$JTO is the governance token of Jito Network, a pioneering MEV‑optimized liquid staking protocol on Solana . It empowers users to stake SOL, receive JitoSOL, and earn both staking rewards and MEV revenue—without sacrificing liquidity .

📊 Current Market Snapshot

Price: Around $2.24–2.30, up ~17% in the past 24 hours

Market Cap: ~$750M, ranking in the mid-100s by market cap

Trading Volume: Typically $130–160M/day, with Binance leading in volume via JTO/USDT spot pair (~$22M)

Performance: Recent week gain (+18%), though still down ~30% from April 2024 ATH of ~$5.29

🔧 Team & Governance

Origin: Jito launched by founder Lucas Bruder (ex‑Tesla), backed by Solana Labs leadership, including Anatoly Yakovenko, with support from Solana Ventures .

DAO Structure: Token holders steer protocol via JitoDAO—voting on fee models, delegation strategies, treasury use, and StakeNet management

Recent Governance Update: JIP‑3 approved—transferring stake pool admin to StakeNet, improving decentralization and security .

⚙️ Technology & Economics

Block Engine & MEV Capture

Jito’s standout feature is its custom Block Engine—a transaction reordering mechanism on Solana to extract MEV value on behalf of users, distributing this as extra yield alongside staking rewards .

JitoSOL & Liquid Staking

Users stake $SOL → receive JitoSOL (liquid token usable in DeFi), all while earning staking plus MEV rewards .

Value Accrual & Tokenomics

Fee model: Robust protocol fee generation—up to ~$36–41M/month in 2024—underscores sustainable revenue .

Token supply:

Total supply: 1B JTO; ~336M in circulation (~33%)

Unlocks: ~150M tokens unlocking Dec ’24 (1‑year cliff), with further vesting over two subsequent years .

📈 Market Context & Outlook

Technical Analysis

Consolidation pattern: symmetrical triangle with strong support at ~$2.58 and resistance near ~$3.85

Entry breakout above $3.85 could signal trend reversal; downside risk if $2.58 fails .

Forecasts & User Sentimen

Mixed outlook: short‑term prediction: $3.15–3.85 (potential $5 target); bearish scenario: down to ~$2.0

Binance consensus: modest growth to ~$2.34 in 2026, ~$2.84 by 2030 .

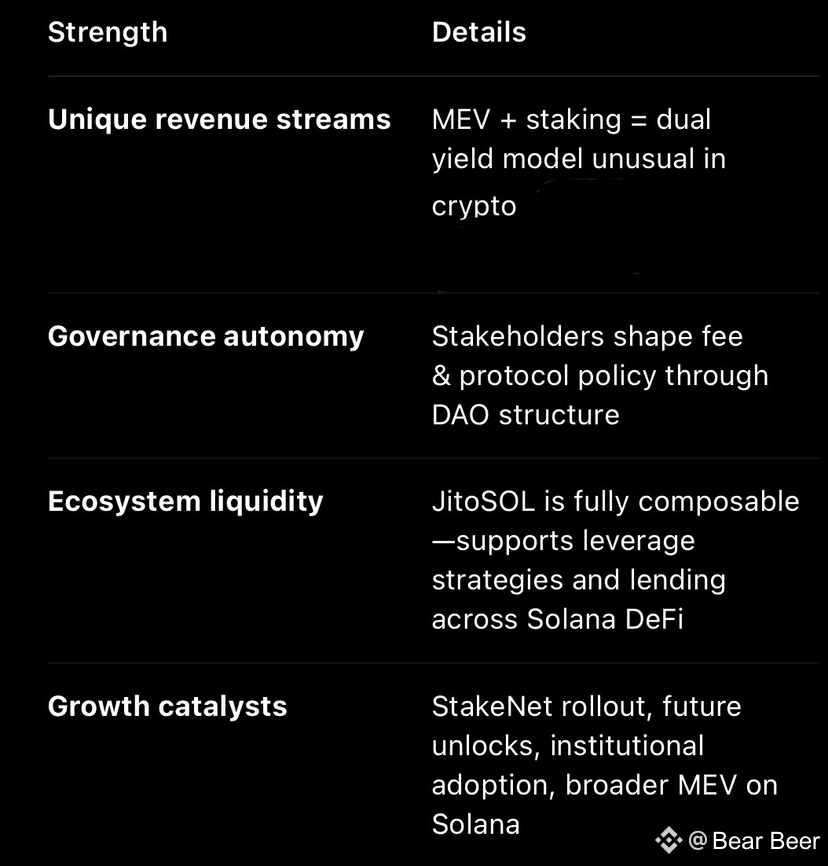

✅ Why JTO Is Worth Watching

⚠️ Risks to Monitor

Token unlock dilution: ~150M tokens due Dec ’24 could weigh on price

Regulatory uncertainty around validator revenue or MEV mechanics

Market conditions: broad crypto crashes often impact niche tokens harder

Competition: Other liquid staking & MEV protocols like LDO (Ethereum), Eigenlayer, or new Solana-native competitors

🔍 Final Take

$JTO stands out by merging liquid staking, MEV capture, and DAO governance into a cohesive protocol with genuine value accrual. As Solana staking continues to mature and MEV becomes mainstream, Jito’s approach could gain traction.

The key pivot points to track:

Dec ’24 unlocks

StakeNet implementation

Breakout above ~$3.85

Sustained MEV/staking revenue trends

If Jito sustains its yield and utility advantages, governance-driven upside is plausible. Yet, investors should hinge bets on execution and macro resilience.

👇 What’s your verdict?

Do you believe Jito’s MEV‑powered staking is the next frontier—or just another yield chase?

Drop your thoughts & share your JitoSOL Dashboard flex 🧠💬