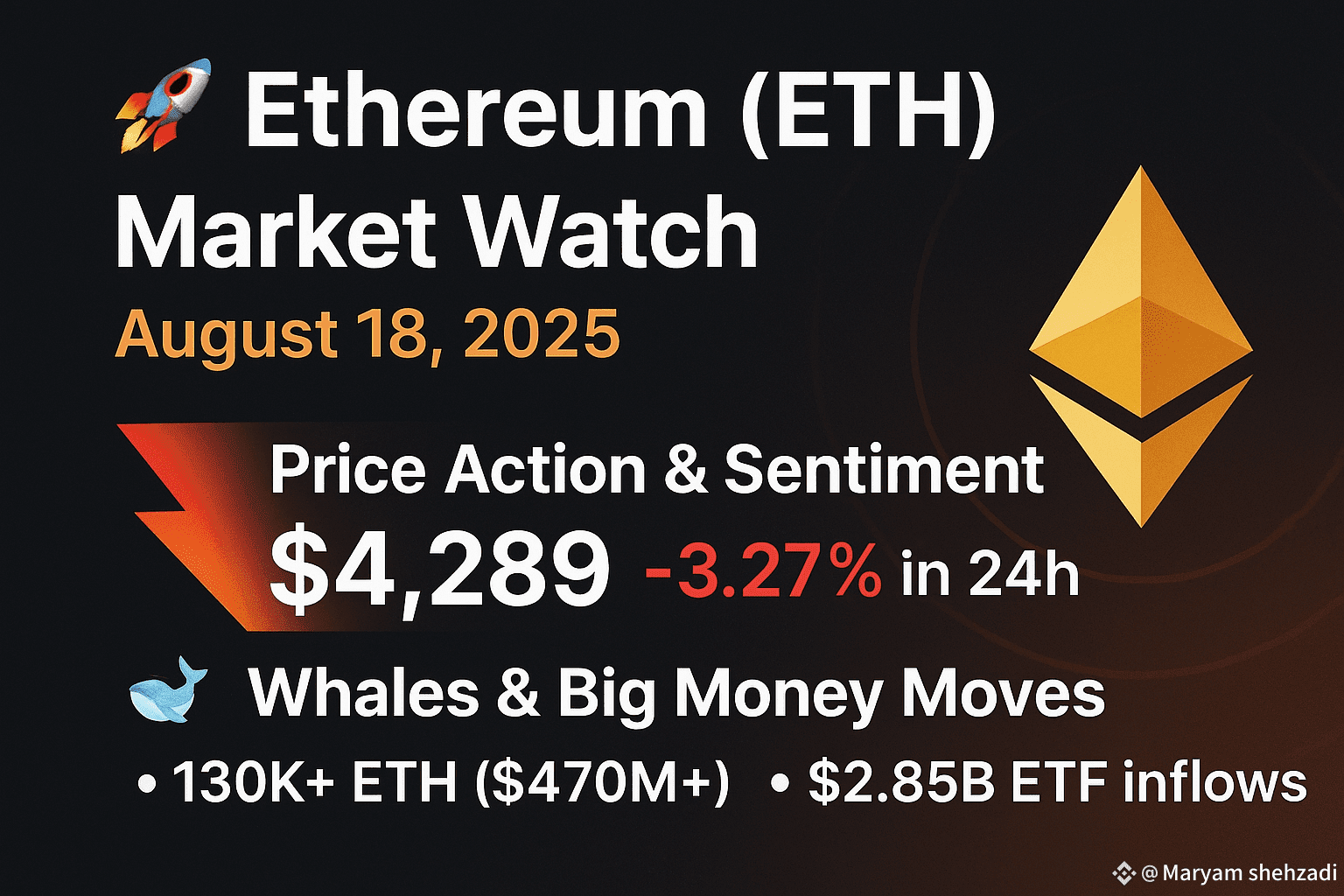

📉 Price Action & Sentiment

Ethereum is trading around $4,289 (-3.27% in 24h), slipping below the $4,300 support as the broader market cools off. Despite this dip, ETH is still up +4.5% weekly, showing hidden strength.$DOGE $HOT

🐋 Whales & Big Money Moves

Massive 130K+ ETH ($470M+) scooped up by whales/institutions 🏦

Spot ETF inflows hit $2.85B last week → bullish adoption signal 📈

📊 Technical Outlook

🔑 Support: $4,245 (key floor). Losing this could drag ETH toward $3,845–$3,800.

🚧 Resistance: $4,793–$4,900 (ATH zone). A breakout here unlocks $5K+ rally.

📐 RSI: 66.8 → nearing overbought, signaling a possible cooldown before another push.

⚖️ Catalysts vs. Risks

✅ Bullish Drivers:

Layer-2 growth (Arbitrum, Optimism) supercharging ETH utility ⚡

Fed rate cut odds (84.6% Sept) could boost risk assets 💵

⚠️ Risks:

Profit-taking by traders 🏃

Regulatory clouds hanging over crypto ☁️

💎 Short-Term Outlook

ETH faces heavy resistance near $4,900, but as long as it holds $4,245, bulls eye a potential run toward $5,500 later this month. Losing support risks a fall to $3,355–$3,800.

📌 Key Levels to Watch

Level Price ($) Significance 🧐

Resistance 4,793–4,900 ATH zone 🔥 breakout target

Support 1 4,245 Bullish rebound floor 🛡️

Support 2 3,845 Breakdown danger ⚠️

Q4 Target 15,000 Institutional forecast 🚀

---