscape increasingly shaped by regulation and real economic activity, that kind of quiet reliability is rare. By 2026 and beyond, it may also be exactly what allows Dusk Network to endure as a foundational layer for regulated finance.