📌 Although I firmly believe Bitcoin will reach $1M per BTC, I still decided to take profits on a significant portion of my Bitcoin holdings around the $100,000 mark.

📌 It’s not that I could predict today’s correction, but rather thanks to experience, disciplined risk management, and capital preservation strategies.

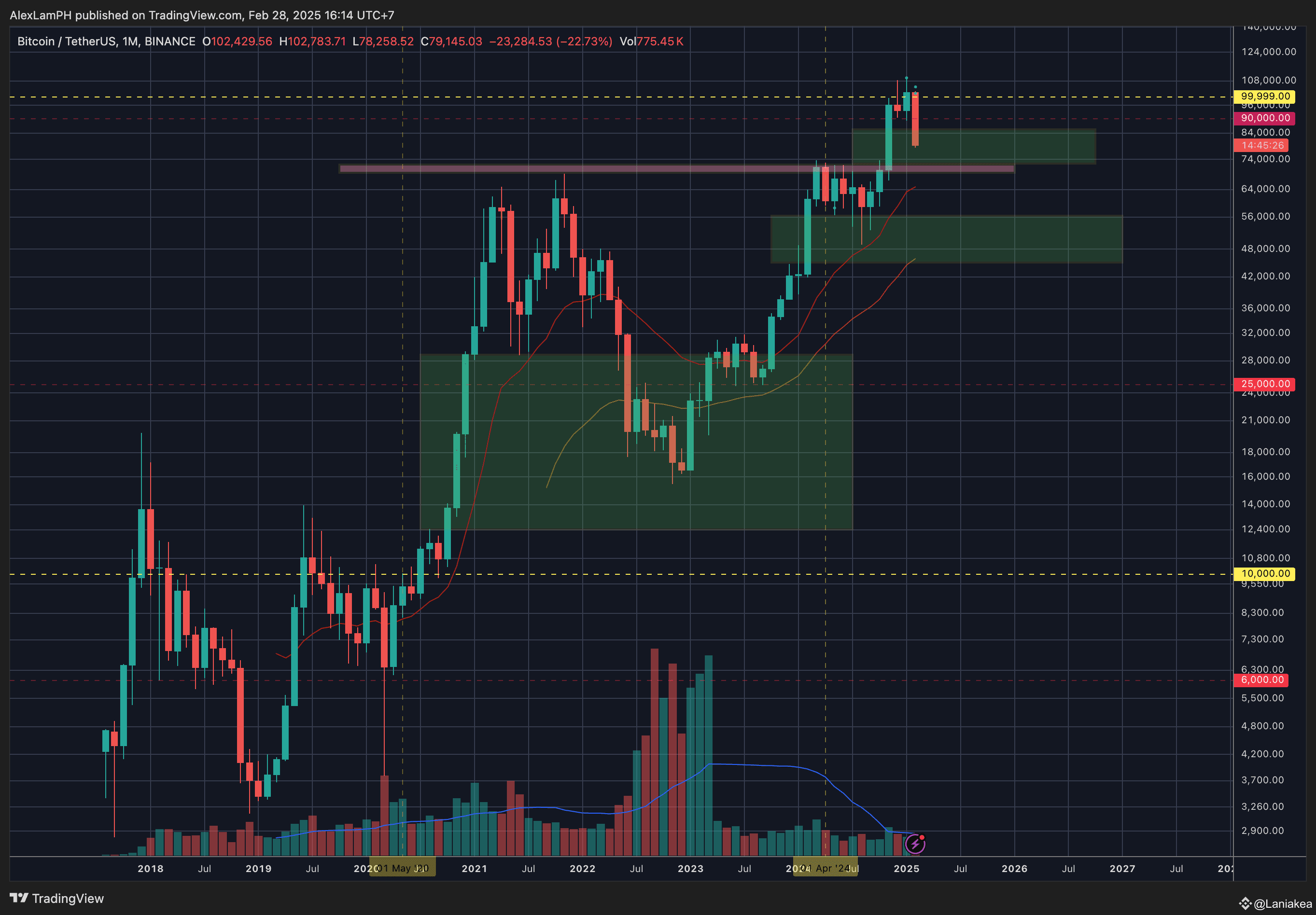

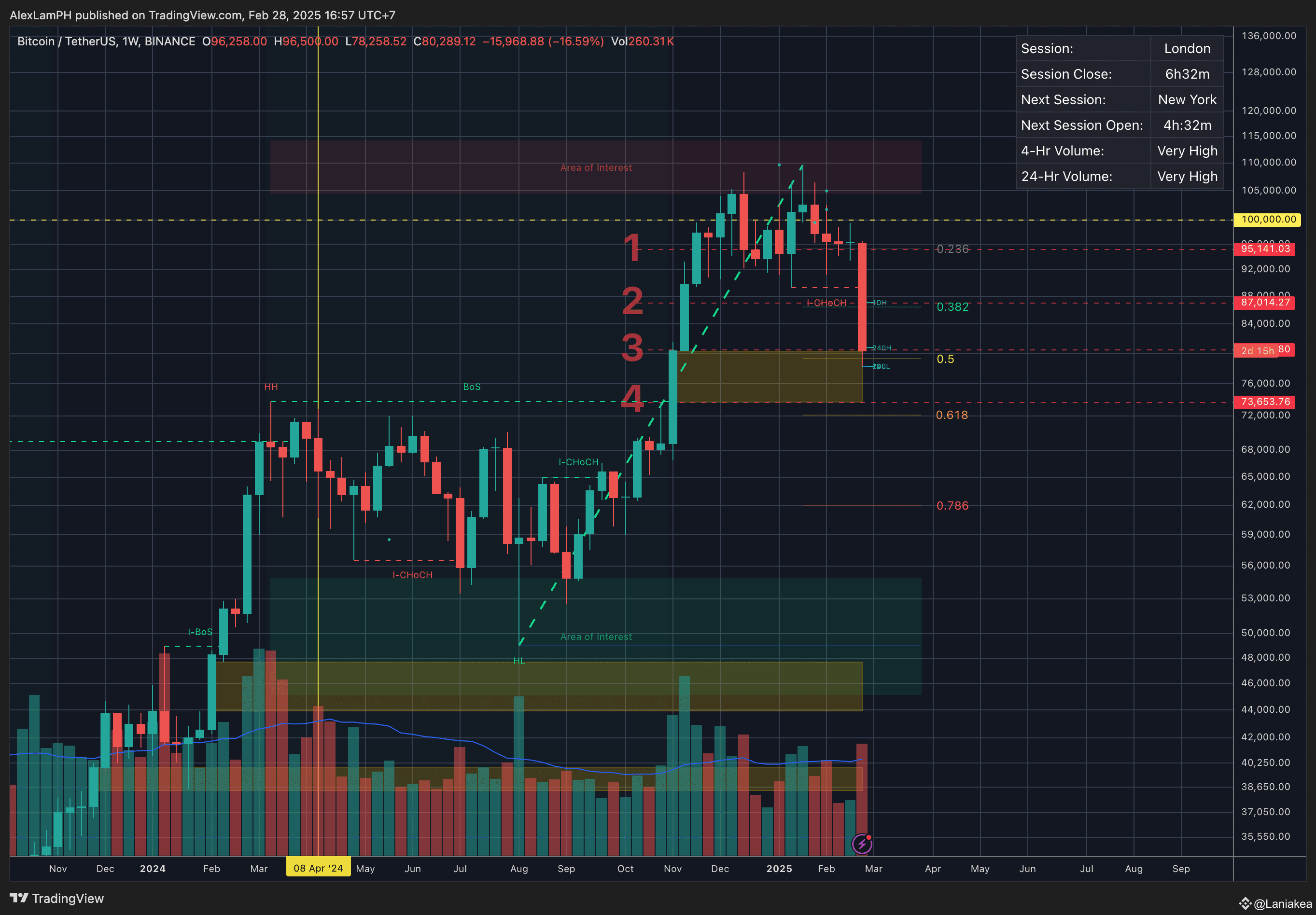

📌 If we look closely at previous bull runs, whenever Bitcoin’s price surged too fast within a short period, it often left behind a “liquidity gap.” The same happened during the rally in November 2024, when BTC soared rapidly, creating a liquidity gap between $72,000 and $90,000.

📌 This zone lacks substantial buy/sell activity, meaning that when Bitcoin retraces into this liquidity void, prices tend to drop rapidly due to weak support. Historically, most liquidity gaps eventually get filled—it’s only a matter of time.

📌 Not only Bitcoin but most assets behave similarly around liquidity gaps because of these key factors:

1️⃣ Magnet Liquidity Effect – Liquidity acts like a magnet. Market makers push prices back into these gaps to absorb unfilled liquidity orders, restoring market equilibrium.

2️⃣ Market Structure & Re-Accumulation – After a major rally, institutions & whales need to accumulate more positions at lower price levels, causing prices to revisit prior liquidity voids.

3️⃣ Market Inefficiency – Self-Correcting Mechanism – Markets naturally retest unconfirmed price levels to ensure a more accurate reflection of real supply and demand.

4️⃣ Stop-Hunt & Liquidity Sweeps – Market makers and whales often drive prices back to liquidity gaps to trigger stop-losses of retail traders, causing cascading liquidations.

📌 Why is now a critical moment for filling the liquidity gap?

1️⃣ U.S. CPI inflation is rising again, and the FED has hinted at delaying rate cuts until at least Q3 2025.

2️⃣ Uncertainty over trade wars & tariffs initiated by Trump, which could significantly impact the U.S. economy.

3️⃣ A cautious and pessimistic sentiment in U.S. stock markets, increasing overall market volatility.

4️⃣ FED’s ongoing quantitative tightening (QT) – The FED’s balance sheet shows a continuous decline in total assets, indicating liquidity is being drained from the economy.

5️⃣ Cooling off the market after an overheated rally, as leverage positions across exchanges remain at high levels, making the market vulnerable to liquidations.

🔥 Overall, this $BTC correction isn’t surprising. The fundamental growth of the market remains strong, so there’s no reason to be overly bearish or assume that the long-term trend has shifted.