Everyone online is buzzing that Bitcoin’s cycle top might already be in, and a bear market could be starting. Let’s jump into the charts 🧐 and check if there’s any real sign of a top.

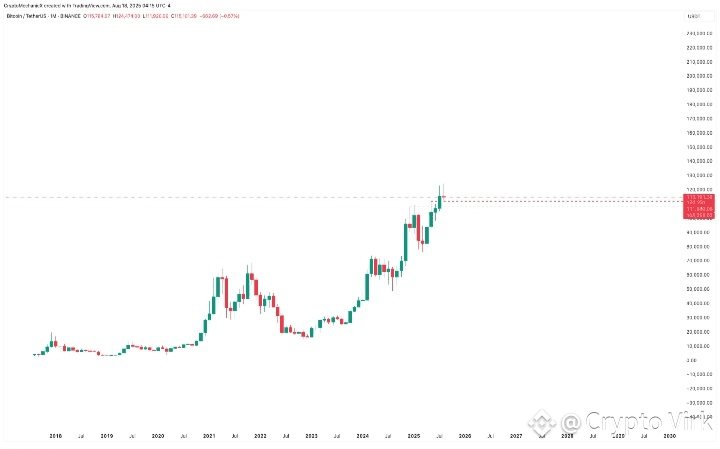

BTCUSD (Monthly)

📈 On the monthly chart, not much drama — still looking healthy ✅. Price is above previous highs and clearly trending upwards.

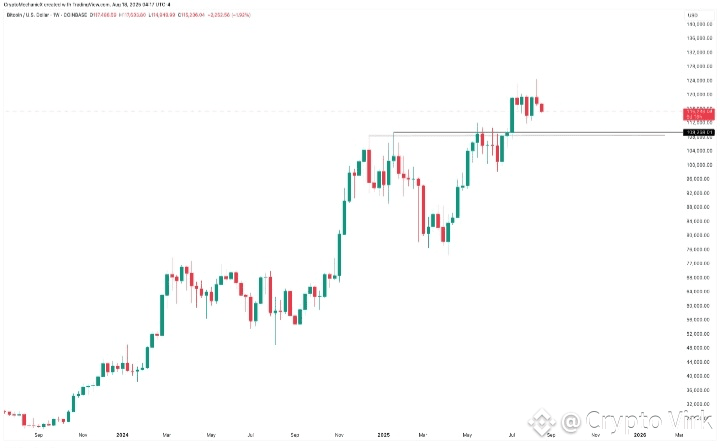

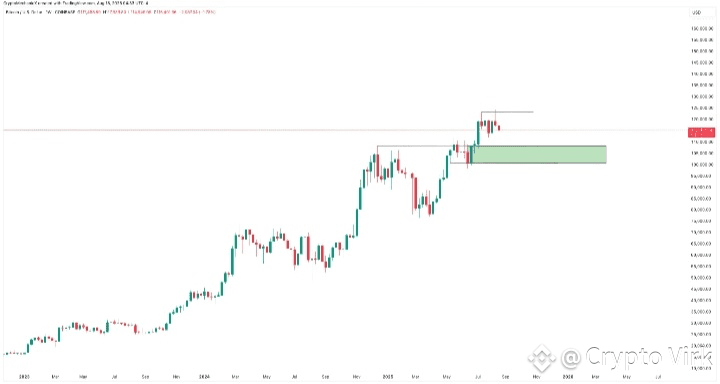

BTCUSD (Weekly)

🔄 Currently, Bitcoin is consolidating above its previous highs. As long as it stays above, the chart still looks strong 💪

🛠 Structurally, this chart stays bullish even if it dips to $100K. It’s far, but on the high-timeframe, the structure supports it.

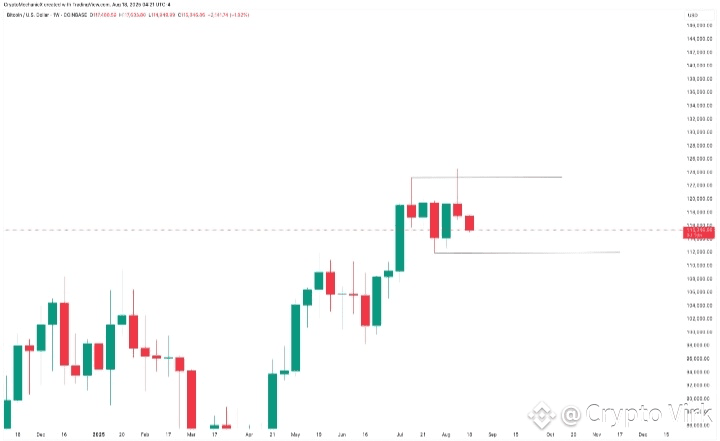

📌 Range bounded

While social media is full of noise 📢, zooming out shows Bitcoin has been trading in the same range for 5 weeks. Everyone flips between ultra-bullish and ultra-bearish, but price barely moves.

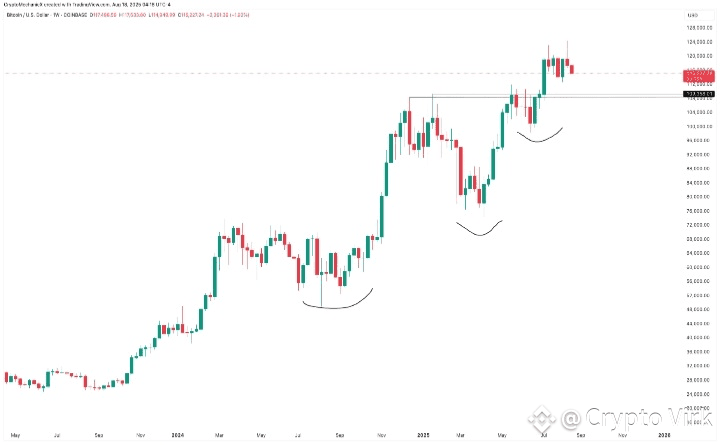

⚠️ Concerning part: There’s one thing on the chart that catches attention…

👻 There’s a weekly fake-out on Bitcoin — also called an SFP (Swing Failure Pattern).

📊 Looking at history, weekly fake-outs usually signal a strong move in the opposite direction. Even the 2021 top happened after a fake-out, so this pattern can’t be ignored ⚡.

My market thoughts: I personally don’t think the top is in yet. One candle isn’t enough to decide the future; I focus on structure, and it’s still bullish 🌟

🤔 Not sure if Bitcoin will just pull back slightly above $112K or drop deeper to the $100K–108K zone. As long as the structure holds, things look fine 👍.

Everyone got too hyped about Altseason last week 🔥. Market makers love shaking out late buyers.

So far, no crazy top signals. ETH is still below its 2021 ATH, most altcoins are struggling 🚫. True market tops usually have euphoria and huge moves — we haven’t seen that yet.

I might be wrong, but I’d love to hear your thoughts 💬.