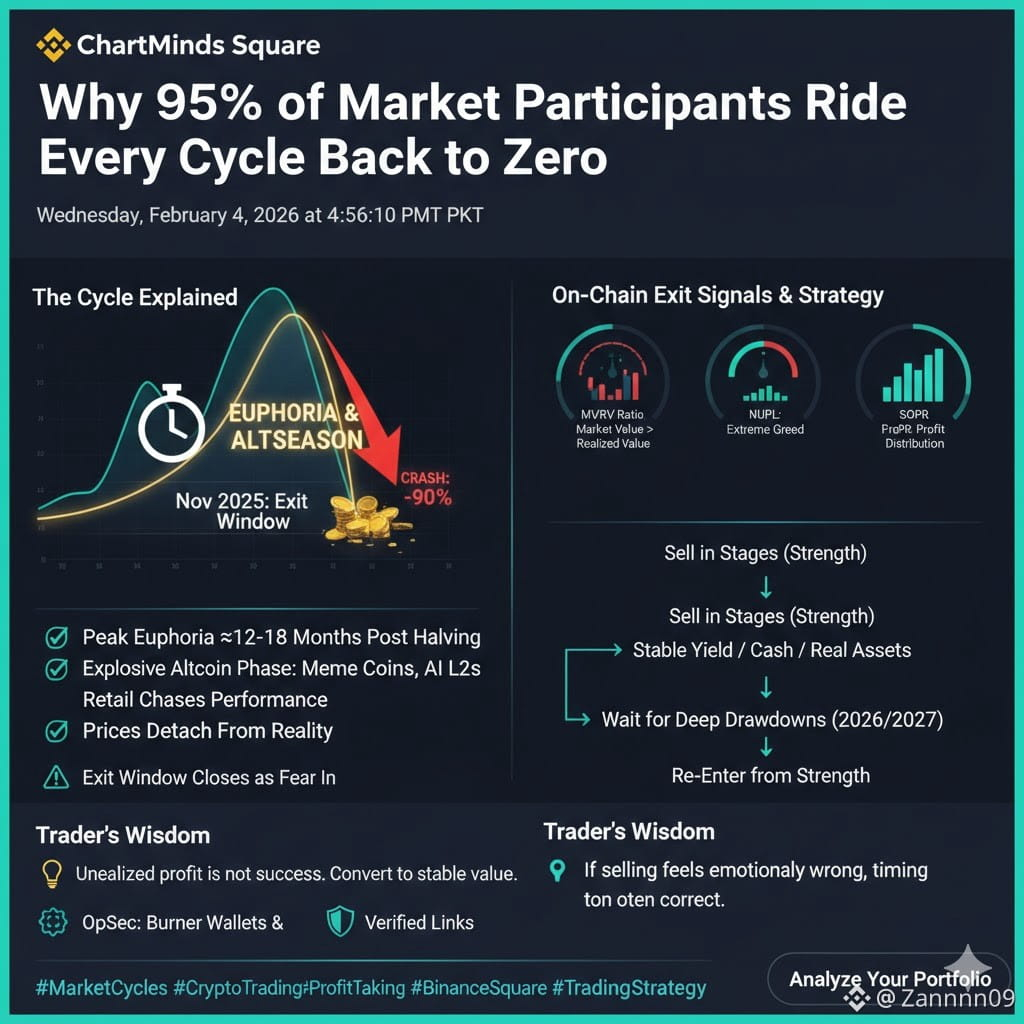

Most participants hold through the crash, watch profits vanish, and let portfolios implode. I’m not here for that.

📅 Exit Window: November 2025

Not prediction — understanding cycles matters. Bull markets peak 12–18 months after Bitcoin halving, driven by confidence, not caution.

💥 Altcoin Madness = Final Phase

• Meme coins, L2s, AI tokens explode 📈

• Retail chases momentum, detaching from reality

• Post-peak: 90–99% losses, liquidity dries, teams vanish

📊 Signals I Watch:

MVRV — Price vs aggregate cost basis

Net Unrealized P/L — How much market is sitting on gains

Spent Output Profit Ratio — Coins being sold at profit

When all align → I reduce exposure, systematically.

💡 Exit Discipline:

• Take profit like income, not speculation

• Sell in stages during strength, not panic

• Rotate capital into stable yield, cash, real assets

• Cold wallets = long-term wealth; Hot wallets = experimentation

⚠️ Late-Cycle Risks:

• Scams, fake launches, malicious airdrops

• Liquidity disappears in microcaps

• Optimism feels safe — that’s when tops form

🧠 Takeaway:

Exiting is discipline, not prediction.

Most lose chasing one more green candle.

Real wealth = realized gains, timing, and patience.

💎 This cycle: I exit properly and wait for asymmetric opportunities in the next bear market.

#CryptoCycles #bitcoin #Altcoins #BinanceSquare #RiskManagement #CryptoDiscipline