👍 Let’s explain BTC/USDT chart in detail.

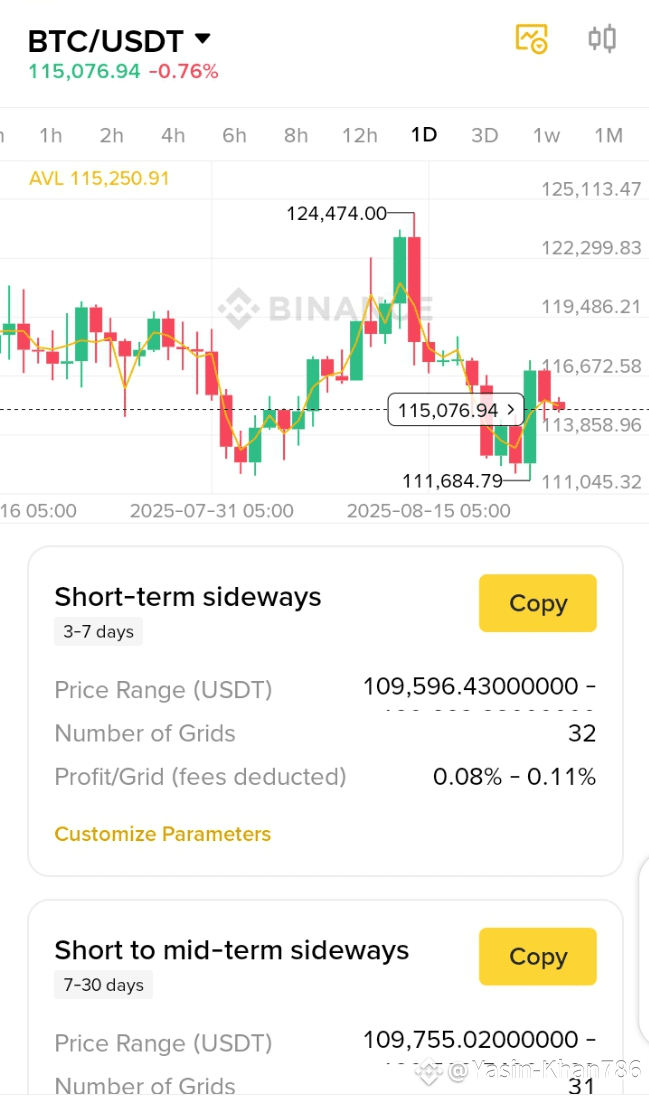

📊 Chart Explanation (BTC/USDT – Daily Timeframe)

🔎 Key Levels on Chart:

Recent High: $124,474

Recent Low: $111,684

Current Price: $115,076 (down -0.76%)

Average Line (AVL): $115,250 (BTC is moving around this line, showing sideways consolidation).

Support Zone: $111,000 – $112,000

Resistance Zone: $116,500 – $117,000

The candlesticks show:

BTC recently made a big rally from $111k to $124k.

It failed to sustain above $124k and corrected sharply.

Now it’s consolidating between 111k – 117k.

📈 Market Sentiment:

Trend: Currently sideways/bearish bias after rejection from $124k.

Buyers are defending $111k level strongly (seen in the bounce).

Sellers are active near $116k–117k.

This means BTC is in a range-bound market.

🔮 BTC Forecast (Next 7–30 Days)

Bullish Case (Breakout Above $117k):

BTC can retest $120k–122k.

If momentum stays, possible move back toward $124k.

Bearish Case (Breakdown Below $111k):

BTC may drop to $109k–110k.

If heavy selling, deeper correction toward $106k–107k.

Most Likely Case (Sideways):

BTC trades between $111k–117k in coming weeks.

Good zone for grid trading/scalping.

⚡ Trading Strategy

For Traders (Short-term):

Buy near $111k–112k support.

Sell near $116k–117k resistance.

For Swing Traders (7–30 days):

Enter after breakout confirmation:

Above $117k → Long (target $120k–124k).

Below $111k → Short (target $106k–108k).

For Long-term Holders (Investors):

Current zone is an accumulation range.

Historically, such consolidations lead to a big breakout rally.

✅ Summary:

BTC is sideways between 111k–117k.

Short-term → sideways.

Breakout above 117k → bullish.

Breakdown below 111k → bearish.