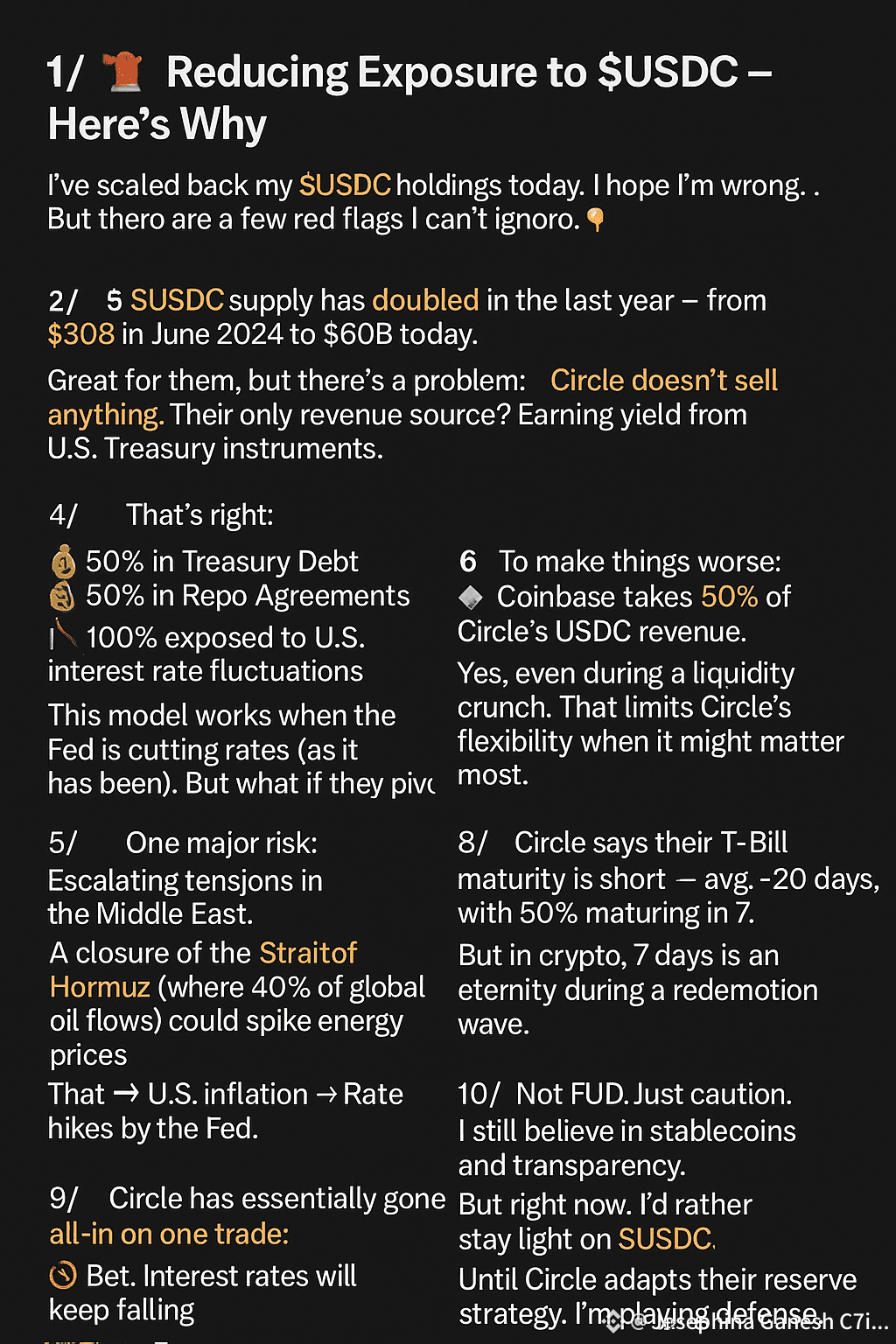

I’ve scaled back my $USDC holdings today. I hope I’m wrong… But there are a few red flags I can’t ignore. 👇 #  USDC #Circle#FOMCMeeting

USDC #Circle#FOMCMeeting

2/ $USDC supply has doubled in the last year — from $30B in June 2024 to $60B today. 🚀 +100% growth.

It's the 2nd largest stablecoin, often seen as the “safe, compliant” option.

But size ≠ safety. Let's talk risk.

3/ Circle, the issuer of $USDC, recently went public. Its stock jumped +160% post-IPO. 🚀

Great for them, but there's a problem: Circle doesn’t sell anything.

Their only revenue source? Earning yield from U.S. Treasury instruments.

4/ That’s right: 💰 50% in Treasury Debt 💰 50% in Repo Agreements 📉 100% exposed to U.S. interest rate fluctuations

This model works when the Fed is cutting rates (as it has been). But what if they pivot?

5/ One major risk: Escalating tensions in the Middle East. A closure of the Strait of Hormuz (where 40% of global oil flows) could spike energy prices.

That → U.S. inflation → Rate hikes by the Fed.

6/ If rates rise, Circle's bond portfolio could lose market value. If redemptions spike during a crisis, they might be forced to sell at a loss.

In crypto, depegs can happen fast. Think $UST — not in size, but in speed. ⚠️

7/ To make things worse: 🔹 Coinbase takes 50% of Circle’s USDC revenue.

Yes, even during a liquidity crunch.

That limits Circle’s flexibility when it might matter most.

8/ Circle says their T-Bill maturity is short — avg. ~20 days, with 50% maturing in 7.

But in crypto, 7 days is an eternity during a redemption wave.

9/ Circle has essentially gone all-in on one trade: 📉 Bet: Interest rates will keep falling 📈 Risk: Rates rise amid war or inflation = trouble

Diversification would help. They haven’t done it.

10/ Not FUD. Just caution. I still believe in stablecoins and transparency.

But right now, I’d rather stay light on $USDC. Until Circle adapts their reserve strategy, I’m playing defense.

Stay safe. 🧠 #USDC #Circle #Stablecoins #FOMC #CryptoRisk #BinanceTGE