Here's the latest news and insights on Internet Computer (ICP):

🚀 ICP Price Is Rallying

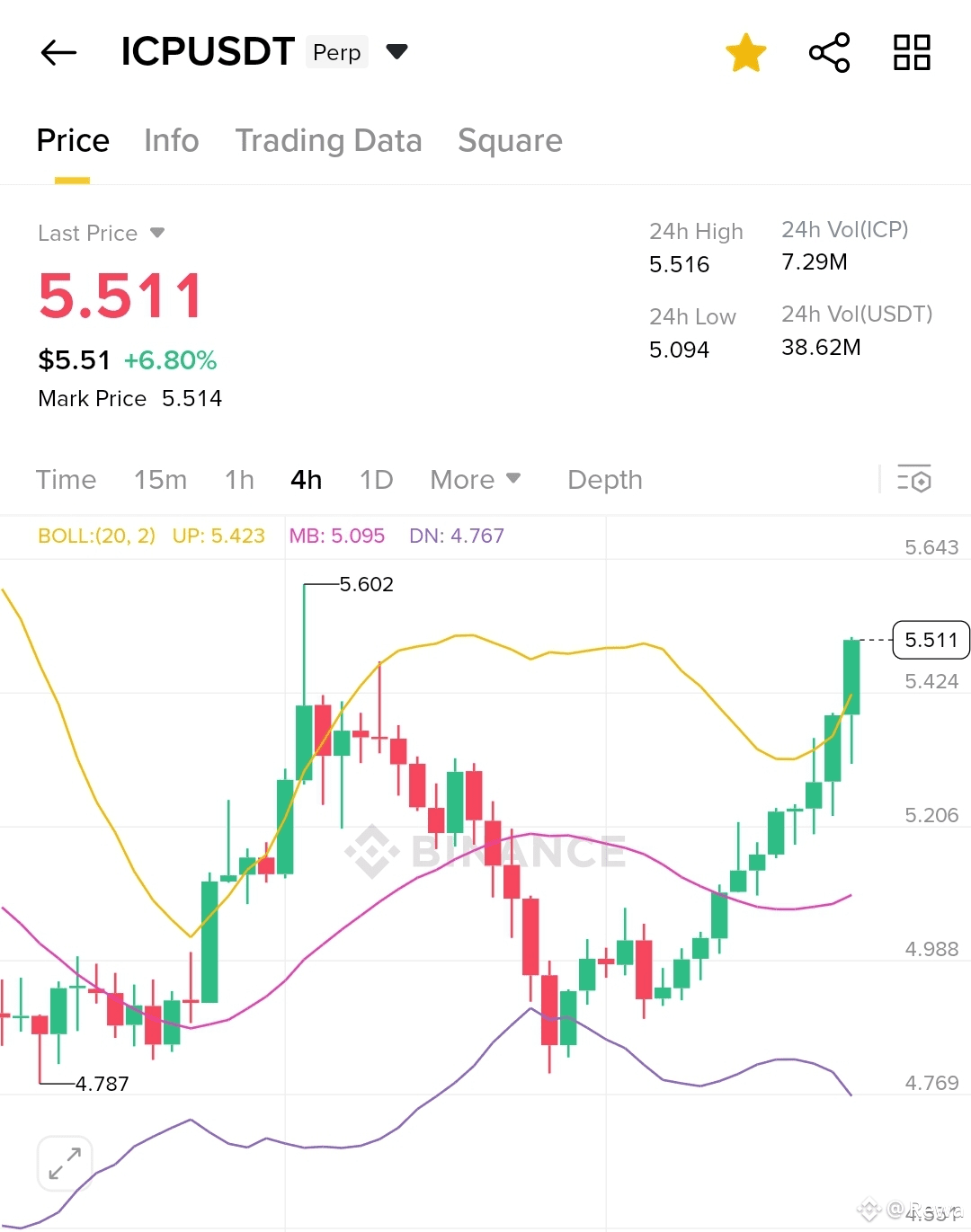

ICP has surged roughly 5% over the past 24 hours, now trading above $5.27–$5.50, with a 21% jump in trading volume—signaling revived investor interest .

This rally is being driven by renewed excitement around ICP’s integration with AI projects and on-chain feature enhancements .

> “ICP is now the second most visited in #AI and top 11th in trending… the only interesting project in ‘AI’ Onchain.”

A major driver is the upcoming platform Caffeine.ai, by DFINITY’s founder, enabling users to interact with on-chain AI tools to build apps rapidly .

📈 Technical Analysis & Forecasts

According to Binance-linked analysis, a breakout above $5.35–$5.50 could propel ICP toward $6.50, potentially delivering ~28% returns from current levels .

FXStreet reports ICP is nearing a trend reversal, trading around $5.51, approaching key resistance above ~$5.84—a bullish signal .

🧭 Longer-Term Predictions & Metrics

InvestingHaven forecasts ICP could range between $5.50 and $21.95 in 2025, with bullish upside even to $30–40 if adoption accelerates .

Historical context: Although ICP once saw large on-chain activity, total value locked (TVL) has declined, and its ecosystem is smaller compared to peers .

However, a rising token burn rate and increasing canister counts (smart contracts) show promising developer activity .

🔍 Summary Table

Key Factor Recent Insight

Price & Volume +5–6%, with ~21–52% volume increase

AI Developments New AI-centric tools like Caffeine.ai boosting demand

Technical Outlook Resistance at $5.35–$5.84; breakout could lead to $6.50+

Long-Term Outlook Forecasts project range between $6–$22 (2025); upside to $30

Ecosystem Growth Growing burn rate and smart contract activity, but TVL is low

🔎 What to Watch

1. Price Action Near $5.35–$5.50: A sustained breakout could trigger short-term gains to ~$6.50.

2. Caffeine.ai Launch: Successful rollout would validate ICP as a serious player in on-chain AI.

3. Ecosystem Metrics: Track increases in TVL, cycle burn, and developer activity to assess long-term strength.