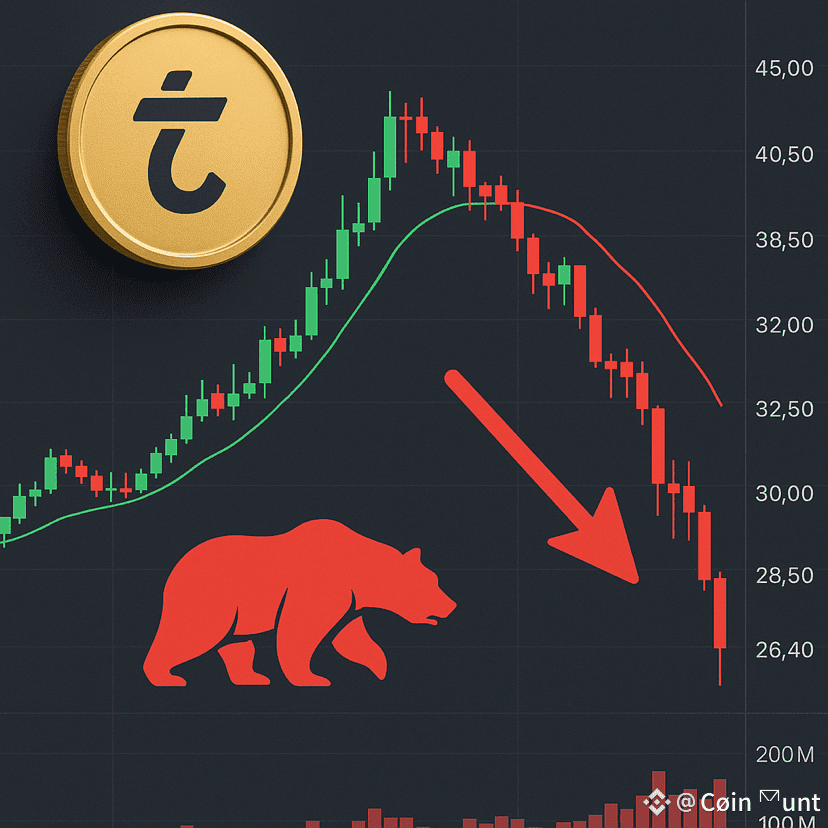

📉 Technical Indicators Pointing to Bearish Momentum

A comprehensive analysis of $TRB

$TRB TRB’s technical indicators reveals a predominantly bearish outlook:

• Moving Averages: The majority of moving averages signal a ‘Sell’ recommendation. Specifically, 10 out of 15 moving average indicators suggest selling, indicating a downward trend in price movement.

#MovingAverages

#bearishmomentum

• Oscillators: Among oscillators, 2 indicate a ‘Sell’, 5 are ‘Neutral’, and 3 suggest a ‘Buy’. Notably, the Average Directional Index (ADX) stands at 42.24, signifying a strong trend, while the Rate of Change (ROC) is at -26.3618, pointing to declining momentum.

• Relative Strength Index (RSI): The RSI is currently at 39.91, which is below the neutral 50 mark, suggesting that the asset is neither overbought nor oversold but is leaning towards bearish territory.

⸻

📊 Recent Short-Selling Signals

Recent trading signals have highlighted potential short-selling opportunities:

• Entry Point: A suggested short entry at $53.50–$54.10.

• Take-Profit Targets: Sequential targets at $49.91, $46.67, $44.43, $42.48, and $40.14.

• Stop-Loss: Recommended at $63.13 to manage risk.

These targets align with the current bearish indicators and suggest potential profit zones for short positions.

⸻

⚠️ Risk Considerations

While technical indicators and recent signals suggest a bearish trend, it’s essential to consider the following:

• Volatility: Cryptocurrency markets are highly volatile.

• Market Sentiment: Sudden shifts in market sentiment can lead to rapid price reversals.

• External Factors: News events, regulatory changes, or macroeconomic factors can impact price movements unexpectedly.