📅 Date: July 11, 2025

🖊️ By Crypto Bulletin Team

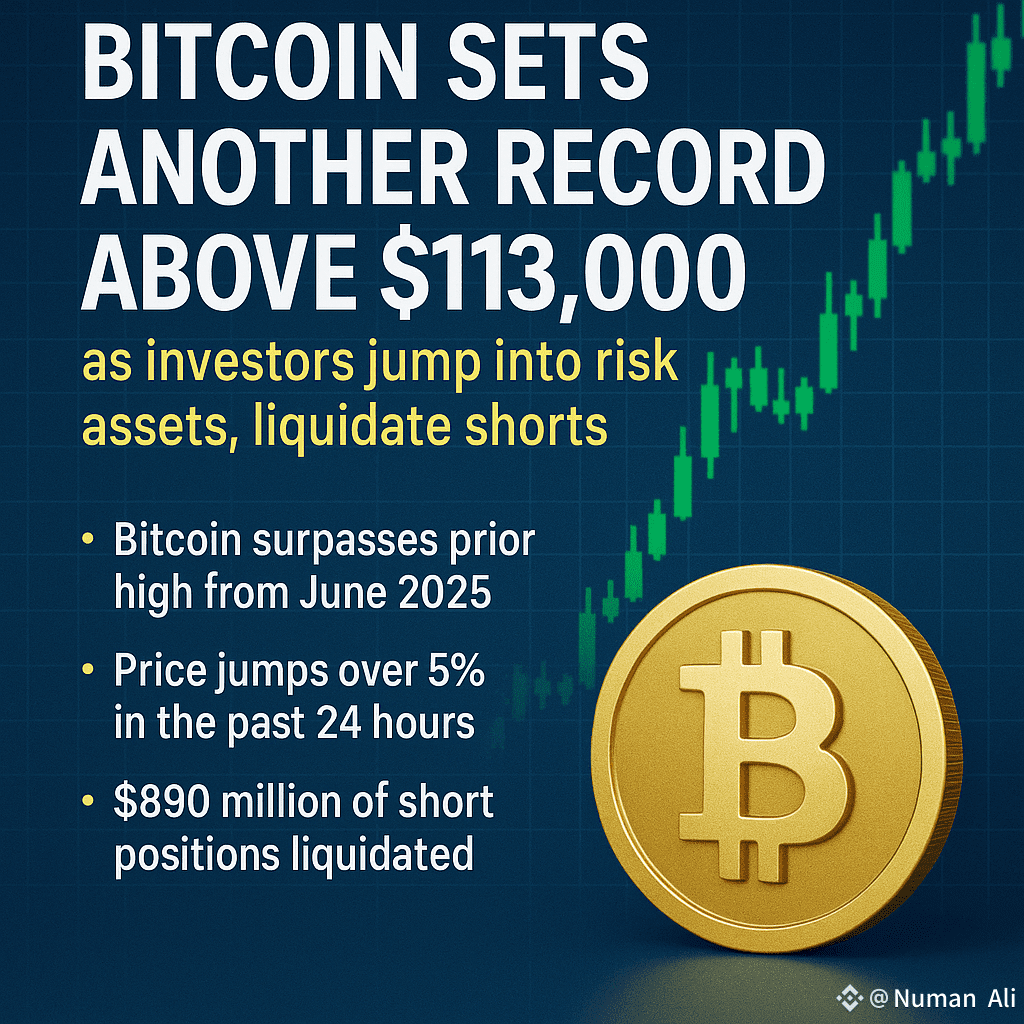

#ETHBreaks3k Bitcoin (BTC) has broken another major barrier by crossing $113,000, marking yet another historic high in 2025. The surge has triggered the liquidation of over $890 million in short positions in the past 24 hours, as investors continue to shift heavily into risk-on assets.#TrendTradingStrategy

📈 Market Reaction:

According to CoinGlass and CryptoQuant data:

Over 225,000 traders were liquidated.

The biggest single liquidation order was worth $10.3 million, executed on OKX.

BTC dominance climbed to 57.8%, the highest since 2021.

🟠 Why Is Bitcoin Rising?

Multiple factors are fueling this rally:

✅ The Federal Reserve’s dovish signals, hinting at possible rate cuts.

✅ Renewed institutional demand, led by BlackRock, Fidelity, and Hong Kong-based funds.

✅ Bitcoin ETF daily inflows topping $800M+, pushing prices higher.

✅ Increasing geopolitical uncertainty, pushing investors toward “digital gold.”

💬 Analyst Commentary:

> “Bitcoin is acting like a magnet for capital in uncertain times,” said Linda Zhou, senior strategist at Galaxy Digital. “We could see $120K much sooner than expected if this volume sustains.”

📊 Altcoin Market Also Rallies:

Ethereum (ETH) is trading above $6,250 (+7%).

Solana (SOL) and Avalanche (AVAX) saw double-digit gains.

Meme coins like Dogecoin and PEPE also rose sharply.

📉 Short Sellers Hit Hard: With over $890 million in shorts liquidated, the market has seen its largest short squeeze since April 2024. Bears are scrambling to cover their positions, fueling even more buying pressure.

📢 Social Media Reactions: Crypto Twitter and Reddit are trending with hashtags like #BTC113K, #BitcoinMoon, and memes mocking short sellers.

🌐 What to Watch Next: All eyes are now on the $115K resistance. If Bitcoin breaks it with strong volume, analysts predict a path to $120K–$125K by end of July.

📌 Disclaimer: Crypto investments carry risk. Always do your own research (DYOR) and invest responsibly.