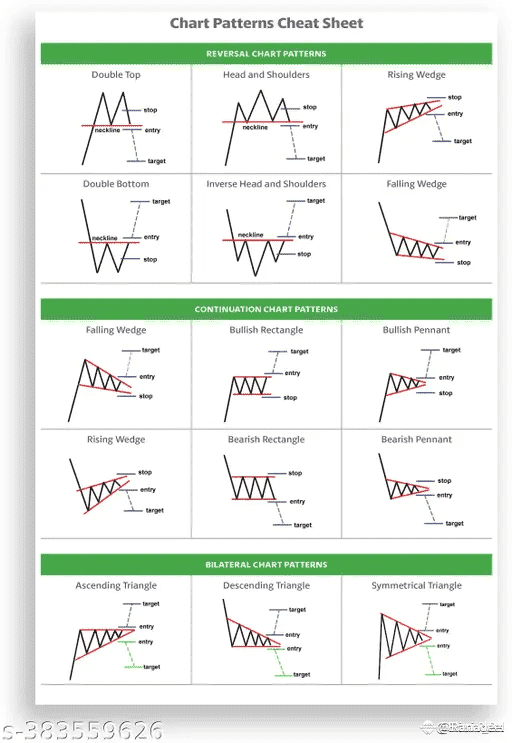

Understanding chart patterns is crucial for predicting price movements in trading. Here’s a breakdown of the three main types of patterns: Reversal, Continuation, and Bilateral Patterns.

---

🔄 Reversal Patterns – Indicate a potential trend change

1️⃣ Double Top – Bearish pattern forming two peaks at the same resistance level before breaking downward.

2️⃣ Head & Shoulders – Bearish pattern with three peaks (left shoulder, head, right shoulder), confirming a trend reversal after breaking the neckline.

3️⃣ Rising Wedge – A narrowing upward channel that signals a bearish reversal when price breaks downward.

4️⃣ Double Bottom – Bullish pattern forming two troughs at the same support level before breaking higher.

5️⃣ Inverse Head & Shoulders – A bullish version of the Head & Shoulders pattern, signaling a trend reversal after breaking above the neckline.

6️⃣ Falling Wedge – A downward-sloping, narrowing pattern that leads to a bullish breakout.

---

🔄 Continuation Patterns – Suggest the current trend is likely to continue

1️⃣ Falling Wedge – A bullish continuation pattern where price consolidates within a downward channel before breaking higher.

2️⃣ Bullish Rectangle – Price moves sideways within a horizontal range before breaking upward.

3️⃣ Bullish Pennant – A small triangular formation after a strong uptrend, signaling further upside upon breakout.

4️⃣ Rising Wedge – A bearish continuation pattern where price consolidates in a narrowing upward channel before breaking downward.

5️⃣ Bearish Rectangle – Price consolidates within a horizontal range before breaking downward.

6️⃣ Bearish Pennant – A small symmetrical triangle forming after a strong downtrend, leading to a continuation lower.

---

🔀 Bilateral Patterns – Can lead to a breakout in either direction

1️⃣ Ascending Triangle – A pattern with horizontal resistance and rising lows, leading to a potential breakout in either direction.

2️⃣ Descending Triangle – Features horizontal support and declining highs, with breakout direction depending on market conditions.

3️⃣ Symmetrical Triangle – A neutral pattern with converging trendlines, signaling a breakout is imminent but direction is uncertain.

---

📌 Key Insights for Traders:

✅ Reversal Patterns indicate a shift in trend direction.

✅ Continuation Patterns signal that the trend is likely to persist.

✅ Bilateral Patterns suggest uncertainty, meaning price could break either way.

Learning these patterns will help you make better trade decisions, set entry points, stop-losses, and targets effectively! 💡💰

💬 Found this helpful? Like, share, and comment! Let’s grow together! 🚀🔥

Here is the picture below 👇