I used to be obsessed with Token Unlocks. I’d mark my calendar, set my price alerts, and prepare for the inevitable dump. But after diving deep into the plasma's xpl blueprint, I’ve realized that I was looking at the scoreboard instead of the actual game.

If you want to understand why Plasma is quietly absorbing billions in liquidity, you have to look at the three pillars of its Value Loop which are:

1. The Fuel Strategy:

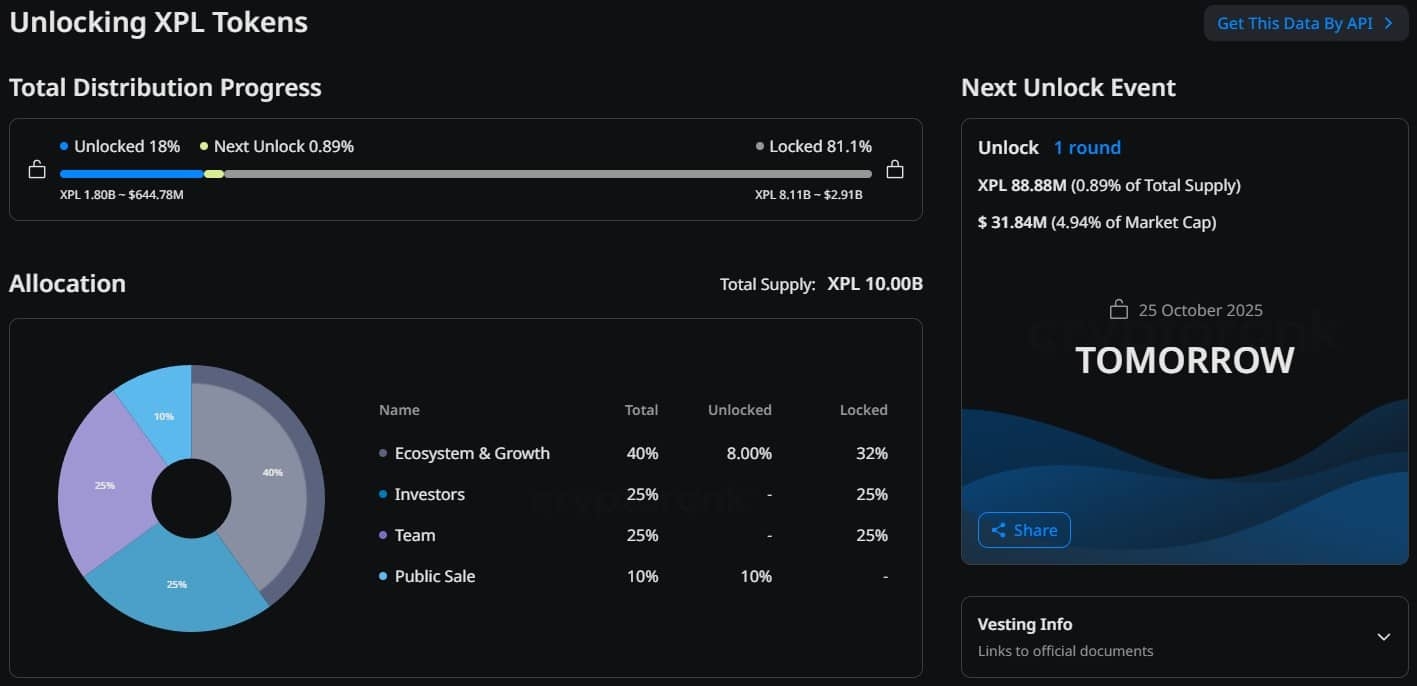

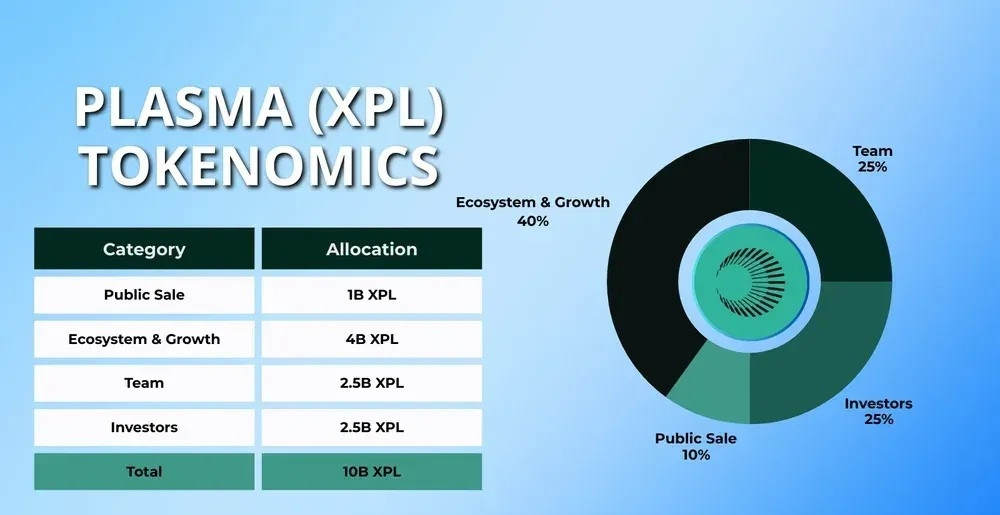

We saw 88 million $XPL unlock on January 25, 2026, and another massive event is scheduled for July 28, 2026. While weak hands see this as dilution, the data shows a different story. A massive 40% of the total 10 billion supply is locked in the Ecosystem & Growth Fund.

This isn't a cash out for insiders, it’s a war chest. These tokens are being used as growth fuel to attract over 100 protocols and neobanks like Plasma One to build on the chain. In 2026, the real value isn't the circulating supply, it's the $13 billion in cross-chain volume that those tokens are subsidizing.

2. The Utility of a Value Guardian:

Plasma's native token is the economic bedrock of the network. I’m particularly excited about the Staking Delegation launching in Q1 2026.

For the first time, I don’t have to be a tech genius to help secure the network. I can delegate my tokens to validators and earn a 5% annual yield. It’s passive income backed by real network security. Plus, $XPL holders get a seat at the table, voting on protocol upgrades and how that War Chest gets spent.

3. The Zero Fee Paradox:

The genius of XPL is that everyday users don't even need to touch it to send USDT for zero fees.

The embedded Paymaster mechanism handles the gas in the background. But don't be fooled, the more people use the network for free stablecoin transfers, the more demand it creates for XPL from the institutions and market makers who do need to hold it to facilitate those billions in volume.

➡️ My 2026 Perspective on Plasma:

I’ve stopped trading the unlock volatility. Instead, I’m watching the Aave deposit peaks (now stable above $6.5 Billion) and the 75,000+ users on Plasma One.

Plasma is transitioning from a concept to a global payment track. When you build an engine that can handle thousands of transactions per second with sub second finality, the tokenomics eventually take care of themselves. I’m playing the long game.